Question

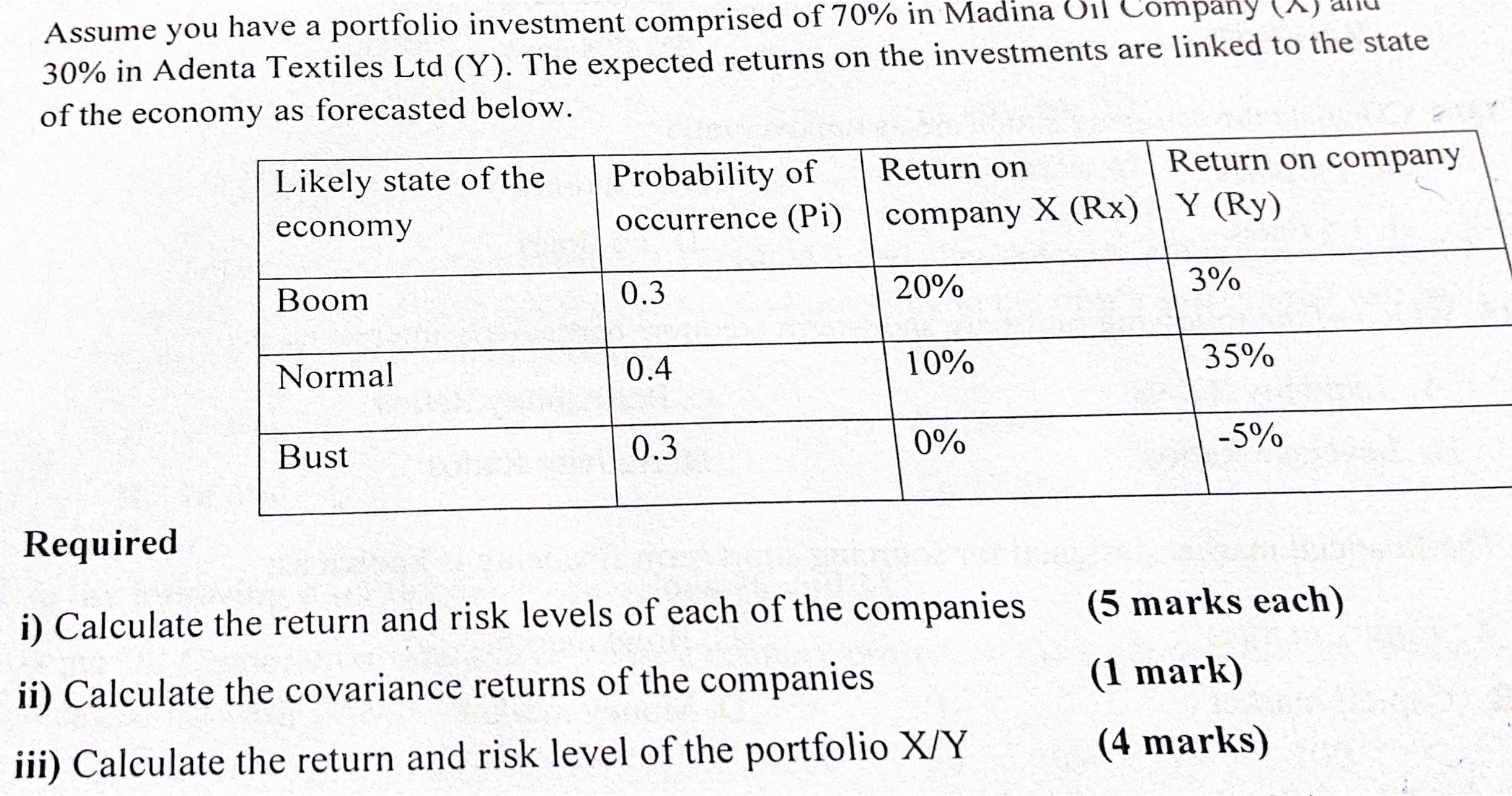

Assume you have a portfolio investment comprised of 70% in Madina Oil Company 30% in Adenta Textiles Ltd (Y). The expected returns on the

Assume you have a portfolio investment comprised of 70% in Madina Oil Company 30% in Adenta Textiles Ltd (Y). The expected returns on the investments are linked to the state of the economy as forecasted below. Likely state of the economy Boom Normal Bust Probability of occurrence (Pi) 0.3 0.4 0.3 Return on company X (Rx) Y (Ry) 3% 20% 10% 0% Return on company Required i) Calculate the return and risk levels of each of the companies ii) Calculate the covariance returns of the companies iii) Calculate the return and risk level of the portfolio X/Y 35% -5% (5 marks each) (1 mark) (4 marks)

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

i Calculating the return and risk levels of each company Madina ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Berk, DeMarzo, Harford

2nd edition

132148234, 978-0132148238

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App