Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming that you have short a European put option contract on a stock with a strike price of $50 that will expire in six

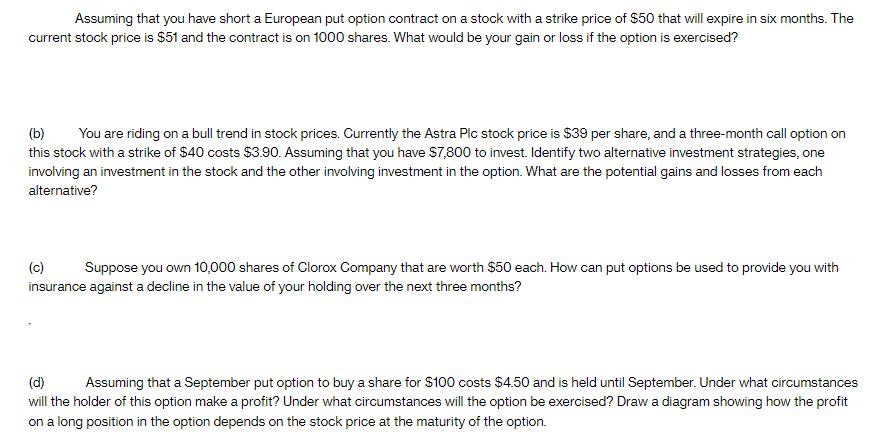

Assuming that you have short a European put option contract on a stock with a strike price of $50 that will expire in six months. The current stock price is $51 and the contract is on 1000 shares. What would be your gain or loss if the option is exercised? (b) You are riding on a bull trend in stock prices. Currently the Astra Plc stock price is $39 per share, and a three-month call option on this stock with a strike of $40 costs $3.90. Assuming that you have $7,800 to invest. Identify two alternative investment strategies, one involving an investment in the stock and the other involving investment in the option. What are the potential gains and losses from each alternative? Suppose you own 10,000 shares of Clorox Company that are worth $50 each. How can put options be used to provide you with insurance against a decline in the value of your holding over the next three months? (d) Assuming that a September put option to buy a share for $100 costs $4.50 and is held until September. Under what circumstances will the holder of this option make a profit? Under what circumstances will the option be exercised? Draw a diagram showing how the profit on a long position in the option depends on the stock price at the maturity of the option.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Assuming you are short a European put option contract on a stock with a strike price of 50 that will expire in six months and the current stock pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started