Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you have just been hired as a business manager of Pizza Stop, a pizza restaurant located adjacent to campus. The company's EBIT was

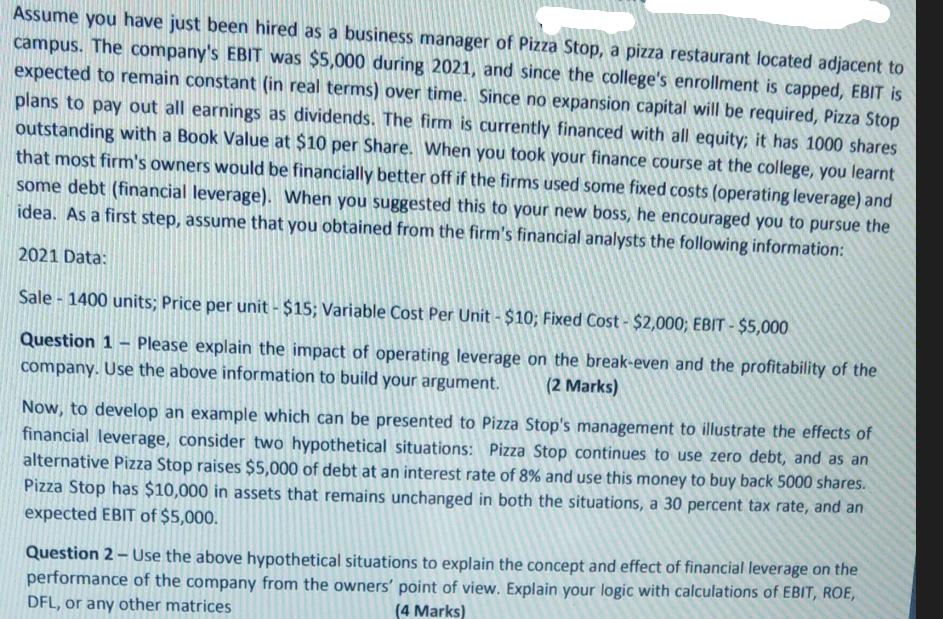

Assume you have just been hired as a business manager of Pizza Stop, a pizza restaurant located adjacent to campus. The company's EBIT was $5,000 during 2021, and since the college's enrollment is capped, EBIT is expected to remain constant (in real terms) over time. Since no expansion capital will be required, Pizza Stop plans to pay out all earnings as dividends. The firm is currently financed with all equity; it has 1000 shares outstanding with a Book Value at $10 per Share. When you took your finance course at the college, you learnt that most firm's owners would be financially better off if the firms used some fixed costs (operating leverage) and some debt (financial leverage). When you suggested this to your new boss, he encouraged you to pursue the idea. As a first step, assume that you obtained from the firm's financial analysts the following information: 2021 Data: Sale - 1400 units; Price per unit - $15; Variable Cost Per Unit - $10; Fixed Cost - $2,000; EBIT - $5,000 Question 1 - Please explain the impact of operating leverage on the break-even and the profitability of the company. Use the above information to build your argument. (2 Marks) Now, to develop an example which can be presented to Pizza Stop's management to illustrate the effects of financial leverage, consider two hypothetical situations: Pizza Stop continues to use zero debt, and as an alternative Pizza Stop raises $5,000 of debt at an interest rate of 8% and use this money to buy back 5000 shares. Pizza Stop has $10,000 in assets that remains unchanged in both the situations, a 30 percent tax rate, and an expected EBIT of $5,000. Question 2 - Use the above hypothetical situations to explain the concept and effect of financial leverage on the performance of the company from the owners' point of view. Explain your logic with calculations of EBIT, ROE, DFL, or any other matrices (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 1 Impact of Operating Leverage on Breakeven and Profitability Operating leverage refers to the degree to which a companys costs are fixed versus variable A high level of operating leverage me...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started