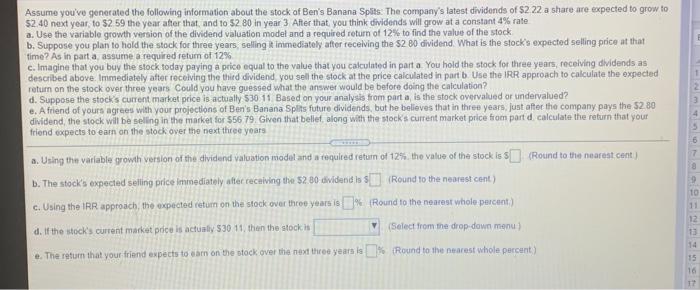

Assume you've generated the following information about the stock of Ben's Banana Splits: The company's latest dividunds of 52 22 a share are expected to grow to 52 40 next year to $2 59 the year after that, and to 52 80 in year 3 After that you think dividends will grow at a constant 4% rate a. Use the variable growth version of the dividend valuation model and a required return of 12% to find the value of the stock b. Suppose you plan to hold the stock for three years, selling timmediately after receiving the 52 80 dividend. What is the stock's expected selling price at that time? As in part a assume a required retum of 12% c. Imagine that you buy the stock today paying a price equal to the value that you calculated in part a. You hold the stock for three years, receiving dividends as described above. Immediately after receiving the third dividend you sell the stock at the price calculated in part b Use the IRR approach to calculate the expected return on the stock over three years Could you have guessed what the answer would be before doing the calculation? d. Suppose the stock's current market price is actually 530 11 Based on your analysis from parta is the stock overvalued or undervalued? e. A friend of yours agrees with your projections of Ben's Banana Splits future dividends, but he believes that in three years, just after the company pays the 52 80 dividend, the stock will be selling in the market for 556 79. Given that bellet along with the stock's current market price from part d calculate the return that your friend expects to earn on the stock over the next three years a. Using the variable growth version of the dividend valuation model and a regalred return of 12% the value of the stock is (Round to the nearest cont) . The stock's expected selling price immediately after receiving the $2,80 dividenis Is $) (Round to the nearest cent) c. Using the IRR approach, the expected return on the stock over three years is % (Round to the nearest whole parcant) (Select from the drop-down menu) d. If the stock's current market price is actually 530 11, then the stockis 12 1 14 .. The return that your friend expects to earn on the stock over the next three years is Round to the nearest whole percent) 17