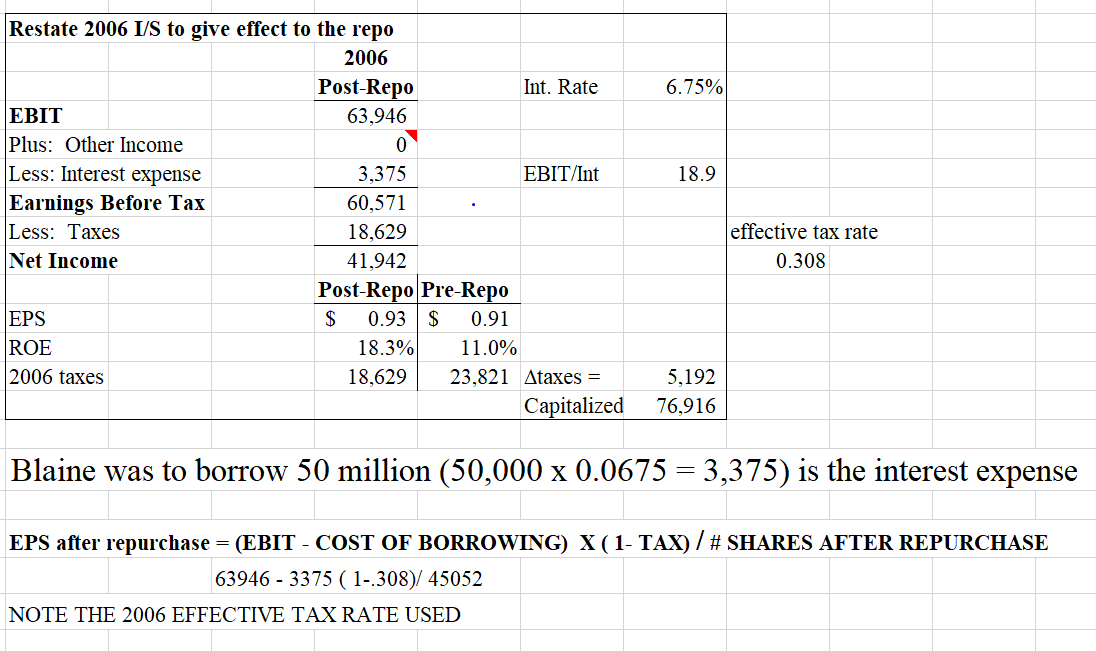

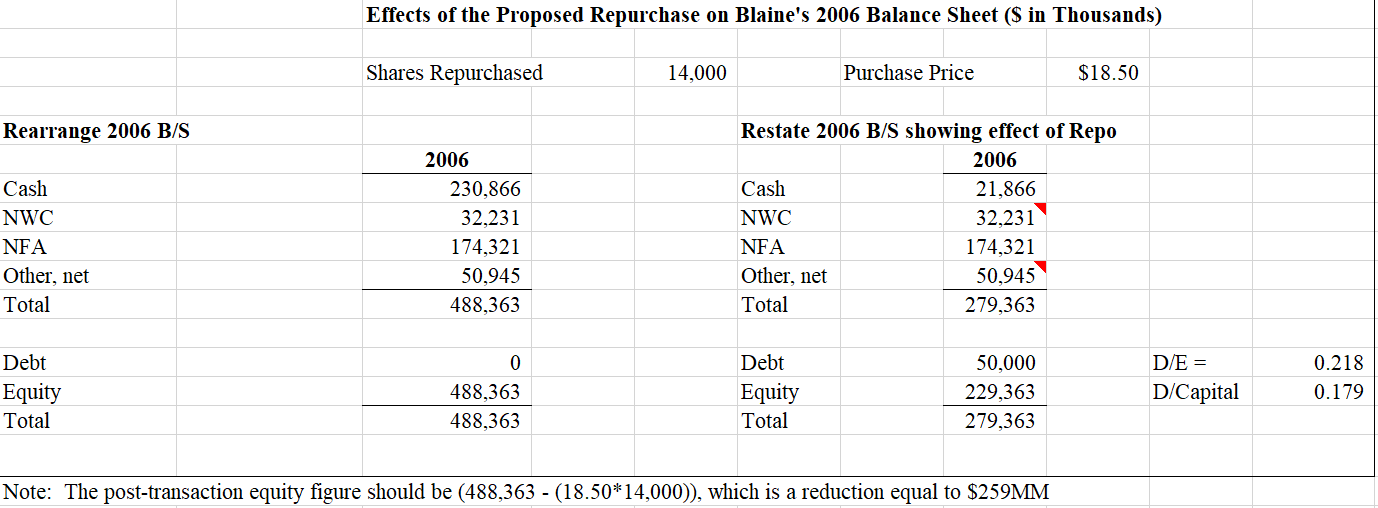

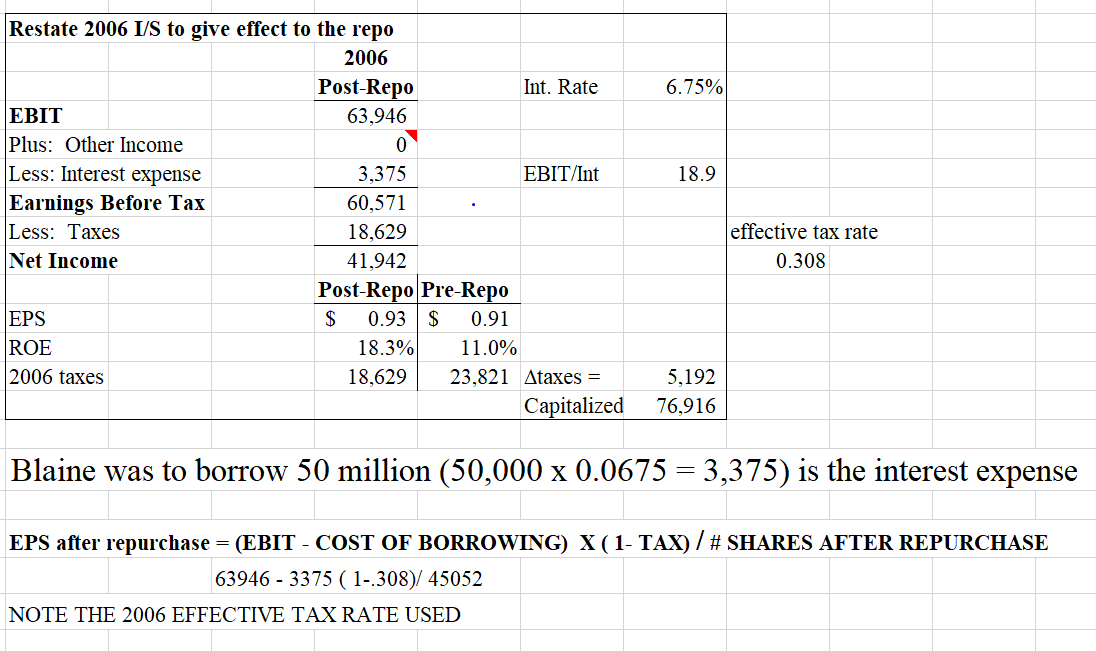

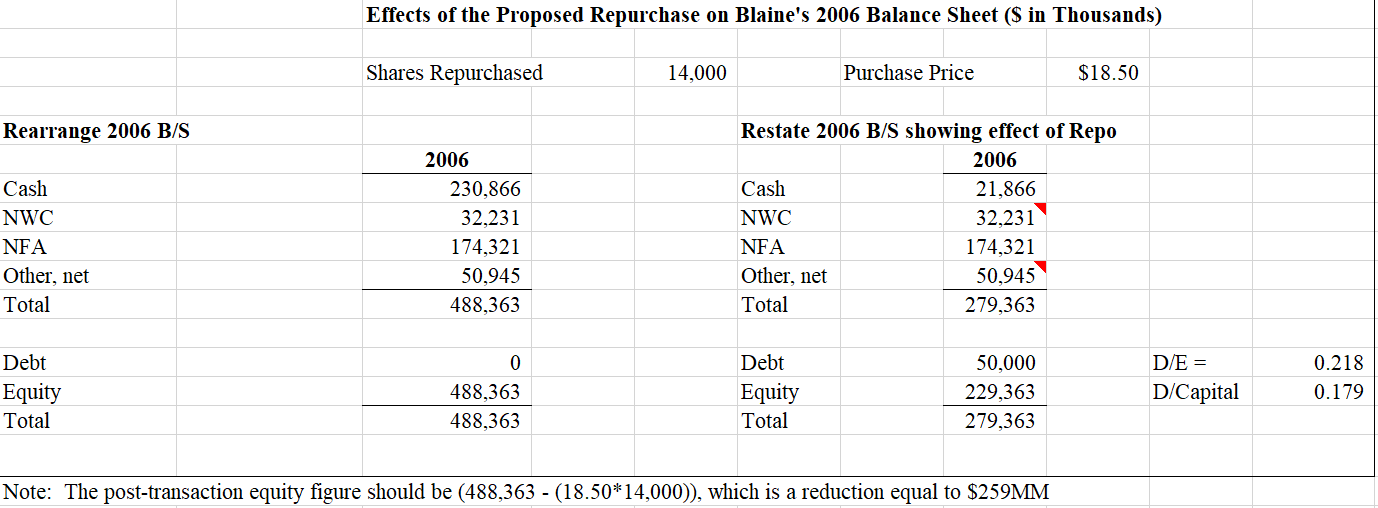

Assuming a constant long term growth rate of 3%, estimate Blaine's share price in 2006 and after the proposed restructuring. 6.75% 18.9 Restate 2006 I/S to give effect to the repo 2006 Post-Repo Int. Rate EBIT 63,946 Plus: Other Income 0 Less: Interest expense 3,375 EBIT/Int Earnings Before Tax 60,571 Less: Taxes 18,629 Net Income 41,942 Post-Repo Pre-Repo EPS $ 0.93 $ 0.91 ROE 18.3% 11.0% 2006 taxes 18,629 23,821 Ataxes = Capitalized effective tax rate 0.308 5,192 76,916 Blaine was to borrow 50 million (50,000 x 0.0675 = 3,375) is the interest expense EPS after repurchase = (EBIT - COST OF BORROWING) X (1- TAX)/# SHARES AFTER REPURCHASE 63946 - 3375 ( 1-.308)/ 45052 NOTE THE 2006 EFFECTIVE TAX RATE USED Effects of the Proposed Repurchase on Blaine's 2006 Balance Sheet ($ in Thousands) Shares Repurchased 14,000 Purchase Price $18.50 Rearrange 2006 B/S Cash NWC NFA Other, net Total 2006 230,866 32,231 174,321 50,945 488,363 Restate 2006 B/S showing effect of Repo 2006 Cash 21,866 NWC 32,231 NFA 174,321 Other, net 50,945 Total 279,363 0 Debt Equity Total Debt Equity Total 50,000 229,363 279,363 D/E = D/Capital 488,363 488,363 0.218 0.179 Note: The post-transaction equity figure should be (488,363 - (18.50*14,000)), which is a reduction equal to $259MM Assuming a constant long term growth rate of 3%, estimate Blaine's share price in 2006 and after the proposed restructuring. 6.75% 18.9 Restate 2006 I/S to give effect to the repo 2006 Post-Repo Int. Rate EBIT 63,946 Plus: Other Income 0 Less: Interest expense 3,375 EBIT/Int Earnings Before Tax 60,571 Less: Taxes 18,629 Net Income 41,942 Post-Repo Pre-Repo EPS $ 0.93 $ 0.91 ROE 18.3% 11.0% 2006 taxes 18,629 23,821 Ataxes = Capitalized effective tax rate 0.308 5,192 76,916 Blaine was to borrow 50 million (50,000 x 0.0675 = 3,375) is the interest expense EPS after repurchase = (EBIT - COST OF BORROWING) X (1- TAX)/# SHARES AFTER REPURCHASE 63946 - 3375 ( 1-.308)/ 45052 NOTE THE 2006 EFFECTIVE TAX RATE USED Effects of the Proposed Repurchase on Blaine's 2006 Balance Sheet ($ in Thousands) Shares Repurchased 14,000 Purchase Price $18.50 Rearrange 2006 B/S Cash NWC NFA Other, net Total 2006 230,866 32,231 174,321 50,945 488,363 Restate 2006 B/S showing effect of Repo 2006 Cash 21,866 NWC 32,231 NFA 174,321 Other, net 50,945 Total 279,363 0 Debt Equity Total Debt Equity Total 50,000 229,363 279,363 D/E = D/Capital 488,363 488,363 0.218 0.179 Note: The post-transaction equity figure should be (488,363 - (18.50*14,000)), which is a reduction equal to $259MM