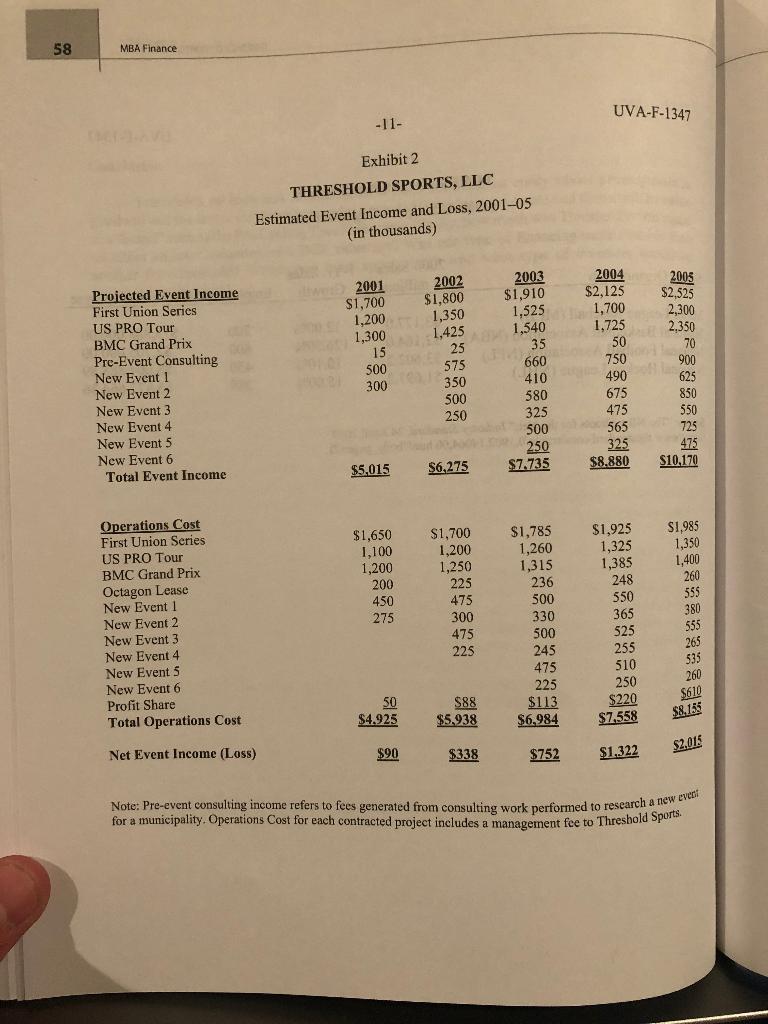

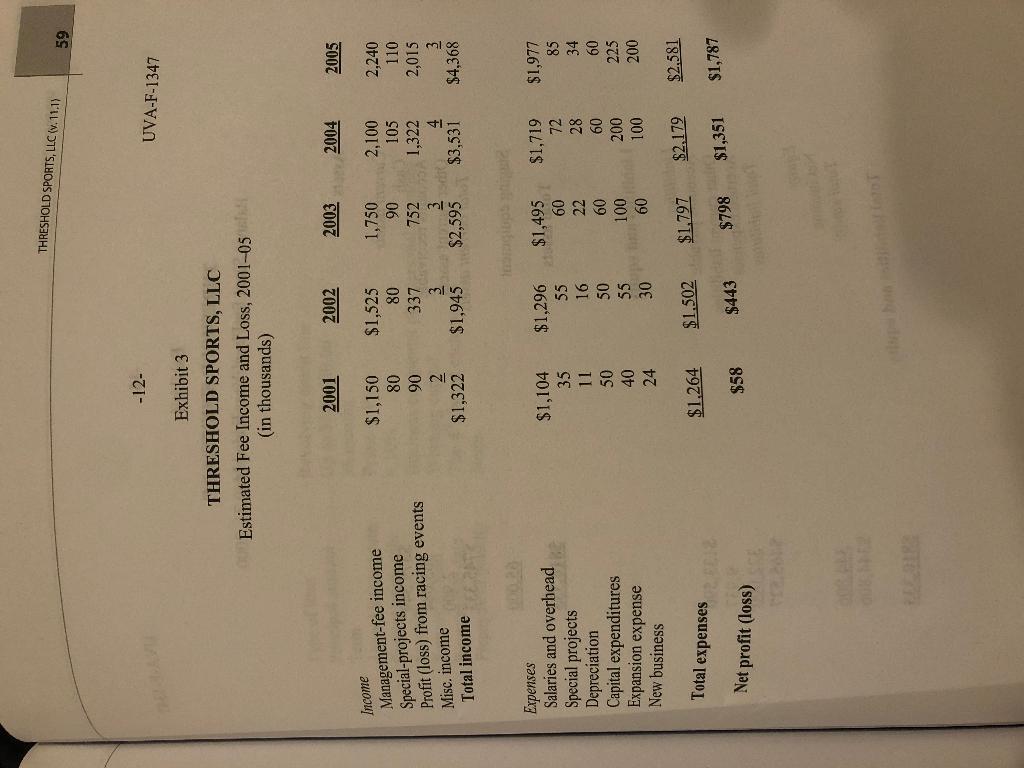

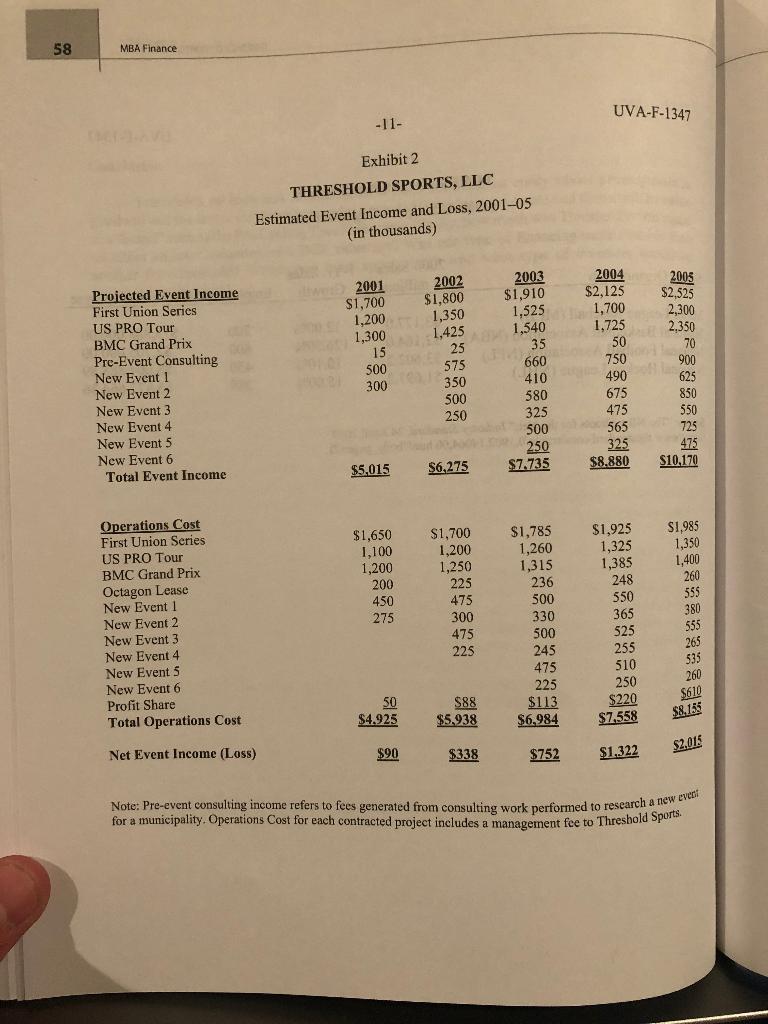

- Assuming a 40% tax rate, what is Threshold worth? Assume that Threshold will not need any additional net working capital (NWC) in Year 2001, but will need an additional $95,000 NWC each year from 2002 to 2005. (Note: The Profit (loss) from racing events line in Exhibit 3 comes from Exhibit 2. Also, Exhibit 3 has some issues with terminology. The Net profit line is not really net profit. Moreover, it would be better to use revenue in place of income. Also, there is a major error in the choice of items to list under Expenses. See if you can spot the error and correct for it in your analysis. Your analysis will require use of the growing perpetuity/constant growth model in order to estimate a terminal value for your cash flows. Show your work for this question in an Excel attachment.)

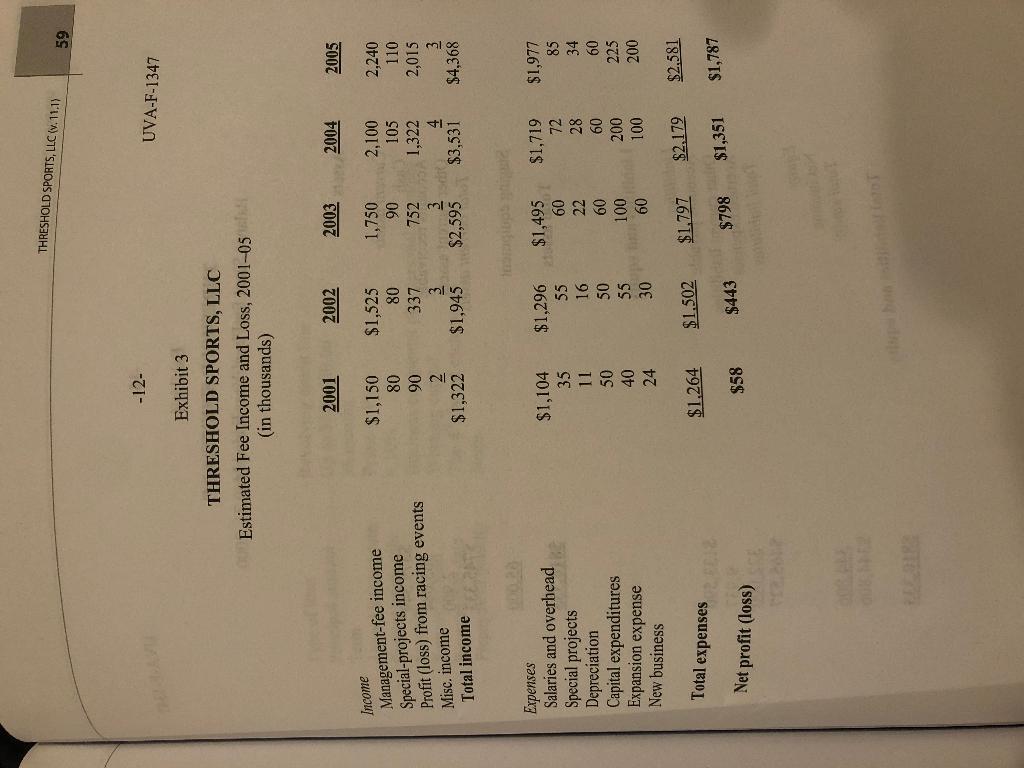

58 MBA Finance UVA-F-1347 -11- Exhibit 2 THRESHOLD SPORTS, LLC Estimated Event Income and Loss, 2001-05 (in thousands) Projected Event Income First Union Series US PRO Tour BMC Grand Prix Pre-Event Consulting New Event 1 2001 $1,700 1,200 1,300 15 500 300 2002 $1,800 1,350 1,425 25 575 350 500 250 2003 $1,910 1,525 1,540 35 660 410 580 325 500 250 2004 $2,125 1,700 1,725 50 750 490 675 475 565 325 $8.880 2005 $2,525 2,300 2,350 70 900 625 850 550 725 475 $10.170 New Event 2 New Event 3 New Event 4 New Event 5 New Event 6 Total Event Income $5,015 $6,275 $7.735 Operations Cost First Union Series US PRO Tour BMC Grand Prix Octagon Lease New Event 1 New Event 2 New Event 3 New Event 4 New Events New Event 6 Profit Share Total Operations Cost $1,650 1,100 1,200 200 450 275 $1,700 1.200 1.250 225 475 300 475 225 $1,785 1,260 1,315 236 500 330 500 245 475 225 $113 $6,984 $1,925 1,325 1,385 248 550 365 525 255 510 250 $220 $7,558 $1,985 1,350 1,400 260 555 380 555 265 535 260 S610 50 $4.925 S88 $5.938 $8.135 $2.015 Net Event Income (Loss) $90 $338 $752 $1,322 Note: Pre-event consulting income refers to fees generated from consulting work performed to research a new even for a municipality, Operations Cost for each contracted project includes a management fee to Threshold Sports. THRESHOLD SPORTS, LLC (1.11.17 59 -12- UVA-F-1347 Exhibit 3 THRESHOLD SPORTS, LLC Estimated Fee Income and Loss, 2001-05 (in thousands) 2001 2002 2003 2004 2005 Income 2,100 105 Management-fee income Special-projects income Profit (loss) from racing events Misc. income Total income $1,150 80 90 2 $1,322 $1,525 80 337 3 1,750 90 752 3 $2,595 1,322 4 $3,531 2,240 110 2,015 3 $4,368 $1,945 Expenses Salaries and overhead Special projects Depreciation Capital expenditures Expansion expense New business $1,104 35 11 50 40 24 $1,296 55 16 50 55 $1,495 60 22 60 $1,719 72 28 60 200 100 $1,977 85 34 60 225 200 100 60 30 $1,797 $2.179 $2,581 $1,264 $1.502 Total expenses $1,351 $1,787 $798 $58 $443 Net profit (loss) 58 MBA Finance UVA-F-1347 -11- Exhibit 2 THRESHOLD SPORTS, LLC Estimated Event Income and Loss, 2001-05 (in thousands) Projected Event Income First Union Series US PRO Tour BMC Grand Prix Pre-Event Consulting New Event 1 2001 $1,700 1,200 1,300 15 500 300 2002 $1,800 1,350 1,425 25 575 350 500 250 2003 $1,910 1,525 1,540 35 660 410 580 325 500 250 2004 $2,125 1,700 1,725 50 750 490 675 475 565 325 $8.880 2005 $2,525 2,300 2,350 70 900 625 850 550 725 475 $10.170 New Event 2 New Event 3 New Event 4 New Event 5 New Event 6 Total Event Income $5,015 $6,275 $7.735 Operations Cost First Union Series US PRO Tour BMC Grand Prix Octagon Lease New Event 1 New Event 2 New Event 3 New Event 4 New Events New Event 6 Profit Share Total Operations Cost $1,650 1,100 1,200 200 450 275 $1,700 1.200 1.250 225 475 300 475 225 $1,785 1,260 1,315 236 500 330 500 245 475 225 $113 $6,984 $1,925 1,325 1,385 248 550 365 525 255 510 250 $220 $7,558 $1,985 1,350 1,400 260 555 380 555 265 535 260 S610 50 $4.925 S88 $5.938 $8.135 $2.015 Net Event Income (Loss) $90 $338 $752 $1,322 Note: Pre-event consulting income refers to fees generated from consulting work performed to research a new even for a municipality, Operations Cost for each contracted project includes a management fee to Threshold Sports. THRESHOLD SPORTS, LLC (1.11.17 59 -12- UVA-F-1347 Exhibit 3 THRESHOLD SPORTS, LLC Estimated Fee Income and Loss, 2001-05 (in thousands) 2001 2002 2003 2004 2005 Income 2,100 105 Management-fee income Special-projects income Profit (loss) from racing events Misc. income Total income $1,150 80 90 2 $1,322 $1,525 80 337 3 1,750 90 752 3 $2,595 1,322 4 $3,531 2,240 110 2,015 3 $4,368 $1,945 Expenses Salaries and overhead Special projects Depreciation Capital expenditures Expansion expense New business $1,104 35 11 50 40 24 $1,296 55 16 50 55 $1,495 60 22 60 $1,719 72 28 60 200 100 $1,977 85 34 60 225 200 100 60 30 $1,797 $2.179 $2,581 $1,264 $1.502 Total expenses $1,351 $1,787 $798 $58 $443 Net profit (loss)