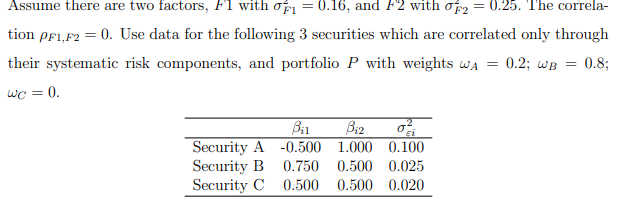

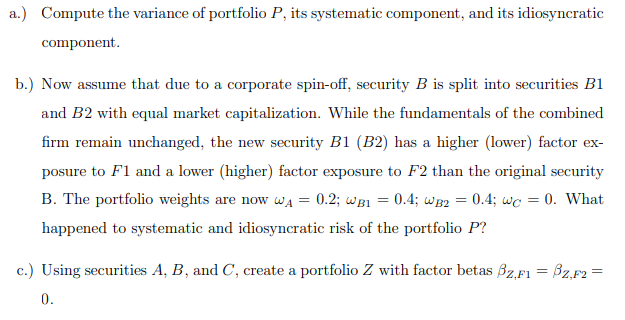

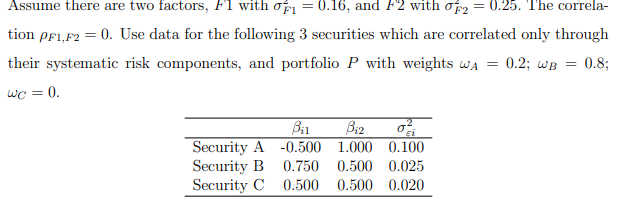

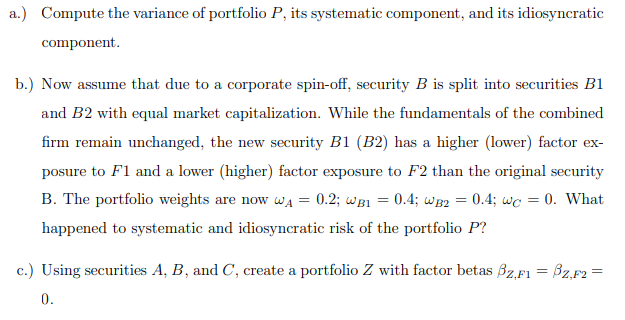

Assume there are two factors, Fl with oti = 0.16, and F2 with of2 = 0.25. The correla- tion PF1,F2 = 0. Use data for the following 3 securities which are correlated only through their systematic risk components, and portfolio P with weights WA = 0.2; wb = 0.8; wc = 0. Bil Security A -0.500 Security B 0.750 Security C 0.500 Biz 1.000 0.100 0.500 0.025 0.500 0.020 a.) Compute the variance of portfolio P, its systematic component, and its idiosyncratic component. b.) Now assume that due to a corporate spin-off, security B is split into securities B1 and B2 with equal market capitalization. While the fundamentals of the combined firm remain unchanged, the new security B1 (B2) has a higher (lower) factor ex- posure to F1 and a lower (higher) factor exposure to F2 than the original security B. The portfolio weights are now wa= 0.2; WB1 = 0.4; WB2 = 0.4; wc = 0. What happened to systematic and idiosyncratic risk of the portfolio P? = c.) Using securities A, B, and C, create a portfolio Z with factor betas Bz,F1 = B2,F2 = 0. Assume there are two factors, Fl with oti = 0.16, and F2 with of2 = 0.25. The correla- tion PF1,F2 = 0. Use data for the following 3 securities which are correlated only through their systematic risk components, and portfolio P with weights WA = 0.2; wb = 0.8; wc = 0. Bil Security A -0.500 Security B 0.750 Security C 0.500 Biz 1.000 0.100 0.500 0.025 0.500 0.020 a.) Compute the variance of portfolio P, its systematic component, and its idiosyncratic component. b.) Now assume that due to a corporate spin-off, security B is split into securities B1 and B2 with equal market capitalization. While the fundamentals of the combined firm remain unchanged, the new security B1 (B2) has a higher (lower) factor ex- posure to F1 and a lower (higher) factor exposure to F2 than the original security B. The portfolio weights are now wa= 0.2; WB1 = 0.4; WB2 = 0.4; wc = 0. What happened to systematic and idiosyncratic risk of the portfolio P? = c.) Using securities A, B, and C, create a portfolio Z with factor betas Bz,F1 = B2,F2 = 0