Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due in three months. Three-month

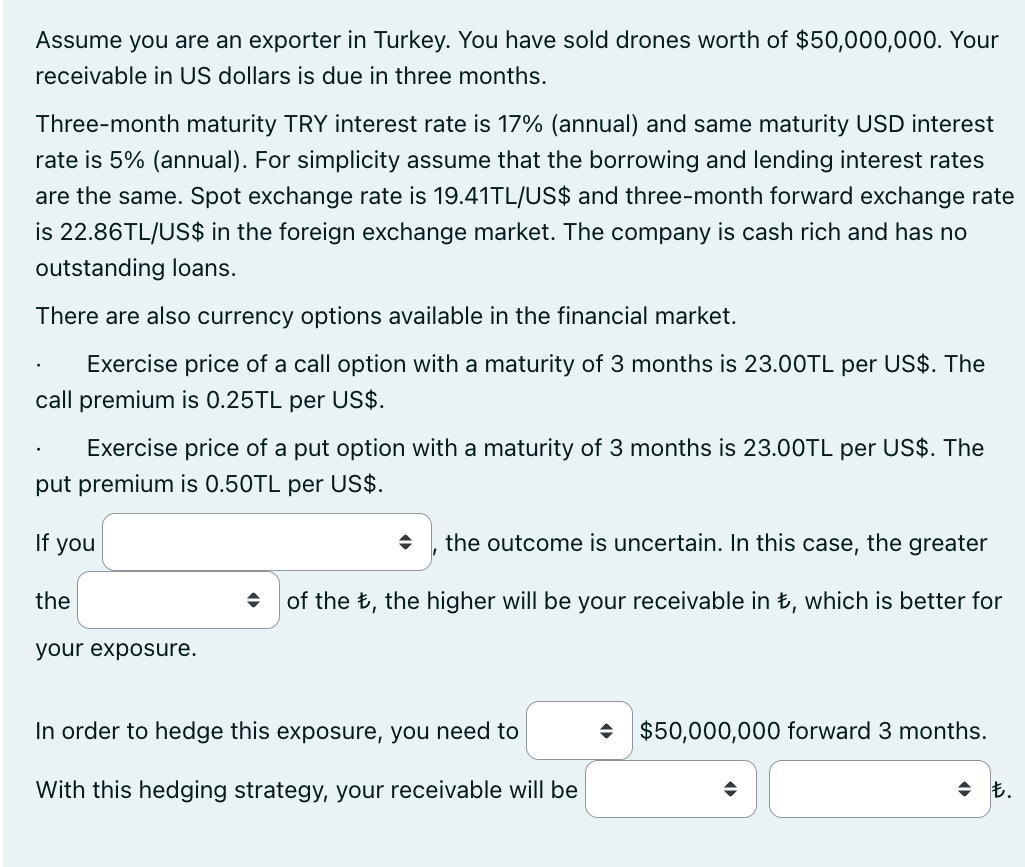

Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due in three months. Three-month maturity TRY interest rate is 17% (annual) and same maturity USD interest rate is 5% (annual). For simplicity assume that the borrowing and lending interest rates are the same. Spot exchange rate is 19.41TL/US$ and three-month forward exchange rate is 22.86TL/US$ in the foreign exchange market. The company is cash rich and has no outstanding loans. There are also currency options available in the financial market. Exercise price of a call option with a maturity of 3 months is 23.00TL per US\$. The call premium is 0.25 TL per US $. Exercise price of a put option with a maturity of 3 months is 23.00TL per US $. The put premium is 0.50 TL per US\$. If you the outcome is uncertain. In this case, the greater the of the , the higher will be your receivable in , which is better for your exposure. In order to hedge this exposure, you need to $50,000,000 forward 3 months. With this hedging strategy, your receivable will be

Assume you are an exporter in Turkey. You have sold drones worth of $50,000,000. Your receivable in US dollars is due in three months. Three-month maturity TRY interest rate is 17% (annual) and same maturity USD interest rate is 5% (annual). For simplicity assume that the borrowing and lending interest rates are the same. Spot exchange rate is 19.41TL/US$ and three-month forward exchange rate is 22.86TL/US$ in the foreign exchange market. The company is cash rich and has no outstanding loans. There are also currency options available in the financial market. Exercise price of a call option with a maturity of 3 months is 23.00TL per US\$. The call premium is 0.25 TL per US $. Exercise price of a put option with a maturity of 3 months is 23.00TL per US $. The put premium is 0.50 TL per US\$. If you the outcome is uncertain. In this case, the greater the of the , the higher will be your receivable in , which is better for your exposure. In order to hedge this exposure, you need to $50,000,000 forward 3 months. With this hedging strategy, your receivable will be Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started