Question: Assume today is t=0. A 10-year fixed rate bond with a 5% coupon rate is selling at par (annual coupons). From $200 FV of

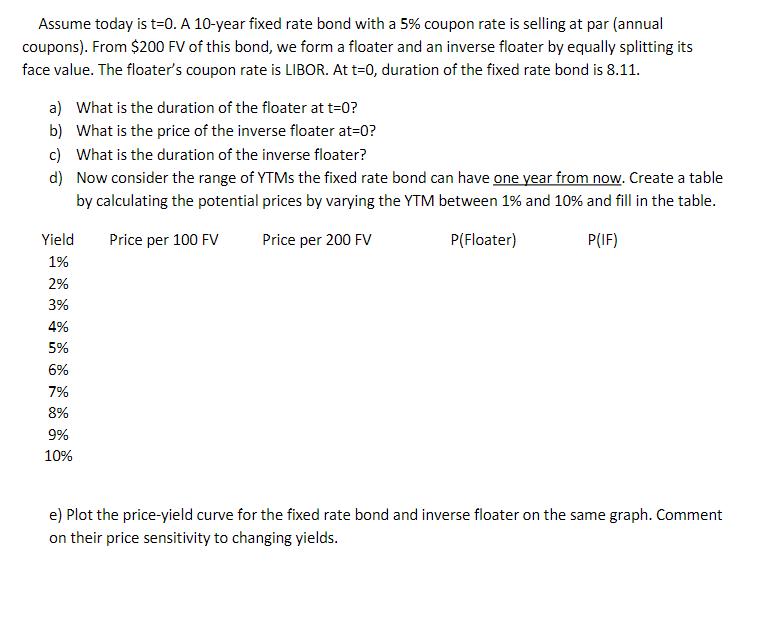

Assume today is t=0. A 10-year fixed rate bond with a 5% coupon rate is selling at par (annual coupons). From $200 FV of this bond, we form a floater and an inverse floater by equally splitting its face value. The floater's coupon rate is LIBOR. At t=0, duration of the fixed rate bond is 8.11. a) What is the duration of the floater at t=0? b) What is the price of the inverse floater at=0? c) What is the duration of the inverse floater? d) Now consider the range of YTMs the fixed rate bond can have one year from now. Create a table by calculating the potential prices by varying the YTM between 1% and 10% and fill in the table. Price per 100 FV Price per 200 FV P(Floater) P(IF) Yield 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% e) Plot the price-yield curve for the fixed rate bond and inverse floater on the same graph. Comment on their price sensitivity to changing yields.

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

a The duration of the floater at t0 can be calculated by taking the weighted average of the durations of its cash flows Since the floaters coupon rate ... View full answer

Get step-by-step solutions from verified subject matter experts