Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due in three months. Three-month

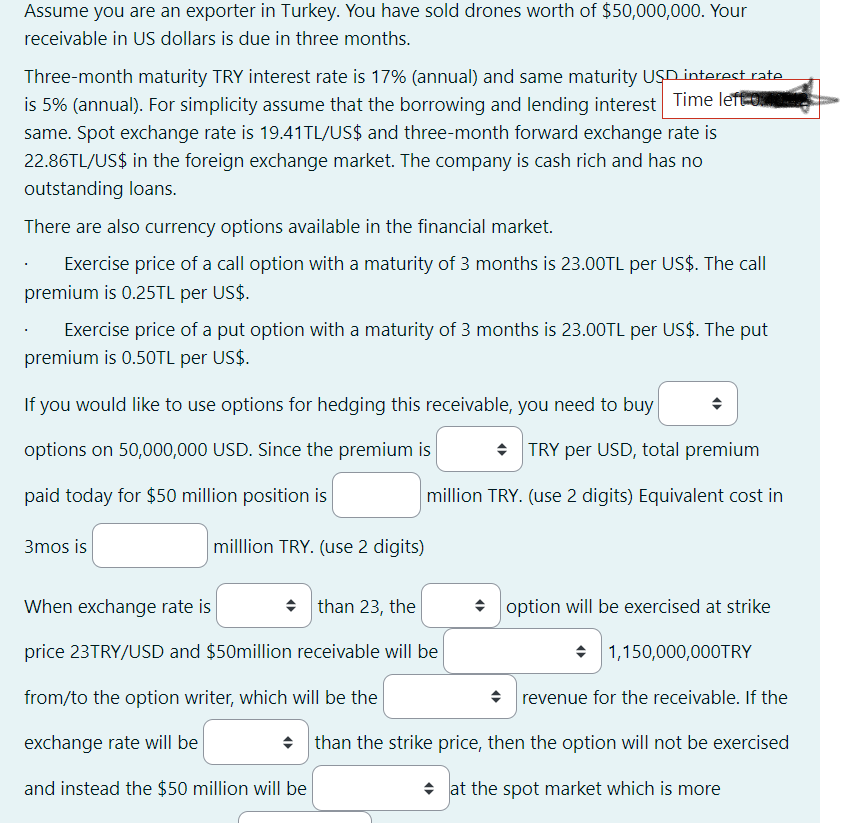

Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due in three months. Three-month maturity TRY interest rate is 17% (annual) and same maturity U@n intarnst m+n is 5% (annual). For simplicity assume that the borrowing and lending interest same. Spot exchange rate is 19.41TL/US$ and three-month forward exchange rate is 22.86TL/US$ in the foreign exchange market. The company is cash rich and has no outstanding loans. There are also currency options available in the financial market. Exercise price of a call option with a maturity of 3 months is 23.00TL per US\$. The call premium is 0.25 TL per US\$. Exercise price of a put option with a maturity of 3 months is 23.00TL per US $. The put premium is 0.50 TL per US\$. If you would like to use options for hedging this receivable, you need to buy options on 50,000,000 USD. Since the premium is TRY per USD, total premium paid today for $50 million position is million TRY. (use 2 digits) Equivalent cost in 3 mos is million TRY. (use 2 digits) When exchange rate is than 23 , the option will be exercised at strike price 23TRY/USD and $50 million receivable will be 1,150,000,000 TRY from/to the option writer, which will be the revenue for the receivable. If the exchange rate will be than the strike price, then the option will not be exercised and instead the $50 million will be at the spot market which is more

Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due in three months. Three-month maturity TRY interest rate is 17% (annual) and same maturity U@n intarnst m+n is 5% (annual). For simplicity assume that the borrowing and lending interest same. Spot exchange rate is 19.41TL/US$ and three-month forward exchange rate is 22.86TL/US$ in the foreign exchange market. The company is cash rich and has no outstanding loans. There are also currency options available in the financial market. Exercise price of a call option with a maturity of 3 months is 23.00TL per US\$. The call premium is 0.25 TL per US\$. Exercise price of a put option with a maturity of 3 months is 23.00TL per US $. The put premium is 0.50 TL per US\$. If you would like to use options for hedging this receivable, you need to buy options on 50,000,000 USD. Since the premium is TRY per USD, total premium paid today for $50 million position is million TRY. (use 2 digits) Equivalent cost in 3 mos is million TRY. (use 2 digits) When exchange rate is than 23 , the option will be exercised at strike price 23TRY/USD and $50 million receivable will be 1,150,000,000 TRY from/to the option writer, which will be the revenue for the receivable. If the exchange rate will be than the strike price, then the option will not be exercised and instead the $50 million will be at the spot market which is more

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started