Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming that the Muskie family aims to acquire Raye football club (RFC) using the Leverage Buyout (LBO) approach. The acquisition date will be the

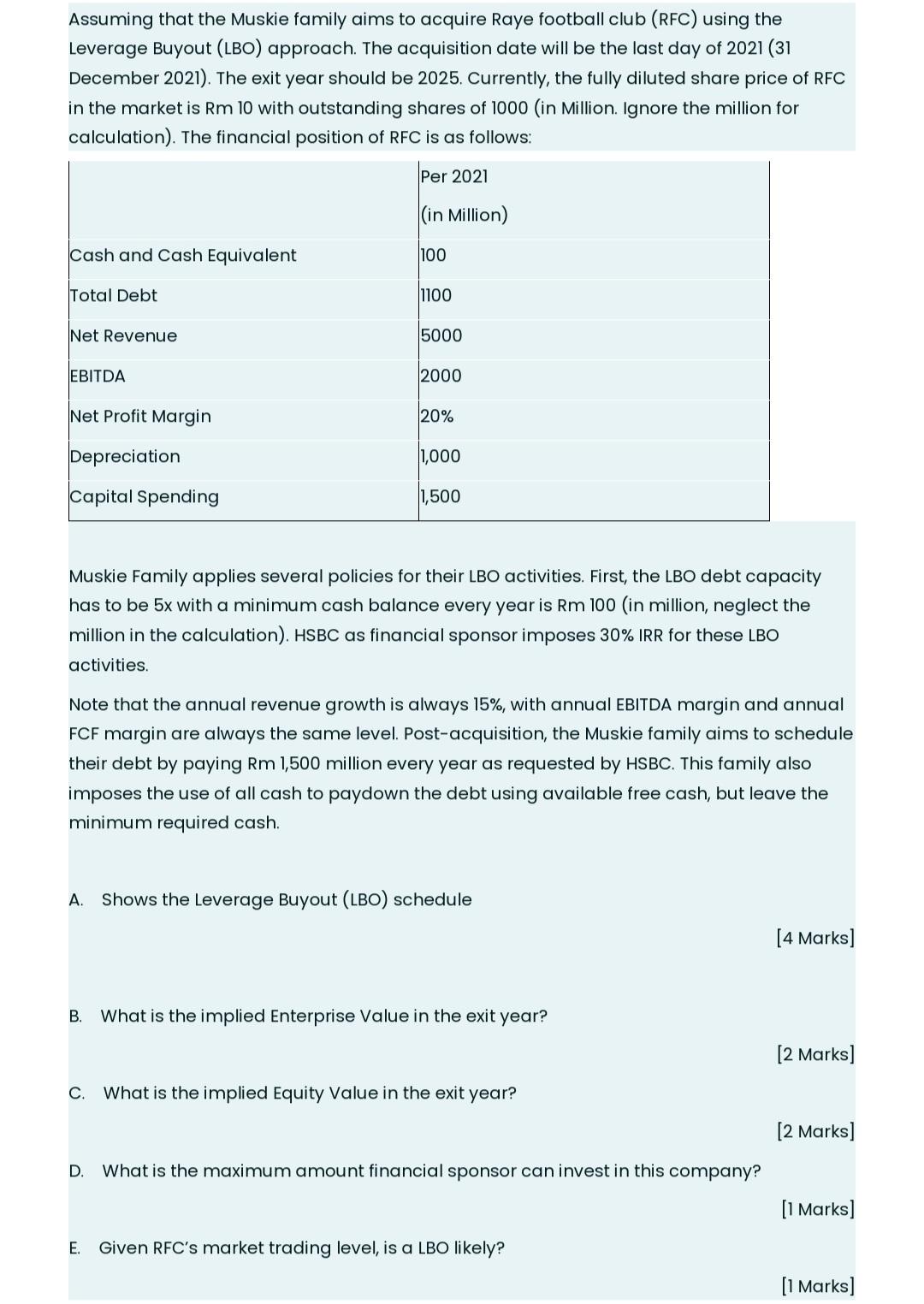

Assuming that the Muskie family aims to acquire Raye football club (RFC) using the Leverage Buyout (LBO) approach. The acquisition date will be the last day of 2021 (31 December 2021). The exit year should be 2025. Currently, the fully diluted share price of RFC in the market is Rm 10 with outstanding shares of 1000 (in Million. Ignore the million for calculation). The financial position of RFC is as follows: Cash and Cash Equivalent Total Debt Net Revenue EBITDA Net Profit Margin Depreciation Capital Spending Per 2021 (in Million) 100 1100 5000 2000 20% 1,000 1,500 Muskie Family applies several policies for their LBO activities. First, the LBO debt capacity has to be 5x with a minimum cash balance every year is Rm 100 (in million, neglect the million in the calculation). HSBC as financial sponsor imposes 30% IRR for these LBO activities. Note that the annual revenue growth is always 15%, with annual EBITDA margin and annual FCF margin are always the same level. Post-acquisition, the Muskie family aims to schedule their debt by paying Rm 1,500 million every year as requested by HSBC. This family also imposes the use of all cash to paydown the debt using available free cash, but leave the minimum required cash. A. Shows the Leverage Buyout (LBO) schedule B. What is the implied Enterprise Value in the exit year? C. What is the implied Equity Value in the exit year? D. What is the maximum amount financial sponsor can invest in this company? E. Given RFC's market trading level, is a LBO likely? [4 Marks] [2 marks] [2 marks] [1 Marks] [1 Marks]

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A Leverage Buyout LBO Schedule To calculate the LBO schedule we need to track the debt cash and equity balances each year based on the given policies ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started