Answered step by step

Verified Expert Solution

Question

1 Approved Answer

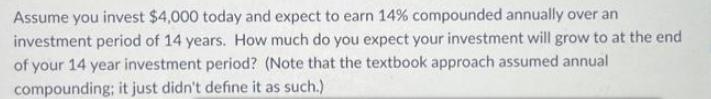

Assume you invest $4,000 today and expect to earn 14% compounded annually over an investment period of 14 years. How much do you expect

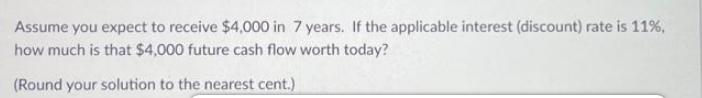

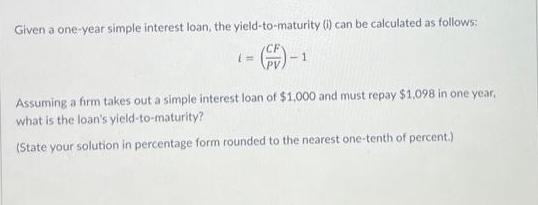

Assume you invest $4,000 today and expect to earn 14% compounded annually over an investment period of 14 years. How much do you expect your investment will grow to at the end of your 14 year investment period? (Note that the textbook approach assumed annual compounding; it just didn't define it as such.) Assume you expect to receive $4,000 in 7 years. If the applicable interest (discount) rate is 11%, how much is that $4,000 future cash flow worth today? (Round your solution to the nearest cent.) Given a one-year simple interest loan, the yield-to-maturity (i) can be calculated as follows: CF -1 Assuming a firm takes out a simple interest loan of $1,000 and must repay $1,098 in one year, what is the loan's yield-to-maturity? (State your solution in percentage form rounded to the nearest one-tenth of percent.)

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the future value of an investment with annual compounding Where FV is the future value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started