Answered step by step

Verified Expert Solution

Question

1 Approved Answer

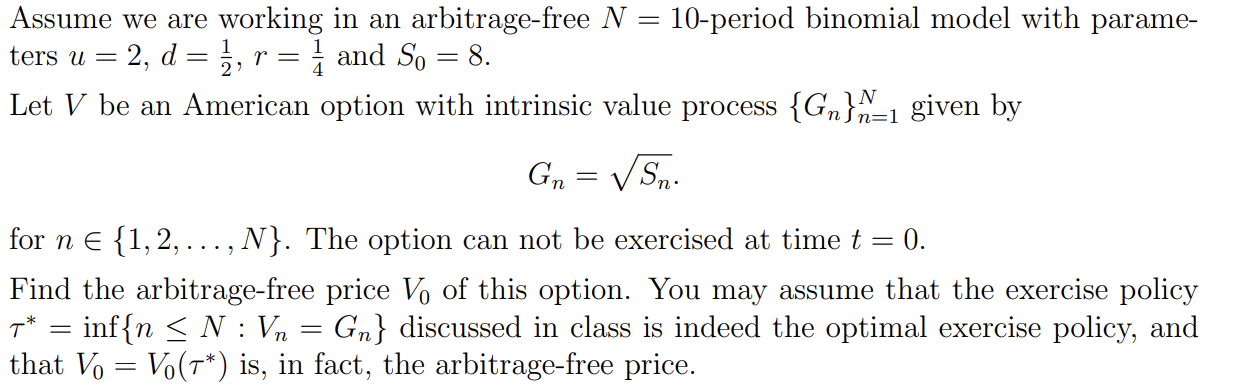

Assume we are working in an arbitrage - free N = 1 0 - period binomial model with parame - ters u = 2 ,

Assume we are working in an arbitragefree period binomial model with parame

ters and

Let be an American option with intrinsic value process given by

for nindots, The option can not be exercised at time

Find the arbitragefree price of this option. You may assume that the exercise policy

inf: discussed in class is indeed the optimal exercise policy, and

that is in fact, the arbitragefree price.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started