Assume today's date is 1 January 2020. You are provided the following information about FunFact Sdn. Bhd, a new company: FunFact Sdn. Bhd. (FunFact)

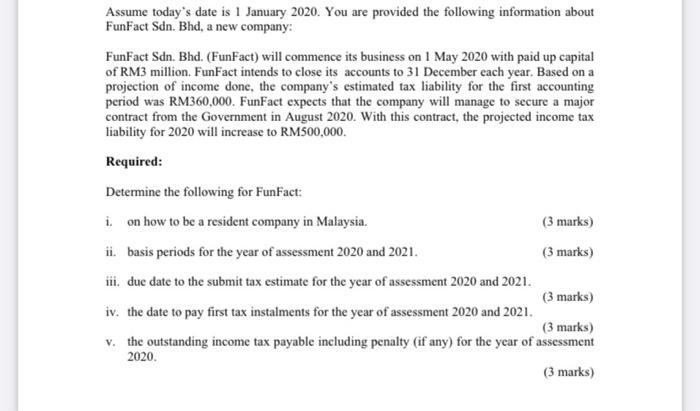

Assume today's date is 1 January 2020. You are provided the following information about FunFact Sdn. Bhd, a new company: FunFact Sdn. Bhd. (FunFact) will commence its business on 1 May 2020 with paid up capital of RM3 million. FunFact intends to close its accounts to 31 December each year. Based on a projection of income done, the company's estimated tax liability for the first accounting period was RM360,000. FunFact expects that the company will manage to secure a major contract from the Government in August 2020. With this contract, the projected income tax liability for 2020 will increase to RM500,000. Required: Determine the following for FunFact: i. on how to be a resident company in Malaysia. (3 marks) ii. basis periods for the year of assessment 2020 and 2021. (3 marks) ii. due date to the submit tax estimate for the year of assessment 2020 and 2021. (3 marks) iv. the date to pay first tax instalments for the year of assessment 2020 and 2021. (3 marks) v. the outstanding income tax payable including penalty (if any) for the year of assessment 2020. (3 marks)

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

i A company is tax resident in Malaysia in a basis year normally the financial year if at any time during the basis year the management and control of its affairs are exercised in Malaysia Generally a ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started