Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you are a farmer and want to hedge the value of a growing commodity. For concreteness, assume current cash prices are $10.00/unit and

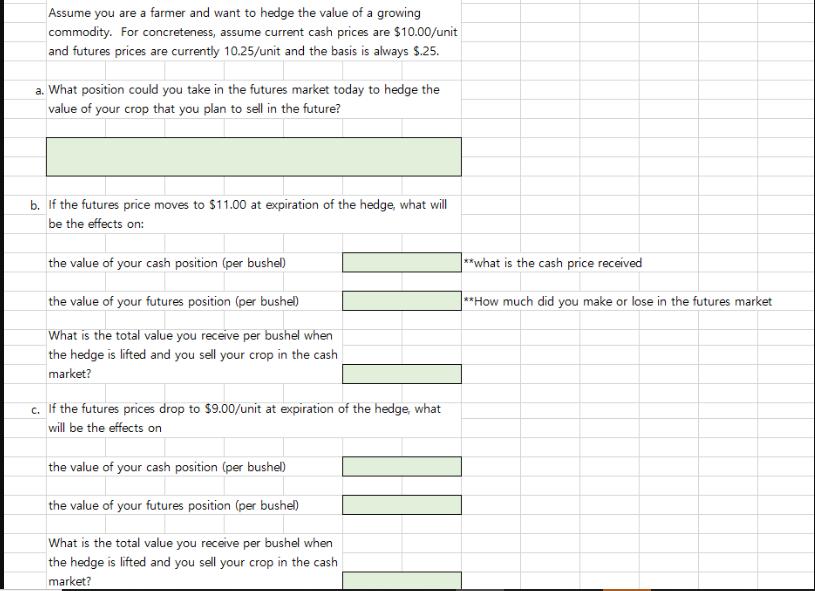

Assume you are a farmer and want to hedge the value of a growing commodity. For concreteness, assume current cash prices are $10.00/unit and futures prices are currently 10.25/unit and the basis is always $.25. a. What position could you take in the futures market today to hedge the value of your crop that you plan to sell in the future? b. If the futures price moves to $11.00 at expiration of the hedge, what will be the effects on: the value of your cash position (per bushel) the value of your futures position (per bushel) What is the total value you receive per bushel when the hedge is lifted and you sell your crop in the cash market? c. If the futures prices drop to $9.00/unit at expiration of the hedge, what will be the effects on the value of your cash position (per bushel) the value of your futures position (per bushel) What is the total value you receive per bushel when the hedge is lifted and you sell your crop in the cash market? **what is the cash price received **How much did you make or lose in the futures market

Step by Step Solution

★★★★★

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Hedging your Crop a Hedging Position As a farmer wanting to hedge your crop you should take a short ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started