Answered step by step

Verified Expert Solution

Question

1 Approved Answer

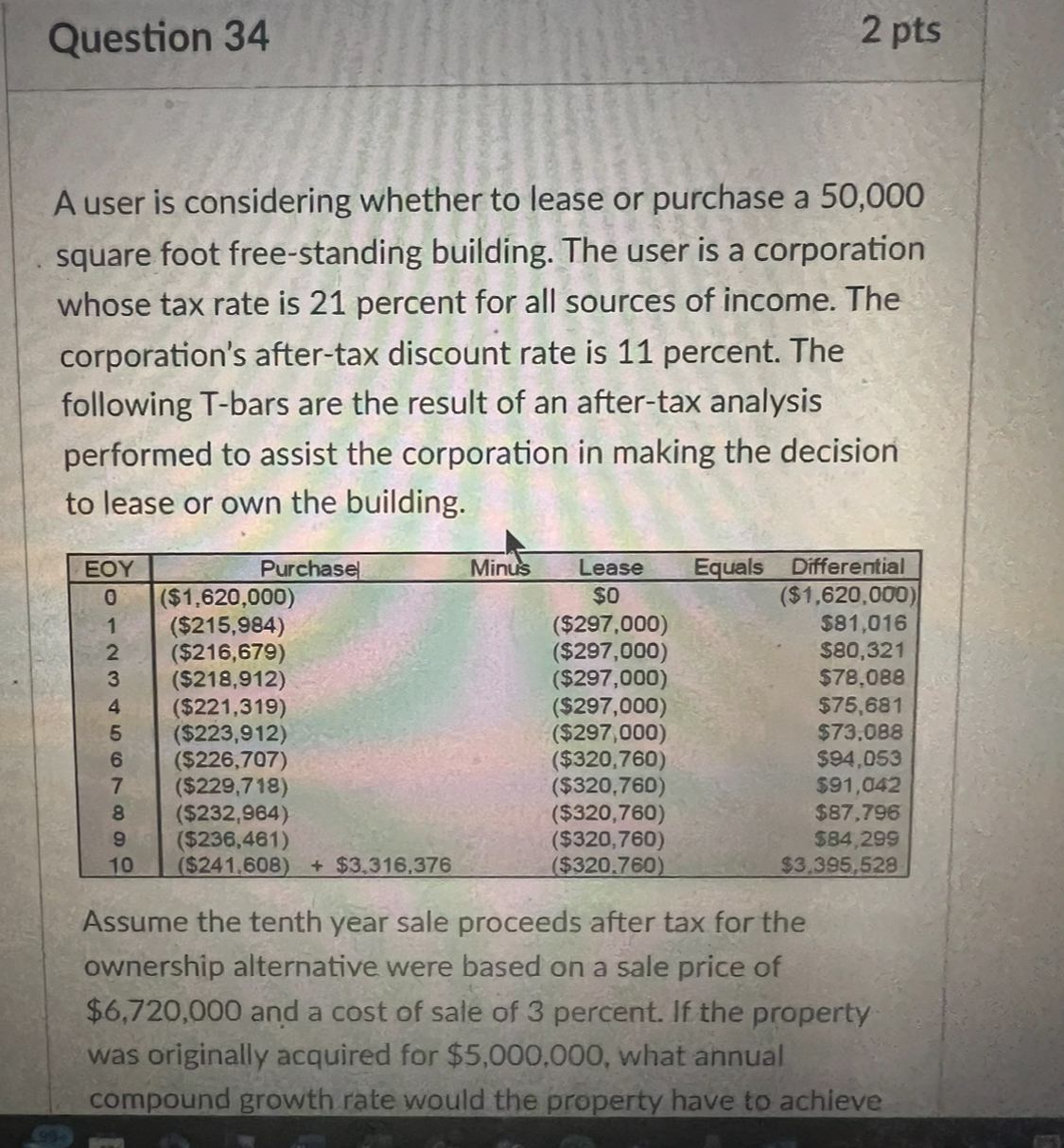

Assume the tenth year sale proceeds after tax for the ownership alternative were based on a sale price of $ 6 , 7 2 0

Assume the tenth year sale proceeds after tax for the ownership alternative were based on a sale price of $ and a cost of sale ch percent. If the property was originally acquired for $ what annual compound growth rate would the property have to achieve over the year holding period in order for the after tax present cost of leasing and owning to be equal?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started