Answered step by step

Verified Expert Solution

Question

1 Approved Answer

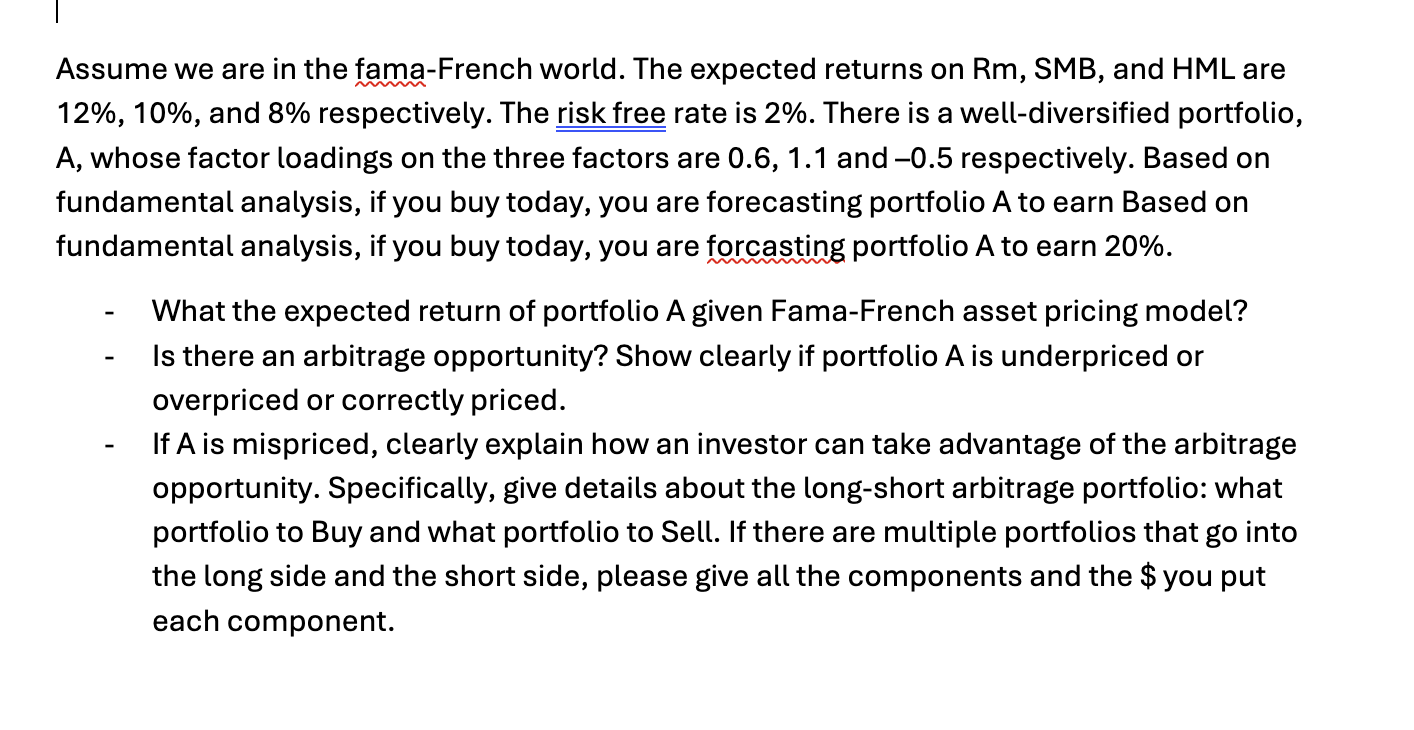

Assume we are in the fama - French world. The expected returns on R m , S M B , and H M L are

Assume we are in the famaFrench world. The expected returns on and are

and respectively. The risk free rate is There is a welldiversified portfolio,

A whose factor loadings on the three factors are and respectively. Based on

fundamental analysis, if you buy today, you are forecasting portfolio to earn Based on

fundamental analysis, if you buy today, you are forcasting portfolio A to earn

What the expected return of portfolio A given FamaFrench asset pricing model?

Is there an arbitrage opportunity? Show clearly if portfolio A is underpriced or

overpriced or correctly priced.

If is mispriced, clearly explain how an investor can take advantage of the arbitrage

opportunity. Specifically, give details about the longshort arbitrage portfolio: what

portfolio to Buy and what portfolio to Sell. If there are multiple portfolios that go into

the long side and the short side, please give all the components and the $ you put

each component.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started