Answered step by step

Verified Expert Solution

Question

1 Approved Answer

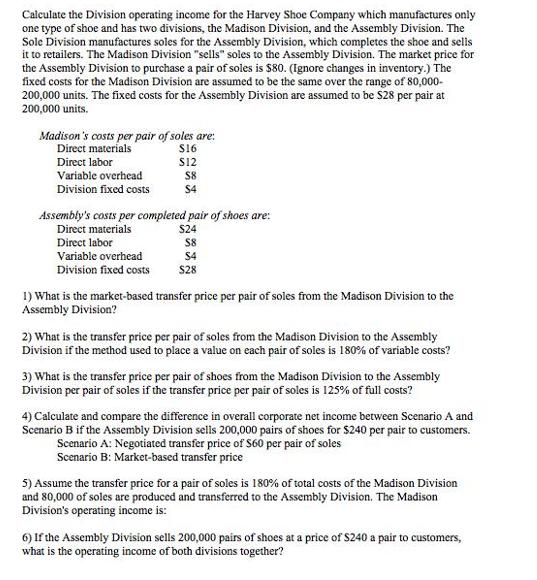

Calculate the Division operating income for the Harvey Shoe Company which manufactures only one type of shoe and has two divisions, the Madison Division,

Calculate the Division operating income for the Harvey Shoe Company which manufactures only one type of shoe and has two divisions, the Madison Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Madison Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $80. (Ignore changes in inventory.) The fixed costs for the Madison Division are assumed to be the same over the range of 80,000- 200,000 units. The fixed costs for the Assembly Division are assumed to be S28 per pair at 200,000 units. Madison's costs per pair of soles are: Direct materials S16 S12 S8 Direct labor Variable overhead Division fixed costs $4 Assembly's costs per completed pair of shoes are: Direct materials $24 Direct labor S8 Variable overhead S4 Division fixed costs S28 1) What is the market-based transfer price per pair of soles from the Madison Division to the Assembly Division? 2) What is the transfer price per pair of soles from the Madison Division to the Assembly Division if the method used to place a value on each pair of soles is 180% of variable costs? 3) What is the transfer price per pair of shoes from the Madison Division to the Assembly Division per pair of soles if the transfer price per pair of soles is 125% of full costs? 4) Calculate and compare the difference in overall corporate net income between Scenario A and Scenario B if the Assembly Division sells 200,000 pairs of shoes for $240 per pair to customers. Scenario A: Negotiated transfer price of S60 per pair of soles Scenario B: Market-based transfer price 5) Assume the transfer price for a pair of soles is 180% of total costs of the Madison Division and 80,000 of soles are produced and transferred to the Assembly Division. The Madison Division's operating income is: 6) If the Assembly Division sells 200,000 pairs of shoes at a price of $240 a pair to customers, what is the operating income of both divisions together?

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Market based transfer price per pair of soles 80 2 Variable cost per sole 16 12 8 36 Transfer pri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started