Answered step by step

Verified Expert Solution

Question

1 Approved Answer

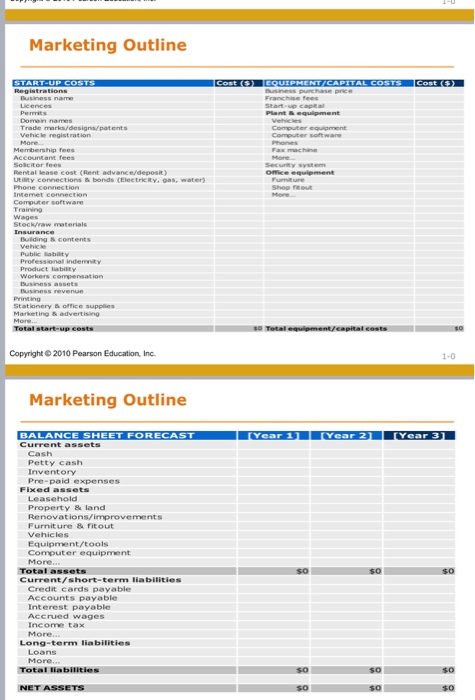

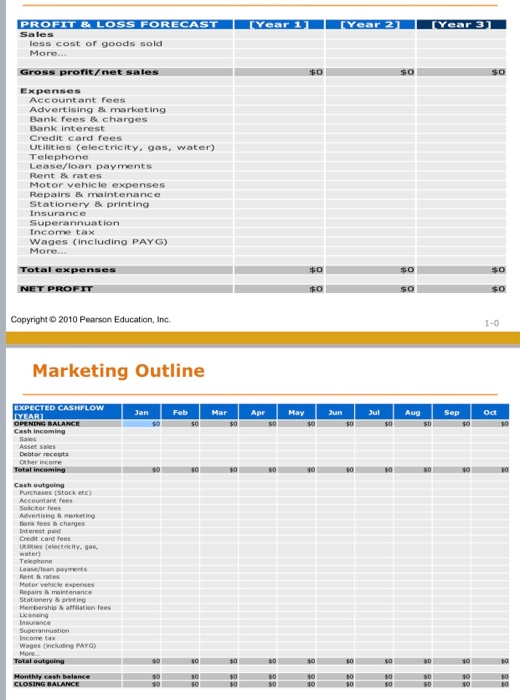

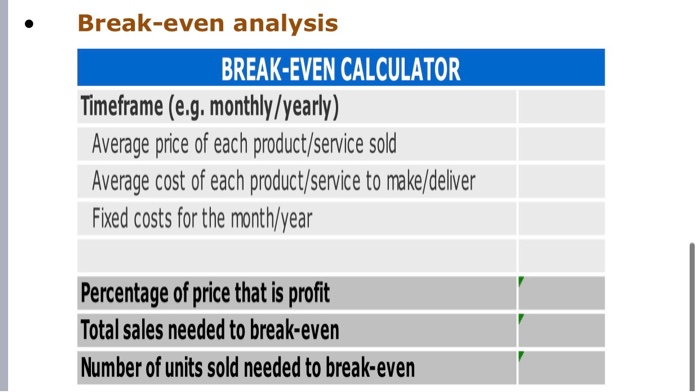

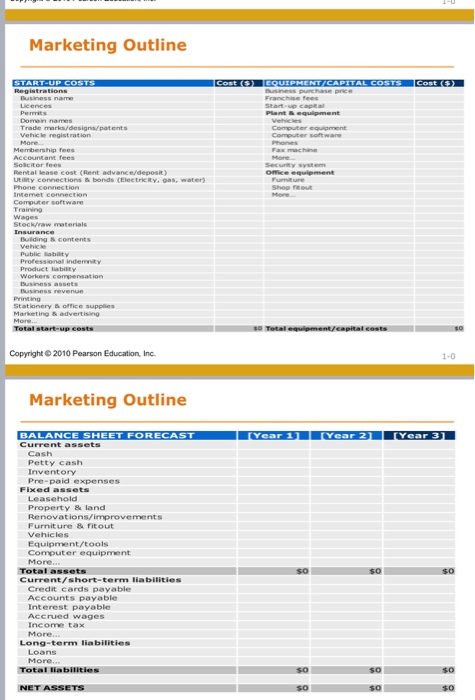

Assume you are starting a babysitting business, prepare a three year forecast for the following financial statements. The investment is $380,000 They want a 5yr

Assume you are starting a babysitting business, prepare a three year forecast for the following financial statements. The investment is $380,000

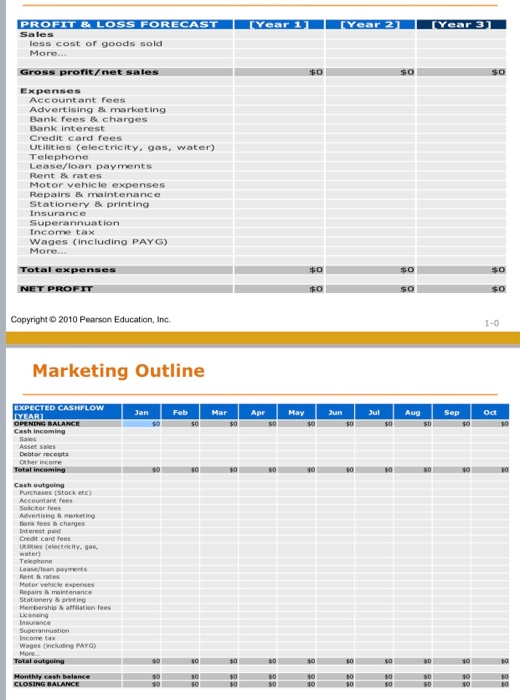

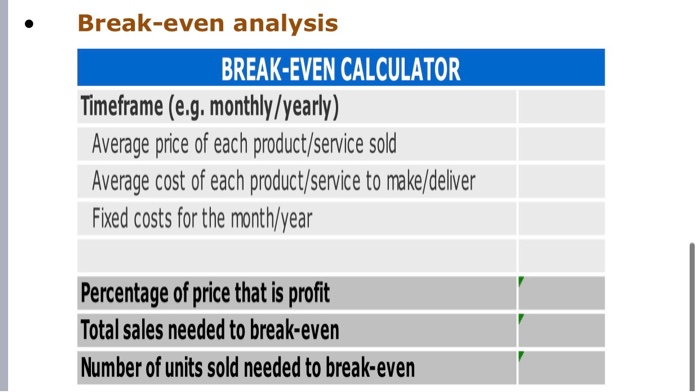

Marketing Outline STARTUP COSTS Cost EQUIPMENT CAPITAL COSTSCOSTO Plants Trademas ters Membership fees Solicitor fees antallas cost Rent avancerepost) U conctions bonds (Electricity gas, water) Stockw materiais Printing Stationery office supplies Total start-up costs Total equipment / capital costs Copyright 2010 Pearson Education, Inc. Marketing Outline TYear 1 Year 2 (Year 3) BALANCE SHEET FORECAST Current assets cash Petty cash Inventory Pre-paid expenses Fixed assets Leasehold Property land Renovations/improvements Furniture & Fitout Vehicles Equipment/tools Computer equipment More Total assets Current/short-term liabilitie Credit Cards payable Accounts payable Interest payable Accred wages Income tax More Long-term liabilities Loans More Total liabilities NET ASSETS PROPIT E LOSS FORECAST Sales less cost of goods sold More Gross prontet sales Accountant fees Advertising & marketing Bank fees charges Bank interest Credit card fees Utilities (electricity, gas, water) Telephone Lease/loan payments Rent rates Motor vehicle expenses Repairs maintenance Stationery B printing Insurance Superannuation Income tax Wages (including PAYG) More... Total expenses $0 NET PROFIT Copyright 2010 Pearson Education, Inc. Marketing Outline EXPECTED CASHFLOW OPENENG BALANCE purchases (Stock ate) Accountant fees Advertis i ng de candles rates Hoorn Stationery W PAYG) Total M y cash balance CLOSING BALANCE Break-even analysis BREAK-EVEN CALCULATOR Timeframe (e.g. monthly/yearly) Average price of each product/service sold Average cost of each product/Service to make/deliver Fixed costs for the month/year Percentage of price that is profit Total sales needed to break-even Number of units sold needed to break-even Marketing Outline STARTUP COSTS Cost EQUIPMENT CAPITAL COSTSCOSTO Plants Trademas ters Membership fees Solicitor fees antallas cost Rent avancerepost) U conctions bonds (Electricity gas, water) Stockw materiais Printing Stationery office supplies Total start-up costs Total equipment / capital costs Copyright 2010 Pearson Education, Inc. Marketing Outline TYear 1 Year 2 (Year 3) BALANCE SHEET FORECAST Current assets cash Petty cash Inventory Pre-paid expenses Fixed assets Leasehold Property land Renovations/improvements Furniture & Fitout Vehicles Equipment/tools Computer equipment More Total assets Current/short-term liabilitie Credit Cards payable Accounts payable Interest payable Accred wages Income tax More Long-term liabilities Loans More Total liabilities NET ASSETS PROPIT E LOSS FORECAST Sales less cost of goods sold More Gross prontet sales Accountant fees Advertising & marketing Bank fees charges Bank interest Credit card fees Utilities (electricity, gas, water) Telephone Lease/loan payments Rent rates Motor vehicle expenses Repairs maintenance Stationery B printing Insurance Superannuation Income tax Wages (including PAYG) More... Total expenses $0 NET PROFIT Copyright 2010 Pearson Education, Inc. Marketing Outline EXPECTED CASHFLOW OPENENG BALANCE purchases (Stock ate) Accountant fees Advertis i ng de candles rates Hoorn Stationery W PAYG) Total M y cash balance CLOSING BALANCE Break-even analysis BREAK-EVEN CALCULATOR Timeframe (e.g. monthly/yearly) Average price of each product/service sold Average cost of each product/Service to make/deliver Fixed costs for the month/year Percentage of price that is profit Total sales needed to break-even Number of units sold needed to break-even They want a 5yr loan of $545,000

They project the sales for the first year will be $600,000 and should increase because they hope to take on 10 more people. There are 2 other day cares in the area, however they close early so our daycare has an advantage.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started