Answered step by step

Verified Expert Solution

Question

1 Approved Answer

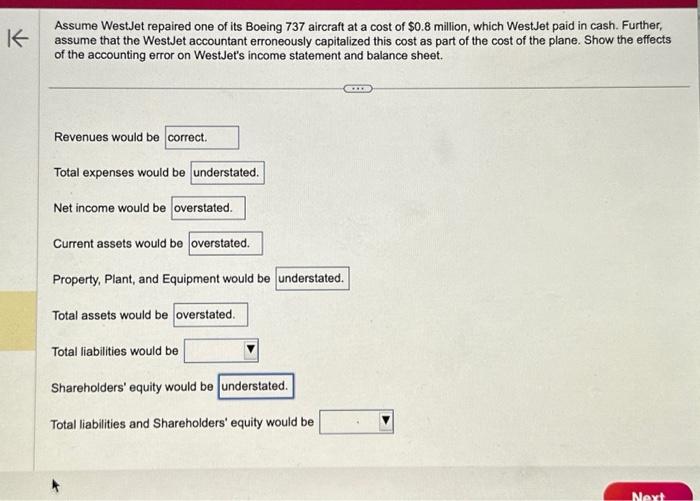

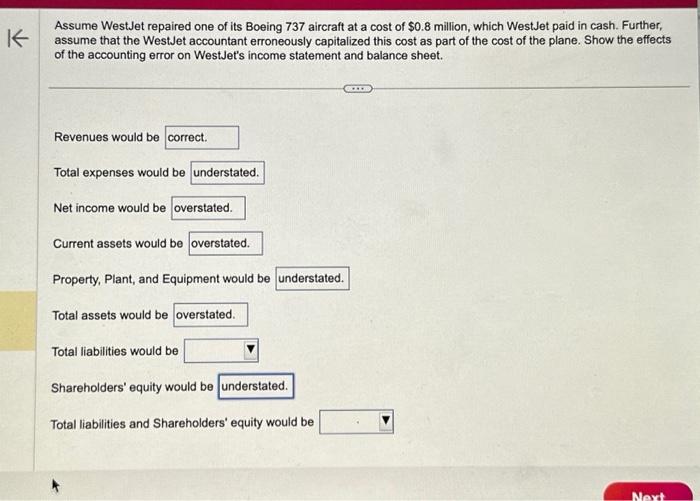

Assume WestJet repaired one of its Boeing 737 aircraft at a cost of $0.8 million, which WestJet paid in cash. Further, assume that the WestJet

Assume WestJet repaired one of its Boeing 737 aircraft at a cost of $0.8 million, which WestJet paid in cash. Further, assume that the WestJet accountant erroneously capitalized this cost as part of the cost of the plane. Show the effects of the accounting error on WestJet's income statement and balance sheet. Revenues would be correct. Total expenses would be understated. Net income would be overstated. Current assets would be overstated. Property, Plant, and Equipment would be understated. Total assets would be overstated. Total liabilities would be Shareholders' equity would be understated. Total liabilities and Shareholders' equity would be ... Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started