Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you have forecast a firm's free cash flows (FCFS) in the first three years (see the below table). You believe that the firm's

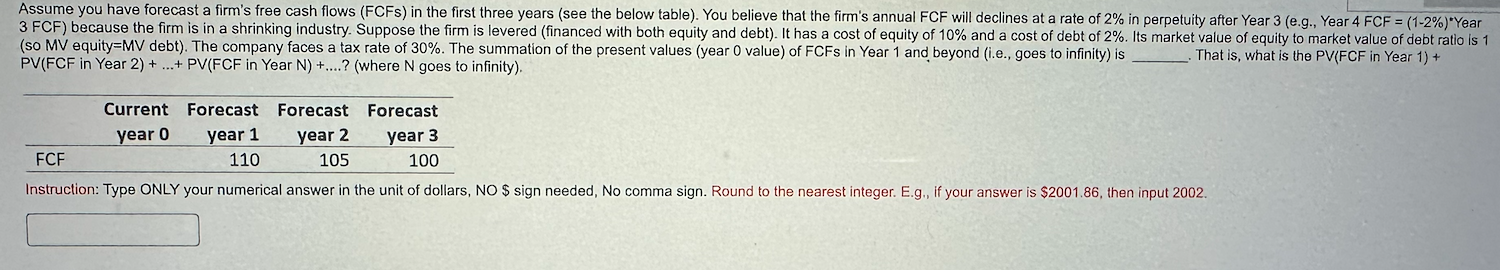

Assume you have forecast a firm's free cash flows (FCFS) in the first three years (see the below table). You believe that the firm's annual FCF will declines at a rate of 2% in perpetuity after Year 3 (e.g., Year 4 FCF = (1-2%)*Year 3 FCF) because the firm is in a shrinking industry. Suppose the firm is levered (financed with both equity and debt). It has a cost of equity of 10% and a cost of debt of 2%. Its market value of equity to market value of debt ratio is 1 (so MV equity=MV debt). The company faces a tax rate of 30%. The summation of the present values (year 0 value) of FCFS in Year 1 and beyond (i.e., goes to infinity) is That is, what is the PV(FCF in Year 1) + PV(FCF in Year 2) +...+ PV(FCF in Year N) +....? (where N goes to infinity). Current year 0 Forecast year 1 Forecast year 2 Forecast year 3 FCF 110 105 100 Instruction: Type ONLY your numerical answer in the unit of dollars, NO $ sign needed, No comma sign. Round to the nearest integer. E.g., if your answer is $2001.86, then input 2002.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the present value of the firms free cash flows FCFs in Year 2 and beyond we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started