Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming a 12% annual interest rate, determine the present value of a five-period annual annuity of $7,400 under each of the following situations: Note:

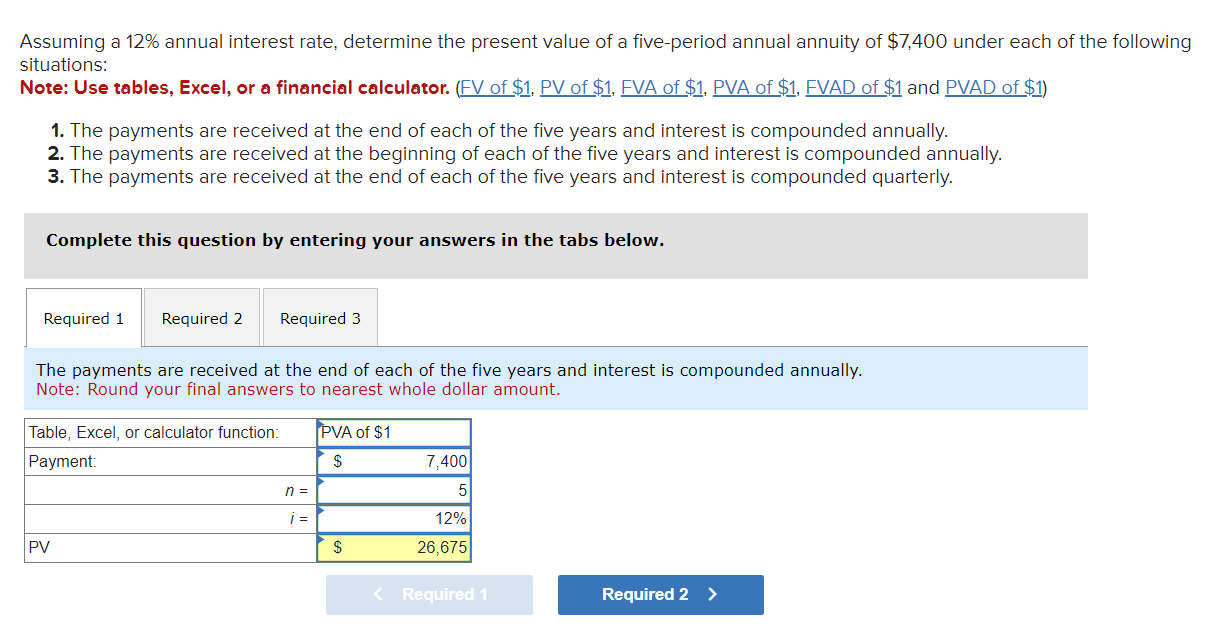

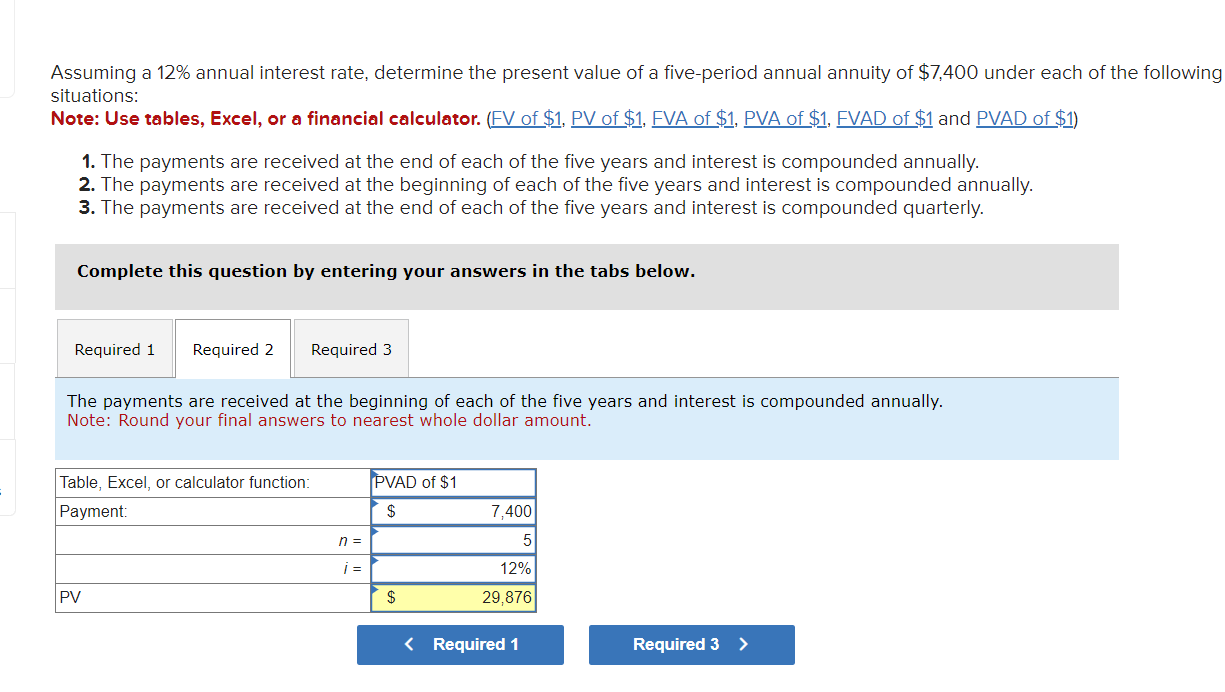

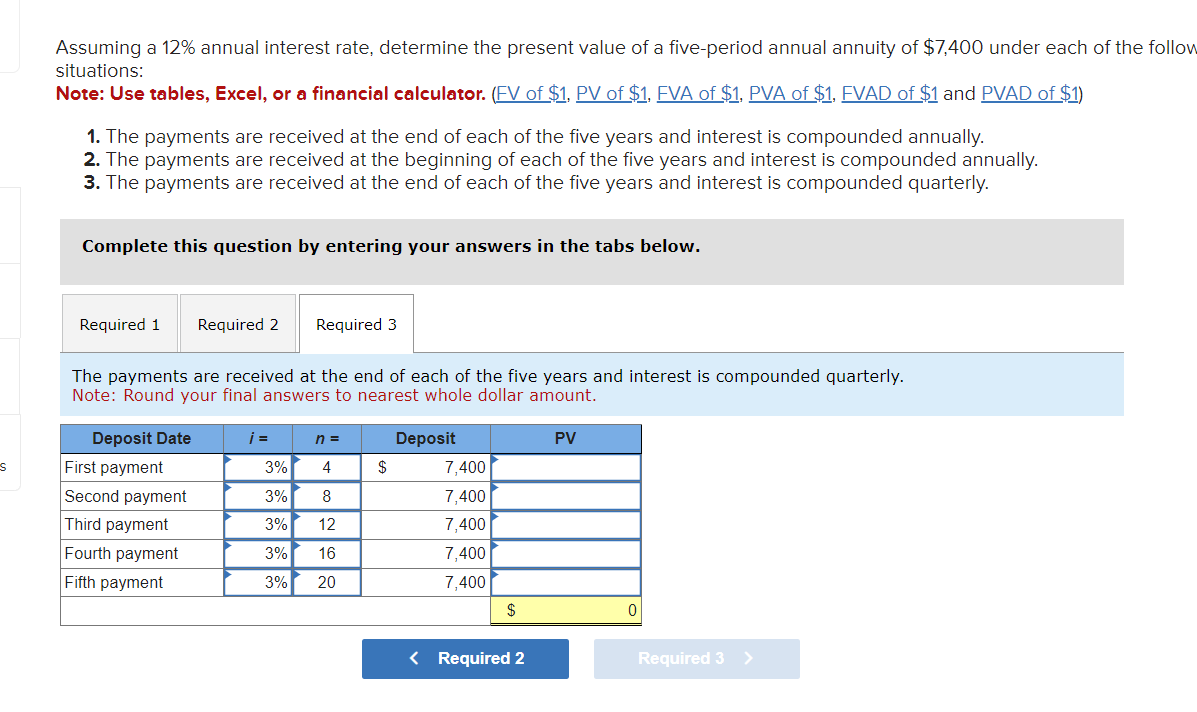

Assuming a 12% annual interest rate, determine the present value of a five-period annual annuity of $7,400 under each of the following situations: Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. EVA of $1, PVA of $1. EVAD of $1 and PVAD of $1) 1. The payments are received at the end of each of the five years and interest is compounded annually. 2. The payments are received at the beginning of each of the five years and interest is compounded annually. 3. The payments are received at the end of each of the five years and interest is compounded quarterly. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 The payments are received at the end of each of the five years and interest is compounded annually. Note: Round your final answers to nearest whole dollar amount. Table, Excel, or calculator function: Payment: PVA of $1 $ 7,400 n = 5 i = 12% PV $ 26,675 < Required 1 Required 2 > Assuming a 12% annual interest rate, determine the present value of a five-period annual annuity of $7,400 under each of the following situations: Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. The payments are received at the end of each of the five years and interest is compounded annually. 2. The payments are received at the beginning of each of the five years and interest is compounded annually. 3. The payments are received at the end of each of the five years and interest is compounded quarterly. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 The payments are received at the beginning of each of the five years and interest is compounded annually. Note: Round your final answers to nearest whole dollar amount. Table, Excel, or calculator function: Payment: PVAD of $1 $ 7,400 n = 5 i= 12% PV $ 29,876 < Required 1 Required 3 > Assuming a 12% annual interest rate, determine the present value of a five-period annual annuity of $7,400 under each of the follow situations: Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) 1. The payments are received at the end of each of the five years and interest is compounded annually. 2. The payments are received at the beginning of each of the five years and interest is compounded annually. 3. The payments are received at the end of each of the five years and interest is compounded quarterly. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 The payments are received at the end of each of the five years and interest is compounded quarterly. Note: Round your final answers to nearest whole dollar amount. Deposit Date = n = Deposit PV S First payment 3% 4 $ 7,400 Second payment 3% 8 7,400 Third payment 3% 12 7,400 Fourth payment 3% 16 7,400 Fifth payment 3% 20 7,400 $ 0 < Required 2 Required 3 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started