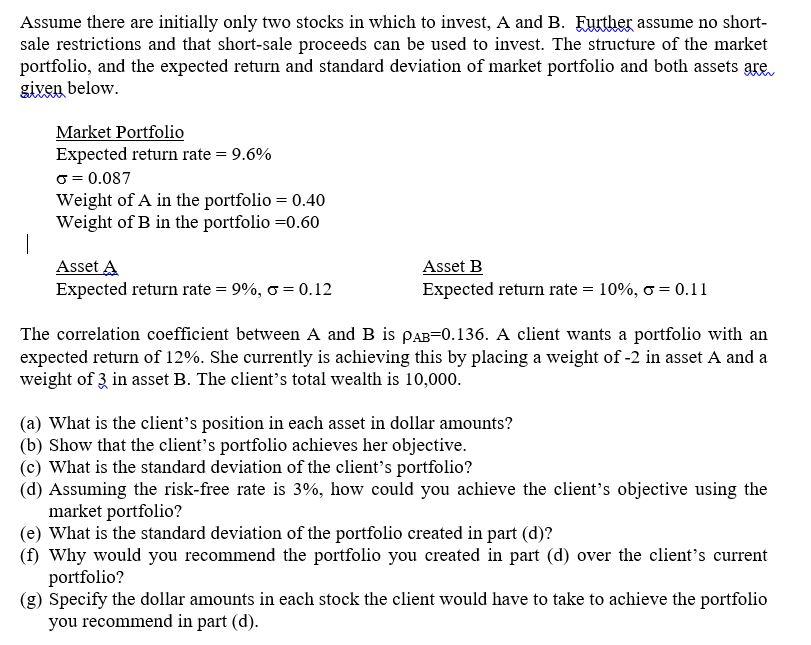

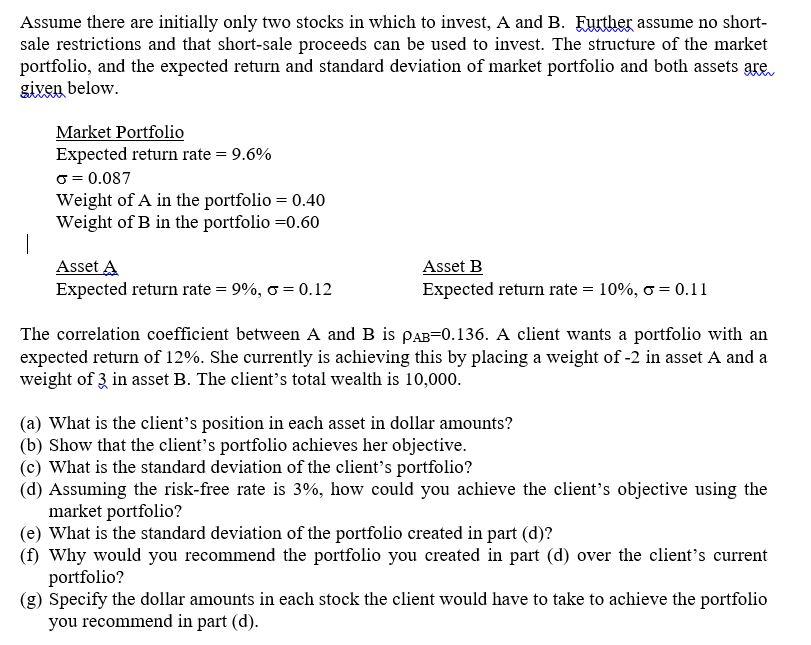

Assume there are initially only two stocks in which to invest, A and B. Further assume no shortsale restrictions and that short-sale proceeds can be used to invest. The structure of the market portfolio, and the expected return and standard deviation of market portfolio and both assets are given below. Market Portfolio Expected return rate =9.6% =0.087 Weight of A in the portfolio =0.40 Weight of B in the portfolio =0.60 The correlation coefficient between A and B is AB=0.136. A client wants a portfolio with an expected return of 12%. She currently is achieving this by placing a weight of 2 in asset weight of 3 in asset B. The client's total wealth is 10,000 . (a) What is the client's position in each asset in dollar amounts? (b) Show that the client's portfolio achieves her objective. (c) What is the standard deviation of the client's portfolio? (d) Assuming the risk-free rate is 3%, how could you achieve the client's objective using the market portfolio? (e) What is the standard deviation of the portfolio created in part (d)? (f) Why would you recommend the portfolio you created in part (d) over the client's current portfolio? (g) Specify the dollar amounts in each stock the client would have to take to achieve the portfolio you recommend in part (d). Assume there are initially only two stocks in which to invest, A and B. Further assume no shortsale restrictions and that short-sale proceeds can be used to invest. The structure of the market portfolio, and the expected return and standard deviation of market portfolio and both assets are given below. Market Portfolio Expected return rate =9.6% =0.087 Weight of A in the portfolio =0.40 Weight of B in the portfolio =0.60 The correlation coefficient between A and B is AB=0.136. A client wants a portfolio with an expected return of 12%. She currently is achieving this by placing a weight of 2 in asset weight of 3 in asset B. The client's total wealth is 10,000 . (a) What is the client's position in each asset in dollar amounts? (b) Show that the client's portfolio achieves her objective. (c) What is the standard deviation of the client's portfolio? (d) Assuming the risk-free rate is 3%, how could you achieve the client's objective using the market portfolio? (e) What is the standard deviation of the portfolio created in part (d)? (f) Why would you recommend the portfolio you created in part (d) over the client's current portfolio? (g) Specify the dollar amounts in each stock the client would have to take to achieve the portfolio you recommend in part (d)