Question

Assume the unit sale price was $ 5 0 and the quantity sold was 1 0 units. Furthermore, the payment term was 2 1 0

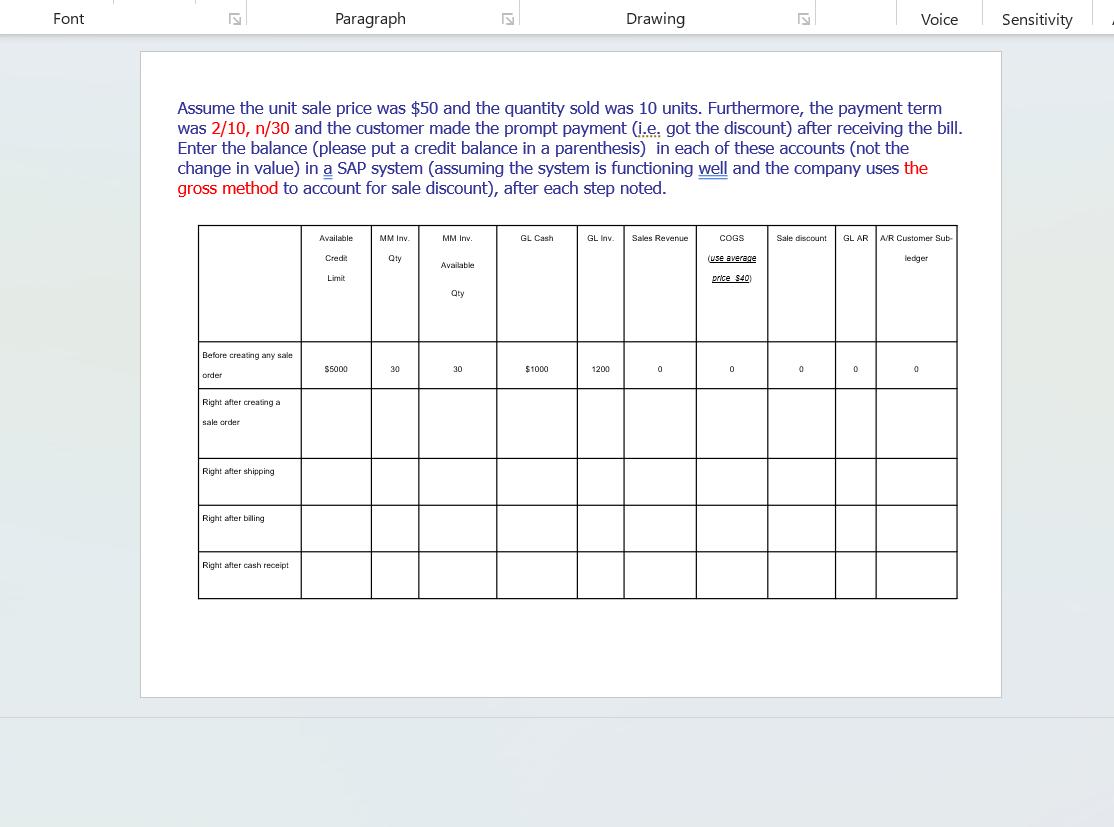

Assume the unit sale price was $ and the quantity sold was units. Furthermore, the payment term was and the customer made the prompt payment ie got the discount after receiving the bill. Enter the balance please put a credit balance in a parenthesis in each of these accounts not the change in value in a SAP system assuming the system is functioning well and the company uses the gross method to account for sale discount after each step noted.tabletableAvailableCreditLimittableMM Inv.OtytableMM Irv.AvailableQtyGL Cash,GL Inv.,Sales Revenue,tableCoGsuse averageprice $Sale discount,GL ARtableAR Customer SubledgertableBefore creating any saleorder$$tableRight after creating asale orderRight after shipping,,,,,,,,,,Right after biling,,,,,,,,,,Right after cash receipt,,,,,,,,,,

Font Paragraph Drawing Voice Sensitivity Assume the unit sale price was $50 and the quantity sold was 10 units. Furthermore, the payment term was 2/10, n/30 and the customer made the prompt payment (i.e. got the discount) after receiving the bill. Enter the balance (please put a credit balance in a parenthesis) in each of these accounts (not the change in value) in a SAP system (assuming the system is functioning well and the company uses the gross method to account for sale discount), after each step noted. Available MM Inv. MM Inv. GL Cash GL Inv. Sales Revenue COGS Sale discount GL AR A/R Customer Sub- Credit Qty (use average ledger Available Limit price $40) Qty Before creating any sale $5000 30 30 $1000 1200 0 0 0 0 order Right after creating a sale order Right after shipping Right after billing Right after cash receipt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started