Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming that Abbott acquired the investment in TAP at the beginning of 2003, how much did Abbott pay for the investment? At 31 December 2005,

Assuming that Abbott acquired the investment in TAP at the beginning of 2003, how much did Abbott pay for the investment?

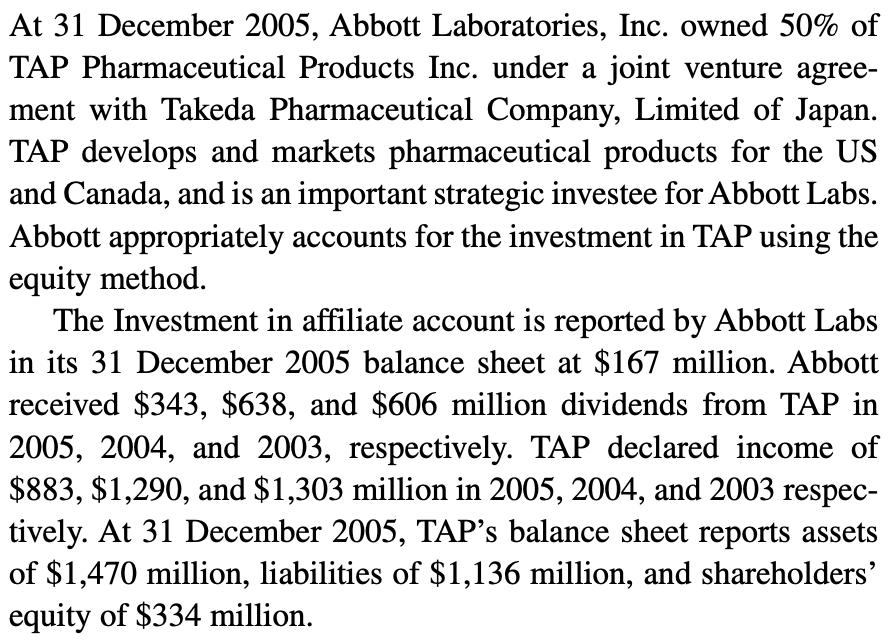

At 31 December 2005, Abbott Laboratories, Inc. owned 50% of TAP Pharmaceutical Products Inc. under a joint venture agree- ment with Takeda Pharmaceutical Company, Limited of Japan. TAP develops and markets pharmaceutical products for the US and Canada, and is an important strategic investee for Abbott Labs. Abbott appropriately accounts for the investment in TAP using the equity method. The Investment in affiliate account is reported by Abbott Labs in its 31 December 2005 balance sheet at $167 million. Abbott received $343, $638, and $606 million dividends from TAP in 2005, 2004, and 2003, respectively. TAP declared income of $883, $1,290, and $1,303 million in 2005, 2004, and 2003 respec- tively. At 31 December 2005, TAP's balance sheet reports assets of $1,470 million, liabilities of $1,136 million, and shareholders' equity of $334 million.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To determine how much Abbott paid for its investment in TAP assuming it was acquired in early 2003 y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started