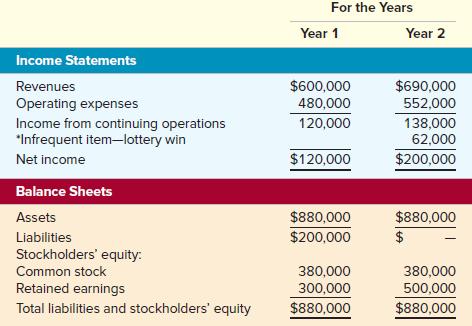

The following information was drawn from the annual report of Machine Imports Company (MIC): Required a. Compute the percentage of growth in net income from

The following information was drawn from the annual report of Machine Imports Company (MIC):

Required

a. Compute the percentage of growth in net income from Year 1 to Year 2. Can stockholders expect a similar increase between Year 2 and Year 3?

b. Assuming that MIC collected $200,000 cash from earnings (i.e., net income), explain how this money was spent in Year 2.

c. Assuming that MIC experiences the same percentage of growth from Year 2 to Year 3 as it did from Year 1 to Year 2, determine the amount of income from continuing operations that the owners can expect to see on the Year 3 income statement.

d. During Year 3, MIC experienced a $40,000 loss due to storm damage. Liabilities and common stock were unchanged from Year 2 to Year 3. Use the information that you computed in Requirement c plus the additional information provided in the previous two sentences to prepare an income statement and balance sheet as of December 31, Year 3.

For the Years Year 1 Year 2 Income Statements Revenues $600,000 $690,000 Operating expenses Income from continuing operations *Infrequent item-lottery win 480,000 552,000 120,000 138,000 62,000 Net income $120,000 $200,000 Balance Sheets Assets $880,000 $880,000 Liabilities $200,000 $ Stockholders' equity: Common stock Retained earnings 380,000 380,000 300,000 500,000 Total liabilities and stockholders' equity $880,000 $880,000

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started