Answered step by step

Verified Expert Solution

Question

1 Approved Answer

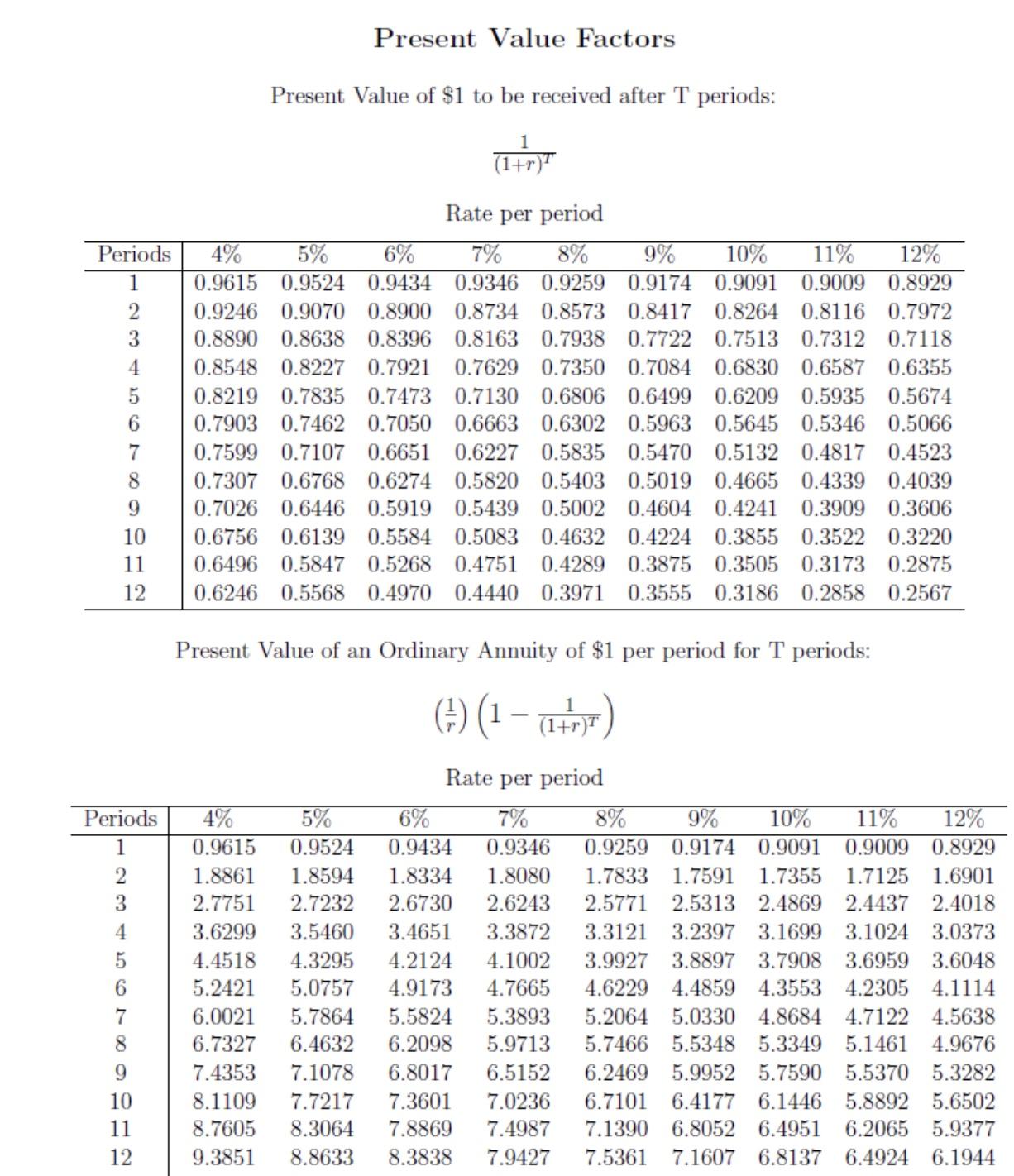

Assume the tax rate is 30 % and use the attached present value table if applicable to answer the below question: A Firm is proceeding

Assume the tax rate is 30 % and use the attached present value table if applicable to answer the below question:

A Firm is proceeding with a bond issue to raise (borrow) $100 million. The interest rate is the cost of debt of 8%, and interest will be paid annually for the nine (9) year term of the debt.

If the company's tax rate is 30%, what is the present value of the total interest tax shields of this nine-year debt?

Periods 4% 1 10 11 12 23 23 Periods 4 12% 9% 10% 11% 0.9174 0.9091 0.9009 0.8929 0.8116 0.7972 0.8417 0.8264 0.7513 0.7312 0.7118 0.6587 0.6355 0.7722 6 7 8 4 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 5 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 0.5674 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 0.5645 0.5346 0.5066 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.4817 0.4523 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4039 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 0.4241 0.3909 0.3606 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 0.3522 0.3220 0.6496 0.5847 0.5268 0.4751 0.4289 0.3875 0.3505 0.3173 0.2875 0.6246 0.5568 0.4970 0.4440 0.3971 0.3555 0.3186 0.2858 0.2567 9 56789112 Present Value Factors Present Value of $1 to be received after T periods: 10 Rate per period 8% 5% 0.9615 0.9524 6% 7% 0.9434 0.9346 0.9259 0.9246 0.9070 0.8900 0.8734 0.8573 0.8890 0.8638 0.8396 0.8163 0.7938 1 (1+r)T Present Value of an Ordinary Annuity of $1 per period for T periods: () (1 - 4% 5% 6% 0.9615 0.9524 0.9434 1.8594 1.8334 1.8861 2.7751 2.7232 3.6299 3.5460 4.4518 4.3295 5.2421 5.0757 6.0021 5.7864 6.7327 6.4632 7.4353 7.1078 8.1109 7.7217 8.7605 8.3064 9.3851 8.8633 (1+r)T Rate per period 7% 8% 9% 10% 11% 12% 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 1.8080 1.7833 1.7591 1.7355 1.7125 1.6901 2.6243 2.5771 2.5313 2.4869 2.4437 2.4018 3.3121 3.2397 3.1699 3.1024 3.0373 3.9927 3.8897 3.7908 3.6959 3.6048 4.6229 4.4859 4.3553 4.2305 4.1114 5.2064 5.0330 4.8684 4.7122 4.5638 5.7466 5.5348 5.3349 5.1461 4.9676 6.2469 5.9952 5.7590 5.5370 5.3282 6.7101 6.4177 6.1446 5.8892 5.6502 7.1390 6.8052 6.4951 6.2065 5.9377 7.5361 7.1607 6.8137 6.4924 6.1944 2.6730 3.4651 3.3872 4.2124 4.1002 4.9173 4.7665 5.5824 5.3893 6.2098 5.9713 6.8017 6.5152 7.3601 7.0236 7.8869 7.4987 8.3838 7.9427

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the present value of the total interest tax shields of the nineyear debt we need to determine the tax shield for each year and discount them to their present value using the appr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started