Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you are the management accountant for the Foleo Group. After her meetings with the various business units, Tracey Chen has identified a number

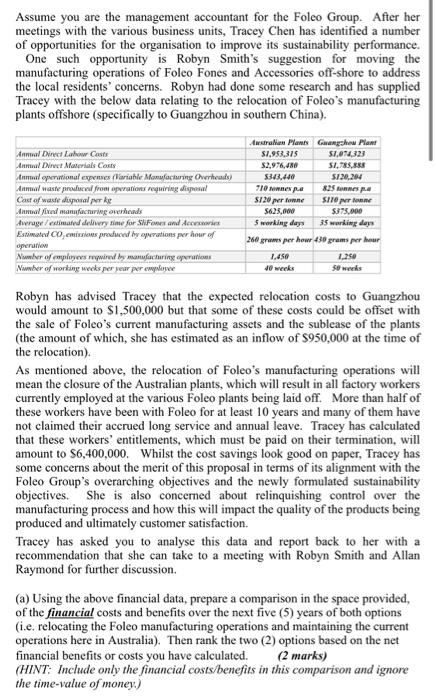

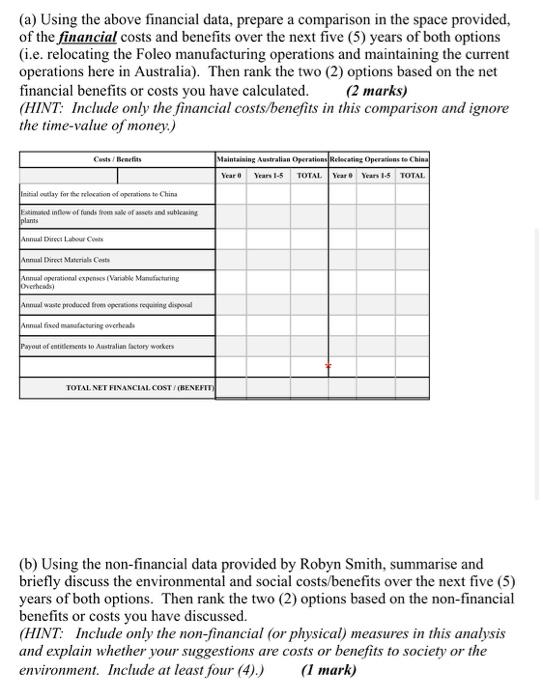

Assume you are the management accountant for the Foleo Group. After her meetings with the various business units, Tracey Chen has identified a number of opportunities for the organisation to improve its sustainability performance. One such opportunity is Robyn Smith's suggestion for moving the manufacturing operations of Foleo Fones and Accessories off-shore to address the local residents' concerns. Robyn had done some research and has supplied Tracey with the below data relating to the relocation of Foleo's manufacturing plants offshore (specifically to Guangzhou in southern China). Aestralian Plants Guangzhou Plant Annual Direct Labour Casts S1,953,315 S1,074,323 Anmual Direct Materials Costs $2.976,480 Annual operational expenses (Variable Manufacturing Cverheads) Annual waste producel from operations requiring disposal Cast of waste disporal per ke Annual fived manfacturing overheads Average / estimated delivery time for ShFones and Accesories S43,440 710 omnes p S120,204 825 tomnes pa S120 per tonne Sle per tonne S625,000 $375,000 S working days 35 working days Estimated CO,emissions produced by opperations per hour of 260 grams per hour 430 grams per hour operation Number of employees ropuired by manufacharing operutions Niwwber of working weeks per year per emplayee 1,450 1,250 40 weeks 50 weeks Robyn has advised Tracey that the expected relocation costs to Guangzhou would amount to $1,500,000 but that some of these costs could be offset with the sale of Foleo's current manufacturing assets and the sublease of the plants (the amount of which, she has estimated as an inflow of $950,000 at the time of the relocation). As mentioned above, the relocation of Foleo's manufacturing operations will mean the closure of the Australian plants, which will result in all factory workers currently employed at the various Foleo plants being laid off. More than half of these workers have been with Foleo for at least 10 years and many of them have not claimed their acerued long service and annual leave. Tracey has calculated that these workers' entitlements, which must be paid on their termination, will amount to $6,400,000. Whilst the cost savings look good on paper, Tracey has some concerns about the merit of this proposal in terms of its alignment with the Foleo Group's overarching objectives and the newly formulated sustainability objectives. She is also concerned about relinquishing control over the manufacturing process and how this will impact the quality of the products being produced and ultimately customer satisfaction. Tracey has asked you to analyse this data and report back to her with a recommendation that she can take to a meeting with Robyn Smith and Allan Raymond for further discussion. (a) Using the above financial data, prepare a comparison in the space provided, of the financial costs and benefits over the next five (5) years of both options (i.e. relocating the Foleo manufacturing operations and maintaining the current operations here in Australia). Then rank the two (2) options based on the net financial benefits or costs you have calculated. (HINT: Include only the financial costs/benefits in this comparison and ignore the time-value of money.) (2 marks) (a) Using the above financial data, prepare a comparison in the space provided, of the financial costs and benefits over the next five (5) years of both options (i.e. relocating the Foleo manufacturing operations and maintaining the current operations here in Australia). Then rank the two (2) options based on the net financial benefits or costs you have calculated. (HINT: Include only the financial costs/benefits in this comparison and ignore the time-value of money.) (2 marks) Maintaining Australian Operations Relocating Operations to China Yeare Years 1-5 TOTAL Year Years 15 TOTAL Custs / Benetits initial outlay for the relocation of operations to China Etimaied inflow of funds fom sale of assets and subleasing plants Annual Direct Labour Conts Annual Direct Materials Cests Annual operational expenses (Variable Manufacturing Overhead) Annual wote produced from operations requining disposal Annual fised manafacturing overheads Payout of entitlenents to Australian factory workers TOTAL NET FINANCIAL COST / (BENEFITm (b) Using the non-financial data provided by Robyn Smith, summarise and briefly discuss the environmental and social costs/benefits over the next five (5) years of both options. Then rank the two (2) options based on the non-financial benefits or costs you have discussed. (HINT: Include only the non-financial (or physical) measures in this analysis and explain whether your suggestions are costs or benefits to society or the environment. Include at least four (4).) (1 mark)

Step by Step Solution

★★★★★

3.47 Rating (190 Votes )

There are 3 Steps involved in it

Step: 1

Prevention cost Environmental training for production staff 5000 Total prevention cost 5000 Appraisa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started