Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume you the staff tax accountant at Johnson & Co. CPAS. Your supervisor, Jane Johnson Tax Manager, has asked you to research a question

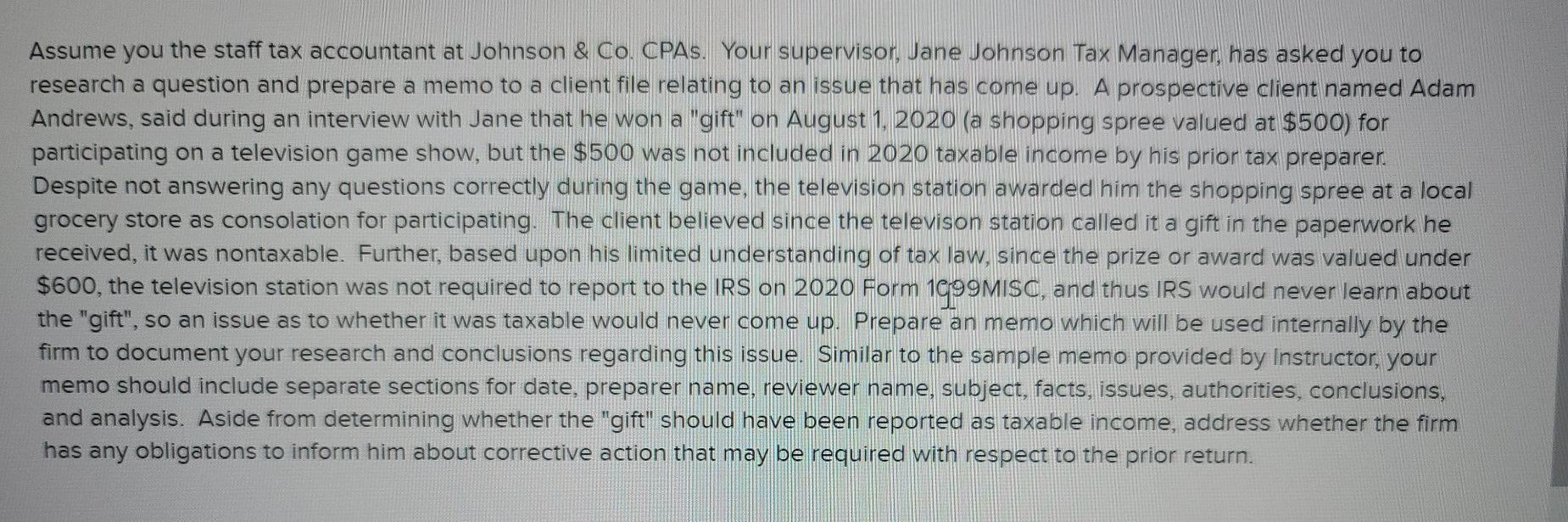

Assume you the staff tax accountant at Johnson & Co. CPAS. Your supervisor, Jane Johnson Tax Manager, has asked you to research a question and prepare a memo to a client file relating to an issue that has come up. A prospective client named Adam Andrews, said during an interview with Jane that he won a "gift" on August 1, 2020 (a shopping spree valued at $500) for participating on a television game show, but the $500 was not included in 2020 taxable income by his prior tax preparer. Despite not answering any questions correctly during the game, the television station awarded him the shopping spree at a local grocery store as consolation for participating. The client believed since the televison station called it a gift in the paperwork he received, it was nontaxable. Further, based upon his limited understanding of tax law, since the prize or award was valued under $600, the television station was not required to report to the IRS on 2020 Form 1099MISC, and thus IRS would never learn about the "gift", so an issue as to whether it was taxable would never come up. Prepare an memo which will be used internally by the firm to document your research and conclusions regarding this issue. Similar to the sample memo provided by Instructor, your memo should include separate sections for date, preparer name, reviewer name, subject, facts, issues, authorities, conclusions, and analysis. Aside from determining whether the "gift" should have been reported as taxable income, address whether the firm has any obligations to inform him about corrective action that may be required with respect to the prior return.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

MEMORANDUM To Johnson Co CPAs Client File From Staff Tax Accountant Date March 1 2021 Re Taxability of Television Game Show Gift Facts Adam Andrews a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started