Assuming the current exit multiple of 6.0x is unchanged, what is the maximum entry amount (total enterprise value) you could pay for AXL and

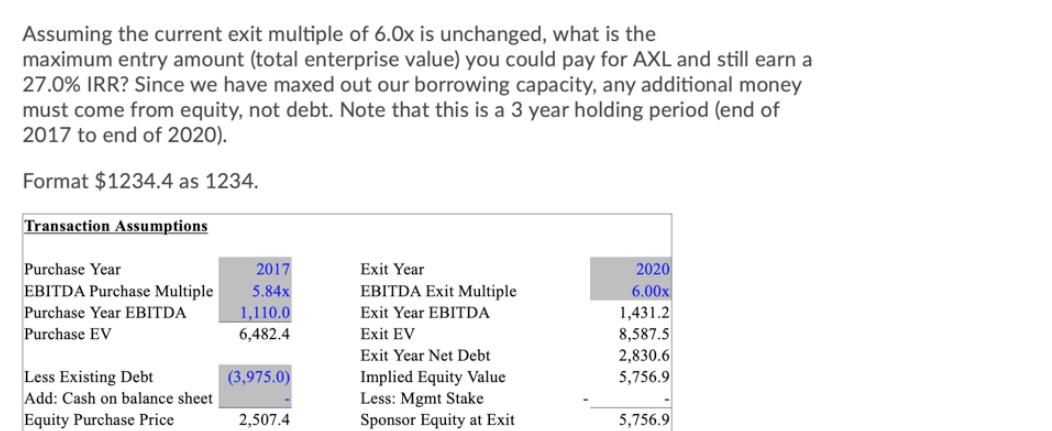

Assuming the current exit multiple of 6.0x is unchanged, what is the maximum entry amount (total enterprise value) you could pay for AXL and still earn a 27.0% IRR? Since we have maxed out our borrowing capacity, any additional money must come from equity, not debt. Note that this is a 3 year holding period (end of 2017 to end of 2020). Format $1234.4 as 1234. Transaction Assumptions Purchase Year 2017 Exit Year 2020 EBITDA Purchase Multiple 5.84x EBITDA Exit Multiple 6.00x Purchase Year EBITDA 1,110.0 Exit Year EBITDA 1,431.2 Purchase EV 6,482.4 Exit EV 8,587.5 Exit Year Net Debt 2,830.6 Less Existing Debt (3,975.0) Implied Equity Value 5,756.9 Add: Cash on balance sheet Less: Mgmt Stake Equity Purchase Price 2,507.4 Sponsor Equity at Exit 5,756.9 Sponsor Equity Check Sponsor Equity/Sources 2,142.4 Sponsor IRR 39.0% 32.5% Sponsor Cash-on-Cash 2.7x

Step by Step Solution

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the maximum entry amount total enterprise value you could pay for AXL and still ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started