Answered step by step

Verified Expert Solution

Question

1 Approved Answer

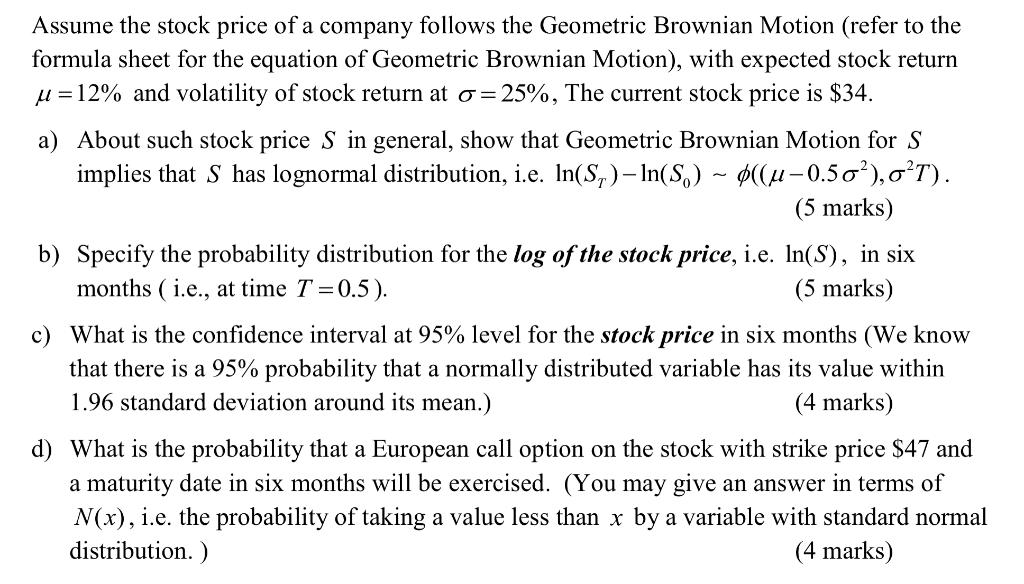

Assume the stock price of a company follows the Geometric Brownian Motion (refer to the formula sheet for the equation of Geometric Brownian Motion),

Assume the stock price of a company follows the Geometric Brownian Motion (refer to the formula sheet for the equation of Geometric Brownian Motion), with expected stock return = 12% and volatility of stock return at o=25%, The current stock price is $34. a) About such stock price S in general, show that Geometric Brownian Motion for S implies that S has lognormal distribution, i.e. In(S)-In(S)~ ((-0.5o), 0T). (5 marks) b) Specify the probability distribution for the log of the stock price, i.e. In(S), in six months (i.e., at time T = 0.5). (5 marks) c) What is the confidence interval at 95% level for the stock price in six months (We know that there is a 95% probability that a normally distributed variable has its value within 1.96 standard deviation around its mean.) (4 marks) d) What is the probability that a European call option on the stock with strike price $47 and a maturity date in six months will be exercised. (You may give an answer in terms of N(x), i.e. the probability of taking a value less than x by a variable with standard normal distribution. ) (4 marks)

Step by Step Solution

★★★★★

3.47 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

a In Geometric Brownian Motion the formula for the stock price S is given by St S0 expmu 05 sigma2 t sigma Wt Where St is the stock price at time t S0 is the initial stock price mu is the expected sto...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started