Answered step by step

Verified Expert Solution

Question

1 Approved Answer

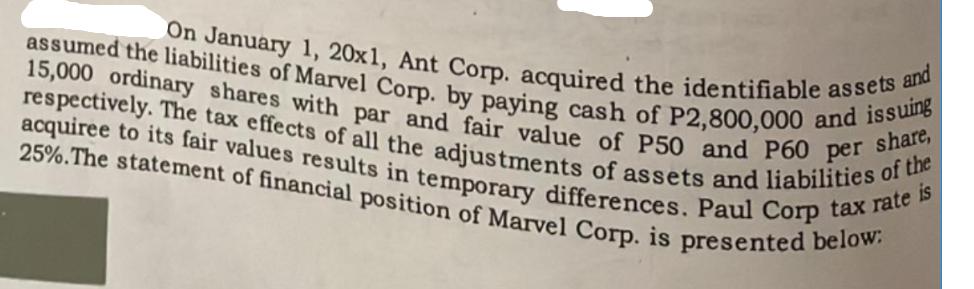

assumed the liabilities of Marvel Corp. by paying cash of P2,800,000 and issuing On January 1, 20x1, Ant Corp. acquired the identifiable assets and

assumed the liabilities of Marvel Corp. by paying cash of P2,800,000 and issuing On January 1, 20x1, Ant Corp. acquired the identifiable assets and 15,000 ordinary shares with par and fair value of P50 and P60 per share, respectively. The tax effects of all the adjustments of assets and liabilities of the acquiree to its fair values results in temporary differences. Paul Corp tax rate is 25%. The statement of financial position of Marvel Corp. is presented below: Cash BUSINESS COMBINATION-STATUTORY MERGER AND CONSOLIDATION 69 Accounts Receivable Book Value Fair Value 500,000 500,000 400,000 380,000 Allowance for doubtful account (40,000) Inventory 220,000 200,000 Equipment 300,000 250,000 Accumulated Depreciation (50,000) Land 1,200,000 1,500,000 Building 1,000,000 850,000 Accumulated Depreciation (100,000) Patent 600,000 550,000 Total Assets 4,030,000 Accounts Payable 1,500,000 1,500,000 Contingent Liabilities 200,000 250,000 Ordinary share P100 par 1,000,000 Share premium 500,000 Retained Earnings 830,000 Total Liabilities and SHE 4,030,000 Ant Corp paid the following other related cost of combination such as: listing fees of shares P5,000; printing cost of share certificates P500; broker's fee P10,000; legal fee P15,000 and indirect cost of P1,000. Req. 1: What is the goodwill from business combination? Req. 2: What is increase in total assets to be recorded by the acquirer after business combination? Req. 3: What is the total increase in shareholder's equity to be recorded by the acquirer after business combination?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the goodwill from the business combination we need to compare the fair value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started