Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you can borrow or lend $1 million at the given interest rate in all countries, and enter both spot and forward exchange market. Can

Assume you can borrow or lend $1 million at the given interest rate in all countries, and enter both spot and forward exchange market.

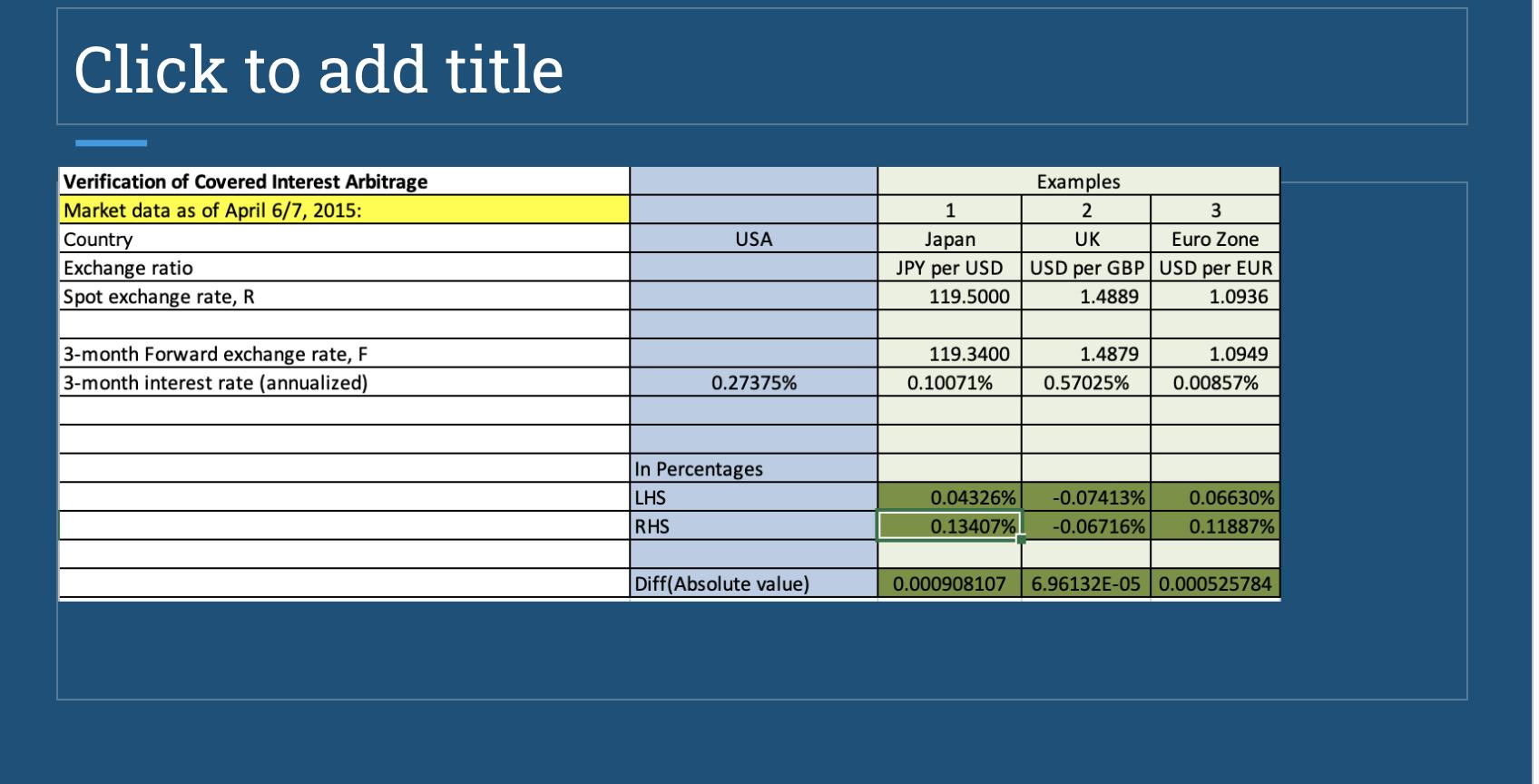

Click to add title Verification of Covered Interest Arbitrage Market data as of April 6/7, 2015: Country Exchange ratio Spot exchange rate, R 3-month Forward exchange rate, F 3-month interest rate (annualized) USA 0.27375% In Percentages LHS RHS Diff(Absolute value) 1 Japan JPY per USD 119.5000 119.3400 0.10071% Examples 2 UK USD per GBP 1.4889 1.4879 0.57025% 0.04326% -0.07413% 0.13407% -0.06716% 3 Euro Zone USD per EUR 1.0936 1.0949 0.00857% 0.06630% 0.11887% 0.000908107 6.96132E-05 0.000525784

Step by Step Solution

★★★★★

3.48 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started