Question

Assume these were the quoted NOK spot, one-year forward rates, one-year fixed interest rates in late November (usual notation: number of NOK per unit

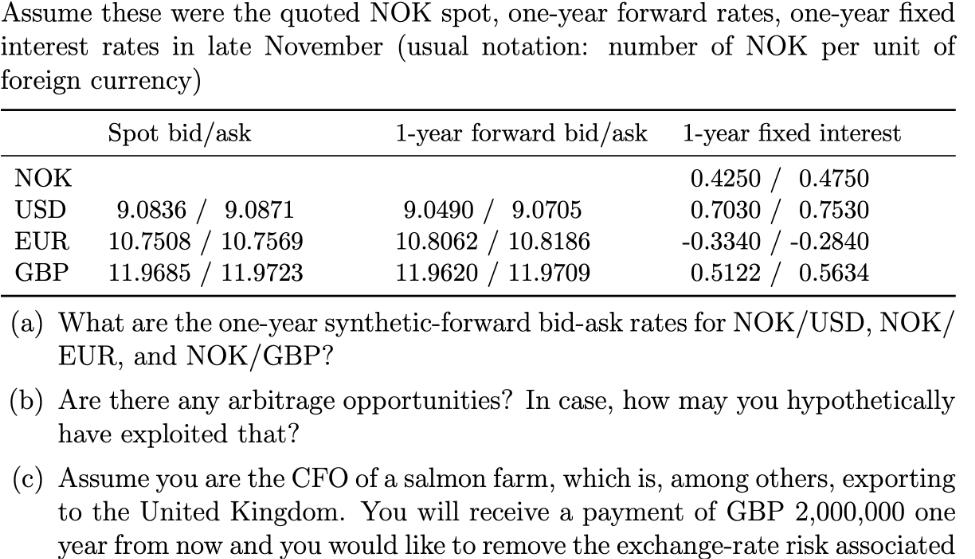

Assume these were the quoted NOK spot, one-year forward rates, one-year fixed interest rates in late November (usual notation: number of NOK per unit of foreign currency) Spot bid/ask NOK USD EUR GBP 9.0836 / 9.0871 10.7508/ 10.7569 11.9685 / 11.9723 1-year fixed interest 9.0490/ 9.0705 10.8062 10.8186 11.9620 / 11.9709 0.4250 / 0.4750 0.7030/0.7530 -0.3340 -0.2840 0.5122 0.5634 synthetic-forward bid-ask rates for NOK/USD, NOK/ (a) What are the one-year EUR, and NOK/GBP? 1-year forward bid/ask (b) Are there any arbitrage opportunities? In case, how may you hypothetically have exploited that? (c) Assume you are the CFO of a salmon farm, which is, among others, exporting to the United Kingdom. You will receive a payment of GBP 2,000,000 one year from now and you would like to remove the exchange-rate risk associated

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Spreadsheet Modeling And Decision Analysis A Practical Introduction To Management Science

Authors: Cliff T. Ragsdale

5th Edition

324656645, 324656637, 9780324656640, 978-0324656633

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App