Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming that the fixed costs are expected to remain at P200,000 for the coming year and the sales price per unit and variable costs per

Assuming that the fixed costs are expected to remain at P200,000 for the coming year and the sales price per unit and variable costs per unit are also expected to remain constant, how much profit after taxes will be produced if the company anticipates sales for the coming year rising to 125 percent of the current year's level?

2.Based on the cost and revenue structure on the income statement, what was NUBD's break-even point in pesos?

3.What was NUBD's margin of safety?

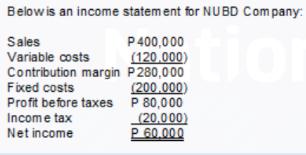

Below is an income statement for NUBD Company: Sales P 400,000 (120,000) Variable costs Contribution margin P280,000 (200,000) P 80,000 (20,000) P 60.000 Fixed costs Profit before taxes Income tax Net income

Step by Step Solution

★★★★★

3.61 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the profit after taxes for the coming year we need to first calculate the expected sales for the coming year If the sales are anticipated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started