Answered step by step

Verified Expert Solution

Question

1 Approved Answer

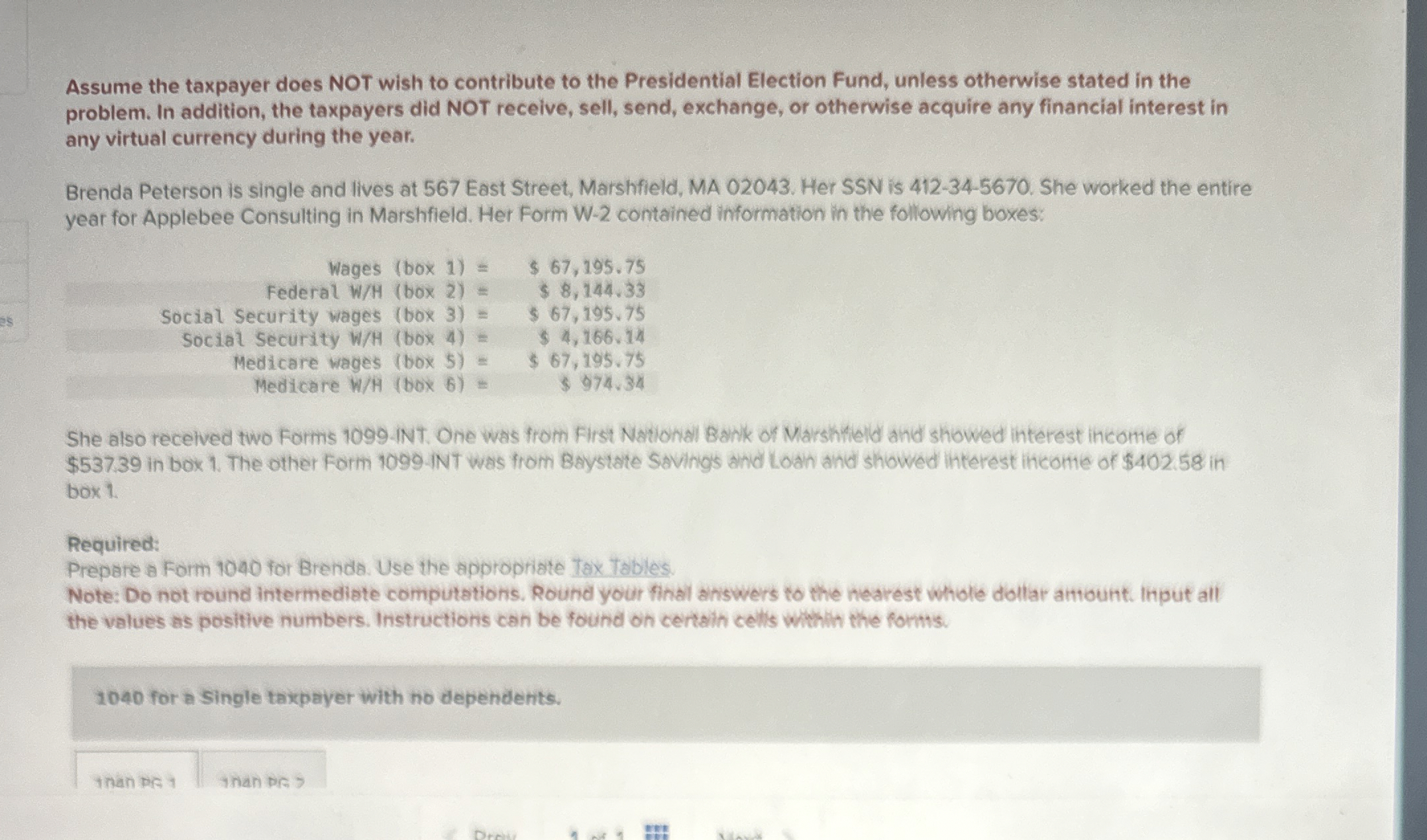

Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the taxpayers did NOT

Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the

problem. In addition, the taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in

any virtual currency during the year.

Brenda Peterson is single and lives at East Street, Marshfield, MA Her SSN is She worked the entire

year for Applebee Consulting in Marshfield. Her Form W contained information in the following boxes:

Wages box $

Federal box $

Social Security wages box $

Social Security box $

Medicare wages box $

Hedlcare whit box $

She also recelved two Forms iNT. One was from First Nationall Bank of Marshimild and showed linterest income of

$ in box The other Form INT was from Baystate Savings and Loan and showed interest incoltle of $ in

box

Required:

Prepare a Form for Brenda. Use the appropriate Tax Tables.

Note: Do not round intermediate computations. Round your final answers to the hearest whole dollar atrount. Input all

the values as positive numbers. Instructions can be found on certain cells within the forms.

for a Single taxpayer with no dependents.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started