Question

Assume you lend $10.000 for a five (5) year period. The current the real rate at the time you lend the money is 2.3%. You

Assume you lend $10.000 for a five (5) year period. The current the real rate at the time you lend the money is 2.3%. You charge no risk premium on the loan.

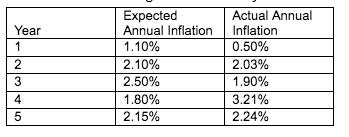

At the end of the 5-years loan period you receive back your $10,000 and then decide to determine your rate of return. You collect the following information for your calculation.

Part 1 Using the Fisher Equation, what is your expected required rate of return on the loan?

Part 2 Using the Fisher Equation, what is your realized required rate of return on the loan?

Expected Actual Annual Inflation Year Annual Inflation 1 1.10% 0.50% 2.10% 2.03% 3 2.50% 1.90% 4 1.80% 3.21% 2.15% 2.24%

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

We have following fisher equation NR 1RR x 1IR STAY H KOREK NR is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Lodging Management

Authors: David K. Hayes, Jack D. Ninemeier, Allisha A. Miller.

2nd edition

132560895, 978-0132560894

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App