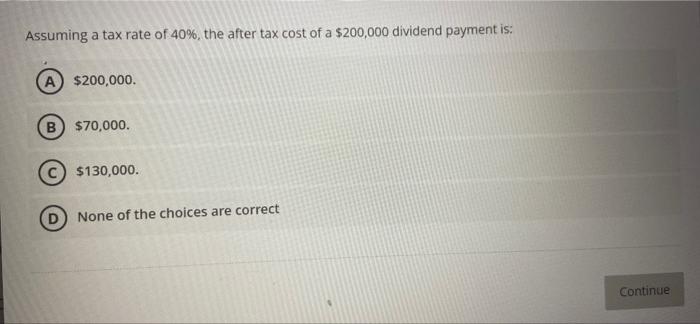

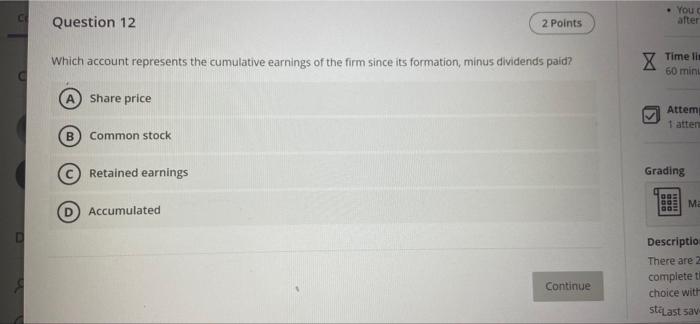

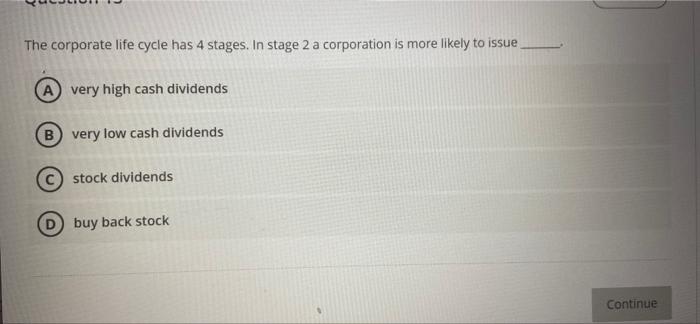

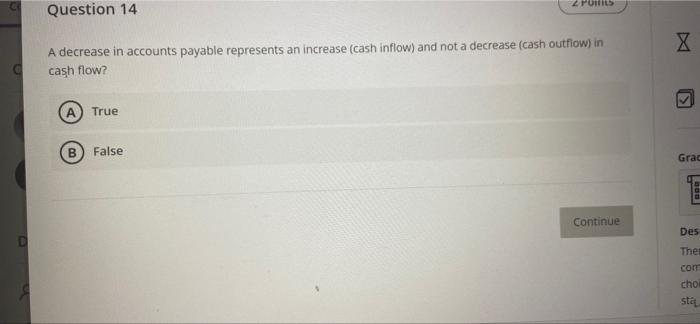

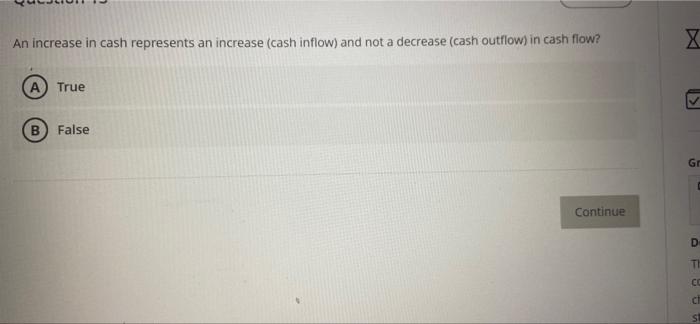

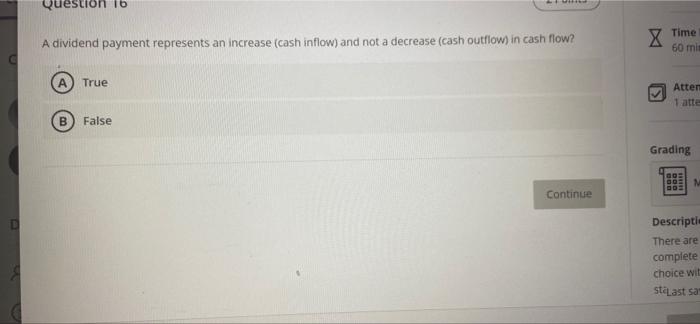

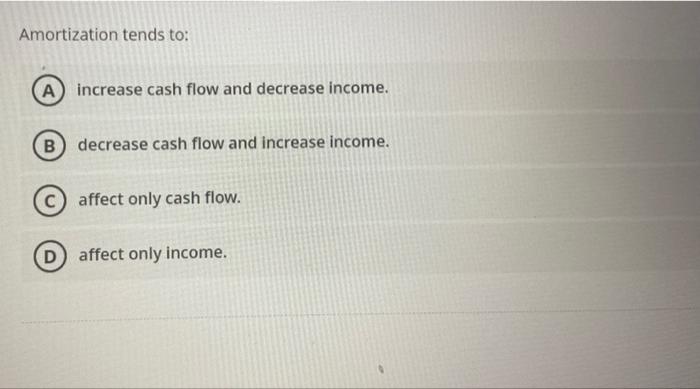

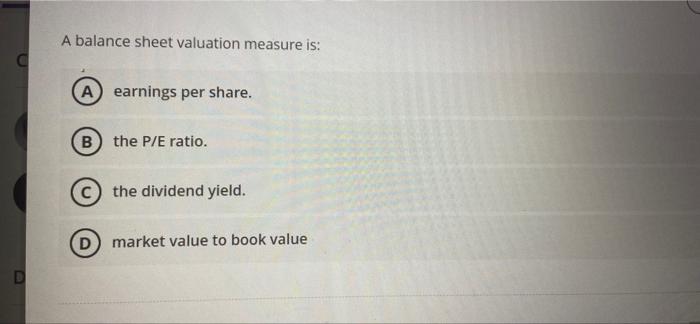

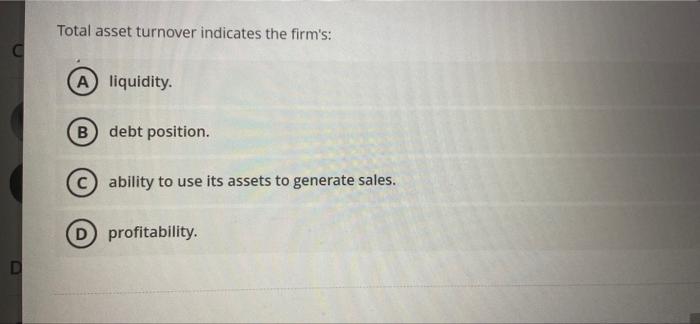

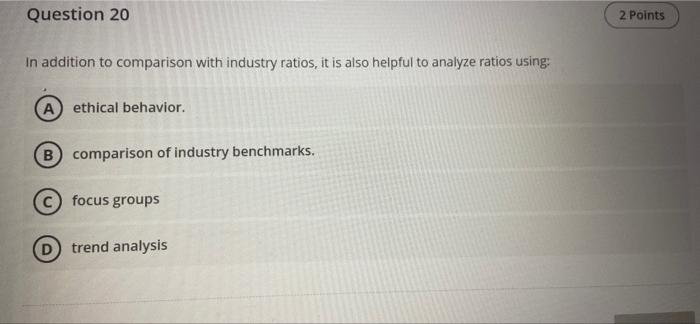

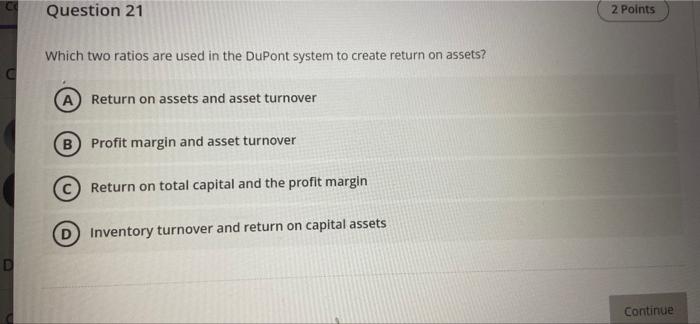

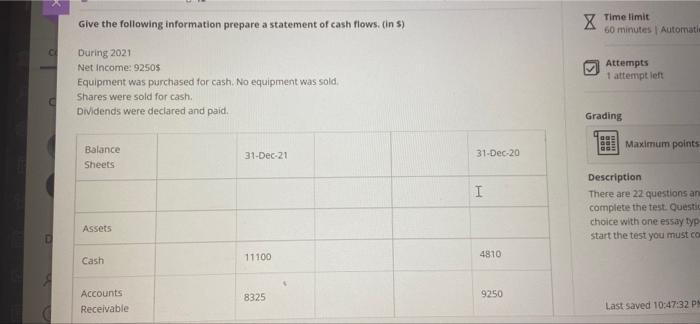

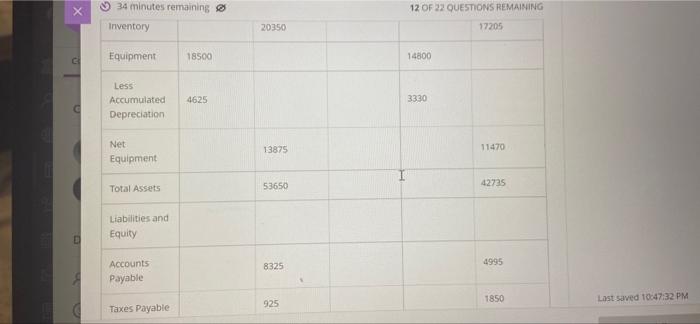

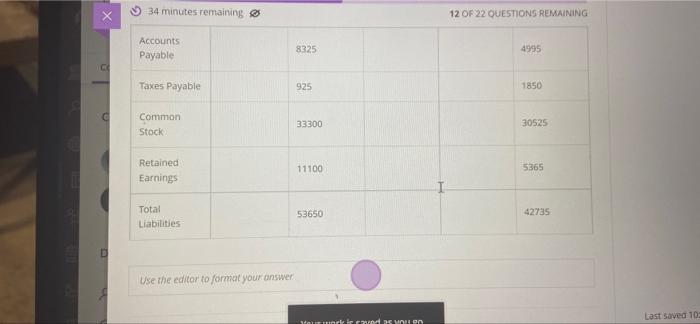

Assuming a tax rate of 40%, the after tax cost of a $200,000 dividend payment is: A $200,000. B $70,000. $130,000. D) None of the choices are correct Continue Co Question 12 2 Points Which account represents the cumulative earnings of the firm since its formation, minus dividends paid? Share price Common stock Retained earnings Accumulated B Continue You c after Time lim 60 minu Attemp 1 atter Grading Ma Description There are 2 complete t choice with staLast sav The corporate life cycle has 4 stages. In stage 2 a corporation is more likely to issue A very high cash dividends B very low cash dividends stock dividends buy back stock Continue CO D Question 14 2 POILS A decrease in accounts payable represents an increase (cash inflow) and not a decrease (cash outflow) in cash flow? A True B False Continue X K Grac BOD Des Ther com choi sta An increase in cash represents an increase (cash inflow) and not a decrease (cash outflow) in cash flow? True False Continue X SI Gr D AFSUS TH CO Question 16 ATMIHIL A dividend payment represents an increase (cash inflow) and not a decrease (cash outflow) in cash flow? A True B False Continue X W Time 60 min Atten 1 atte Grading M Descripti There are complete choice with staLast san Amortization tends to: A increase cash flow and decrease income. B decrease cash flow and increase income. affect only cash flow. D) affect only income. C D A balance sheet valuation measure is: A earnings per share. B) the P/E ratio. D the dividend yield. market value to book value C D Total asset turnover indicates the firm's: A liquidity. B debt position. ability to use its assets to generate sales. profitability. Question 20 In addition to comparison with industry ratios, it is also helpful to analyze ratios using: A ethical behavior. B comparison of industry benchmarks. Cfocus groups trend analysis 2 Points D Question 21 Which two ratios are used in the DuPont system to create return on assets? A Return on assets and asset turnover Profit margin and asset turnover Return on total capital and the profit margin Inventory turnover and return on capital assets 2 Points Continue C D Give the following information prepare a statement of cash flows. (in s) During 2021 Net Income: 9250$ Equipment was purchased for cash. No equipment was sold. Shares were sold for cash. Dividends were declared and paid. Balance 31-Dec-21 Sheets 11100 8325 Assets Cash Accounts Receivable 31-Dec-20 H 4810 9250 X Time limit 60 minutes | Automatic Attempts 1 attempt left Grading Maximum points Description There are 22 questions and complete the test. Questio choice with one essay typ- start the test you must com Last saved 10:47:32 PM X D 34 minutes remaining Inventory Equipment 18500 Less Accumulated 4625 Depreciation Net Equipment Total Assets Liabilities and Equity Accounts Payable Taxes Payable 20350 13875 53650 8325 925 12 OF 22 QUESTIONS REMAINING 17205 14800 3330 11470 42735 4995 1850 Last saved 10:47:32 PM C C D BS 34 minutes remaining Accounts Payable Taxes Payable Common Stock Retained Earnings Total Liabilities Use the editor to format your answer 8325 925 33300 11100 53650 Your work in raved as you en 12 OF 22 QUESTIONS REMAINING 4995 1850 30525 5365 42735 Last saved 10