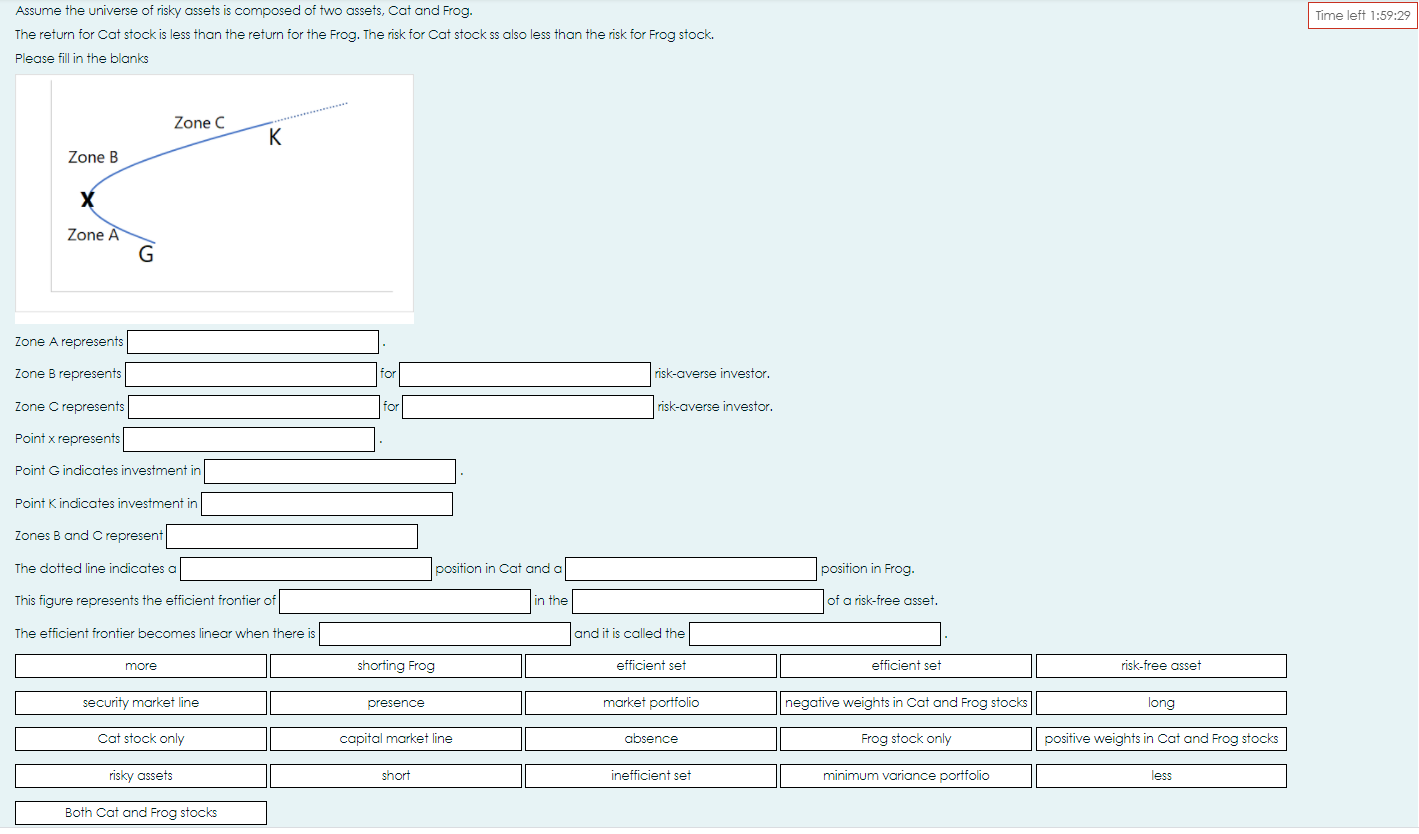

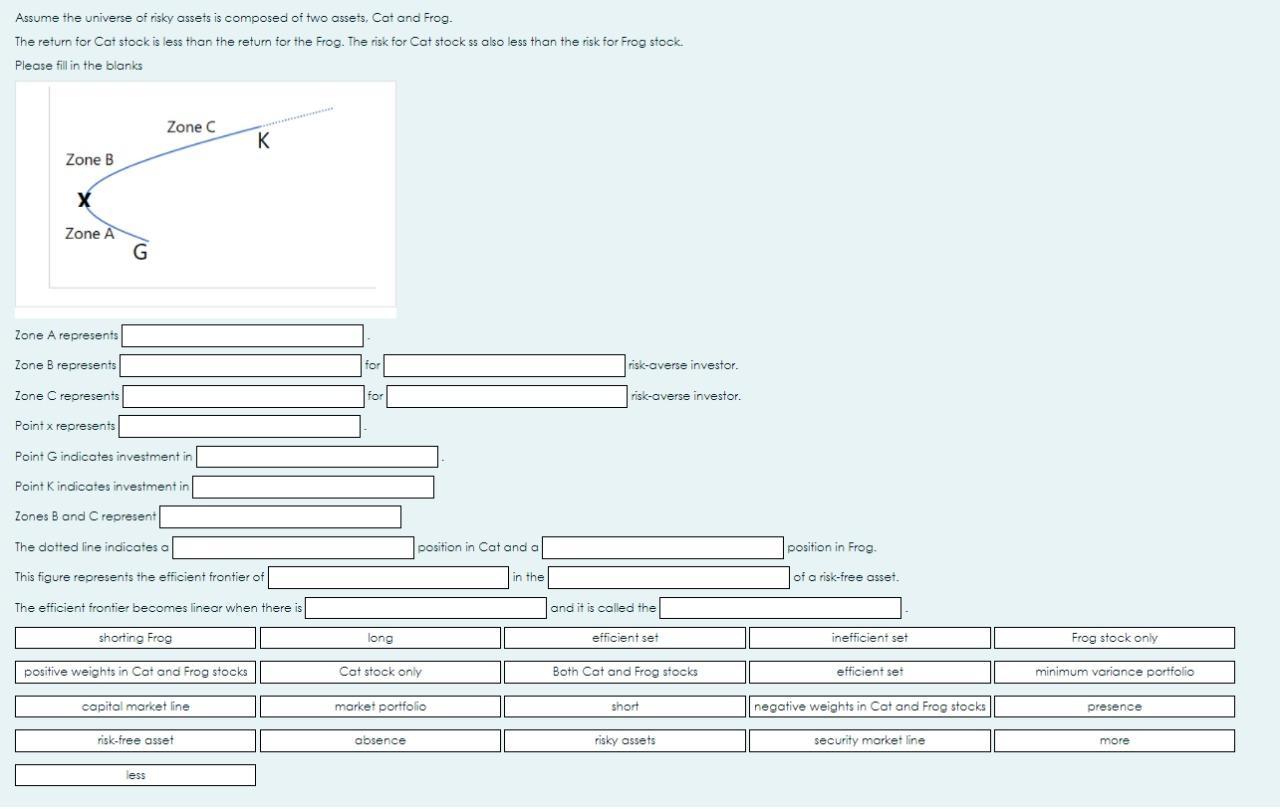

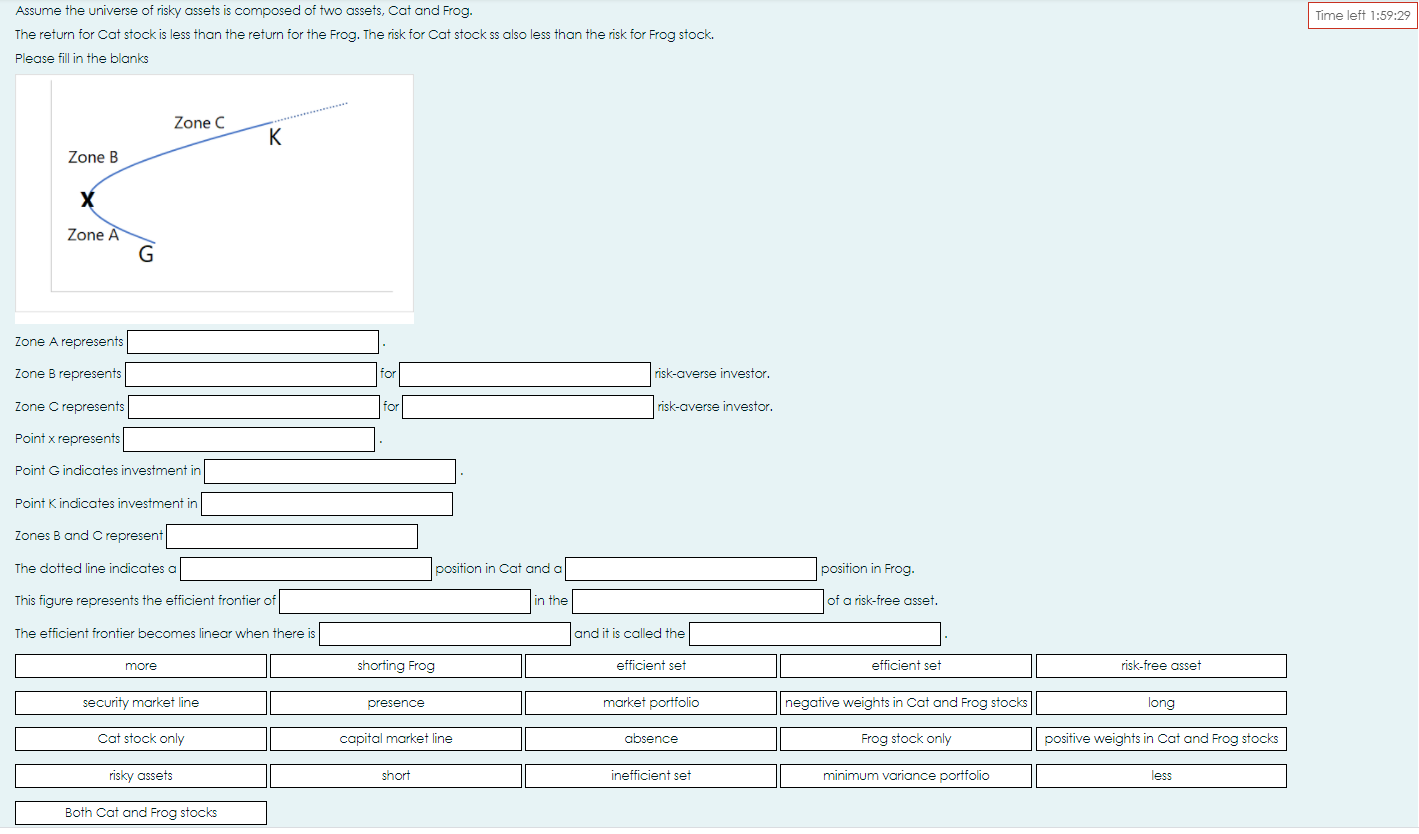

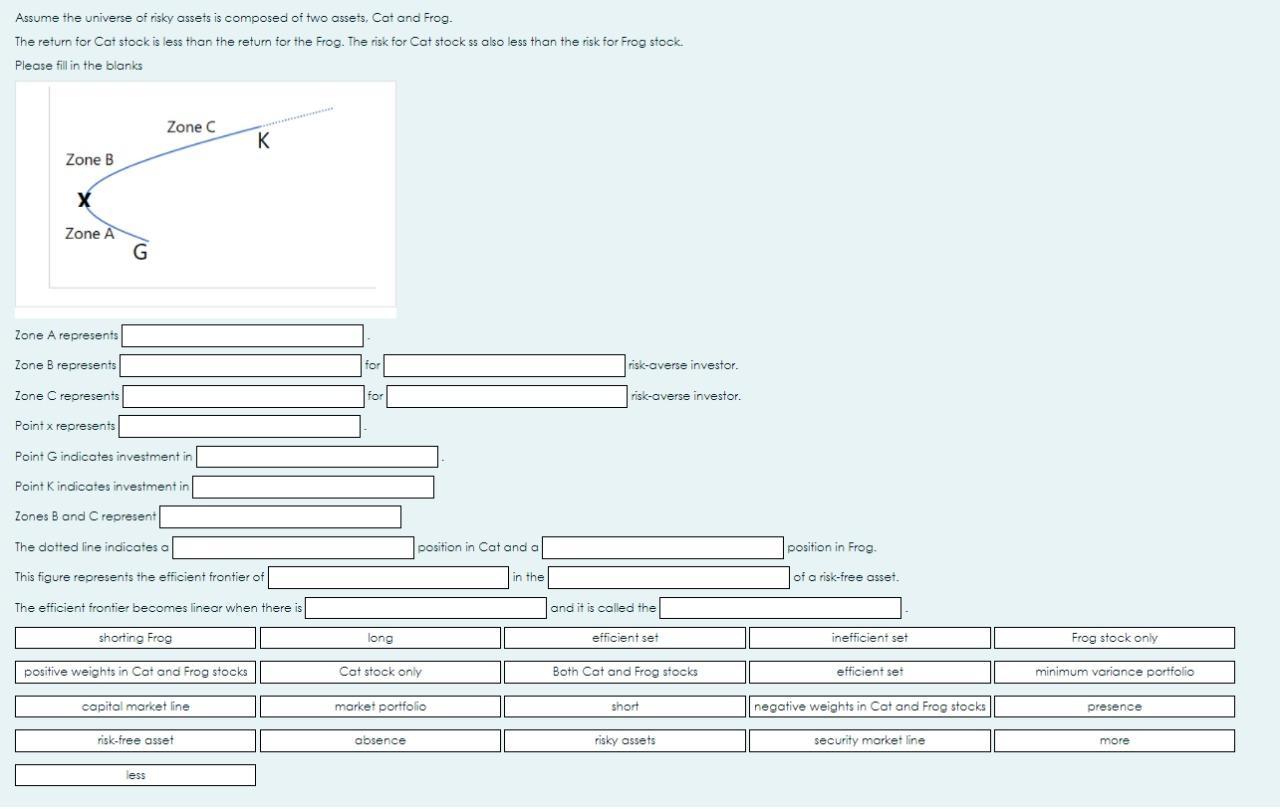

Assume the universe of risky assets is composed of two assets, Cat and Frog. Time left 1:59:29 The return for Cat stock is less than the return for the Frog. The risk for Cat stock ss also less than the risk for Frog stock. Please fill in the blanks Zone C K K Zone B Zone A G Zone A represents Zone B represents for risk-averse investor. Zone C represents for risk-averse investor. Point x represents Point G indicates investment in Point K indicates investment in Zones B and C represent The dotted line indicates a position in Cat and a position in Frog. This figure represents the efficient frontier of in the of a risk-free asset. The efficient frontier becomes linear when there is and it is called the more shorting Frog efficient set efficient set risk-free asset security market line presence market portfolio negative weights in Cat and Frog stocks long Cat stock only capital market line absence Frog stock only positive weights in Cat and Frog stocks risky assets short inefficient set minimum variance portfolio less Both Cat and Frog stocks Assume the universe of risky assets is composed of two assets, Cot and Frog. The return for Cat stock is less than the return for the Frog. The risk for Cat stock ss also less than the risk for Frog stock Please fill in the blanks Zone C Zone B X Zone A G Zone A represents Zone B represents risk-averse investor. Zone Crepresents risk-averse investor. Point x represents Point G indicates investment in Point K indicates investment in Zones B and C represent The dotted line indicates al position in Cat and a position in Frog This figure represents the efficient frontier of in the of a risk-free asset. The efficient frontier becomes linear when there is and it is called the shorting Frog long efficient set inefficient set Frog stock only positive weights in Cot and Frog stocks Cat stock only Both Cot and Frog stocks efficient set minimum variance portfolio capital market line market portfolio short negative weights in Cot and Frog stocks presence risk-free asset absence risky assets security market line more less Assume the universe of risky assets is composed of two assets, Cat and Frog. Time left 1:59:29 The return for Cat stock is less than the return for the Frog. The risk for Cat stock ss also less than the risk for Frog stock. Please fill in the blanks Zone C K K Zone B Zone A G Zone A represents Zone B represents for risk-averse investor. Zone C represents for risk-averse investor. Point x represents Point G indicates investment in Point K indicates investment in Zones B and C represent The dotted line indicates a position in Cat and a position in Frog. This figure represents the efficient frontier of in the of a risk-free asset. The efficient frontier becomes linear when there is and it is called the more shorting Frog efficient set efficient set risk-free asset security market line presence market portfolio negative weights in Cat and Frog stocks long Cat stock only capital market line absence Frog stock only positive weights in Cat and Frog stocks risky assets short inefficient set minimum variance portfolio less Both Cat and Frog stocks Assume the universe of risky assets is composed of two assets, Cot and Frog. The return for Cat stock is less than the return for the Frog. The risk for Cat stock ss also less than the risk for Frog stock Please fill in the blanks Zone C Zone B X Zone A G Zone A represents Zone B represents risk-averse investor. Zone Crepresents risk-averse investor. Point x represents Point G indicates investment in Point K indicates investment in Zones B and C represent The dotted line indicates al position in Cat and a position in Frog This figure represents the efficient frontier of in the of a risk-free asset. The efficient frontier becomes linear when there is and it is called the shorting Frog long efficient set inefficient set Frog stock only positive weights in Cot and Frog stocks Cat stock only Both Cot and Frog stocks efficient set minimum variance portfolio capital market line market portfolio short negative weights in Cot and Frog stocks presence risk-free asset absence risky assets security market line more less