Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you observe the zero interest rate curve in the table below at t = 0, (a) What are the zero rates at each

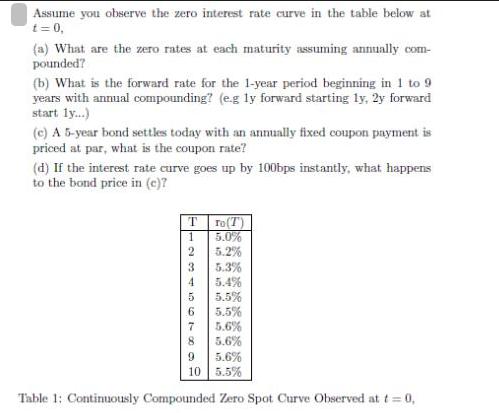

Assume you observe the zero interest rate curve in the table below at t = 0, (a) What are the zero rates at each maturity assuming annually com- pounded? (b) What is the forward rate for the 1-year period beginning in 1 to 9 years with annual compounding? (e.g ly forward starting ly, 2y forward start ly...) (c) A 5-year bond settles today with an annually fixed coupon payment is priced at par, what is the coupon rate? (d) If the interest rate curve goes up by 100bps instantly, what happens to the bond price in (c)? Tro(T) 5.0% 5.2% 1 2 5.3% 5.4% 5.5% 5.5% 5.6% 5.6% 9 5.6% 10 5.5% Table 1: Continuously Compounded Zero Spot Curve Observed at t = 0, 3 4 5 6 7 8 (e) Price a 2-year forward rate agreement (FRA) which pays 5% on 1,000,000 notional and expires in 5 years. (f) Price a 10-year 1,000,000 notional fix-floating interest rate swap which pays 5% fix coupon and receives floating rate (both fix and floating leg pay annually )?

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution a The zero rates at each maturity assuming annually compounded can be found directly from the table Maturity years Zero Rate 1 50 2 52 3 53 4 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started