Answered step by step

Verified Expert Solution

Question

1 Approved Answer

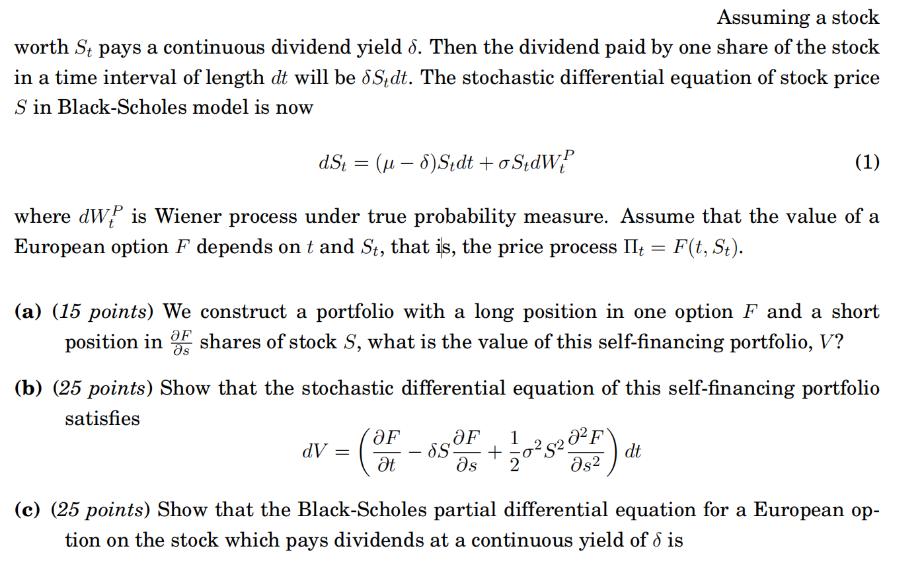

Assuming a stock worth St pays a continuous dividend yield 8. Then the dividend paid by one share of the stock in a time

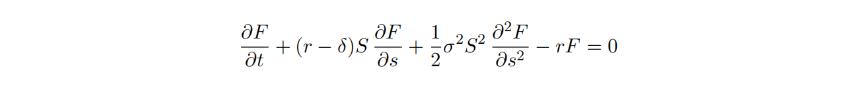

Assuming a stock worth St pays a continuous dividend yield 8. Then the dividend paid by one share of the stock in a time interval of length dt will be 5S,dt. The stochastic differential equation of stock price S in Black-Scholes model is now dSt = (-8)Sdt +SdW (1) where dW is Wiener process under true probability measure. Assume that the value of a European option F depends on t and St, that is, the price process II = F(t, St). (a) (15 points) We construct a portfolio with a long position in one option F and a short position in shares of stock S, what is the value of this self-financing portfolio, V? OF s (b) (25 points) Show that the stochastic differential equation of this self-financing portfolio satisfies dV = OF t 1 - + s 2 02F 2 (c) (25 points) Show that the Black-Scholes partial differential equation for a European op- tion on the stock which pays dividends at a continuous yield of 6 is OF +(r-8)S OF 1 0 F + t - s - TF = 0 ;2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started