Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming the partners agreed to bring their capital to their profit/loss ratio and the adjusted capital of CL already conforms to the P/L ratio,

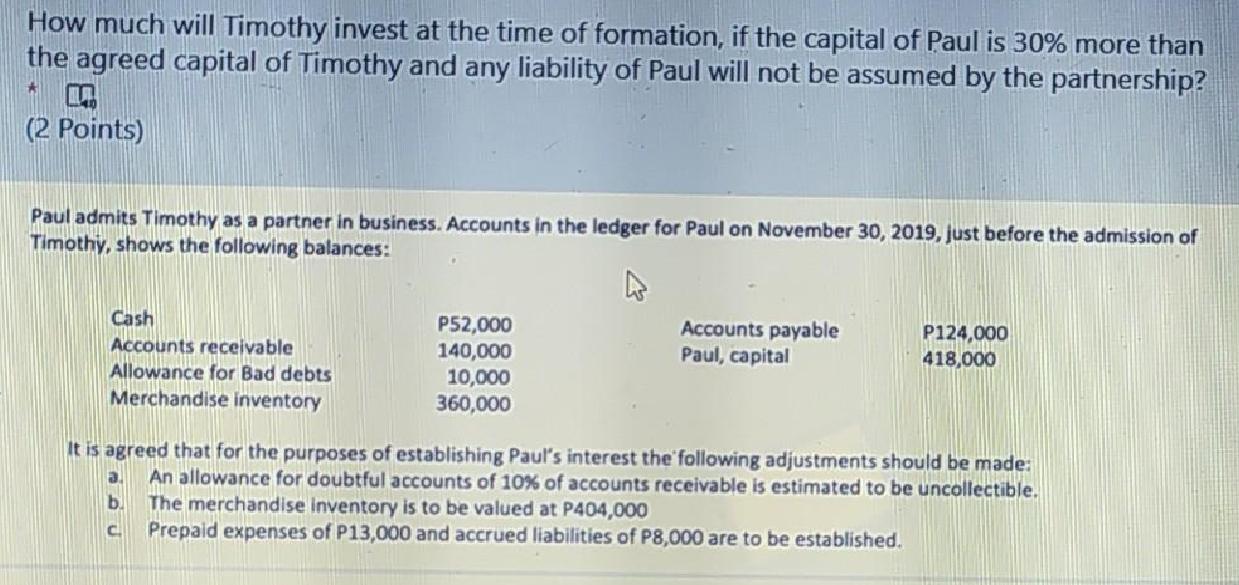

Assuming the partners agreed to bring their capital to their profit/loss ratio and the adjusted capital of CL already conforms to the P/L ratio, how much is the total cash balance at the time of formation if the partners will either withdraw or have an additional investment to the partnership? * (2 Points) GD and CL decided to form a partnership on October 1, 2019. Their Statement of Financial Position on this date were: GD CL P 65,625 Cash Accounts Receivables P 164,062.50 896,875 1,487,500 875,000 Merchandise Inventory 885,937.50 Equipment TOTAL 656,250 P 3,084,375 1,268,750 P3,215,625 Accounts Payable GD, Capital P 459,375 2,625,000 P1,159,375 CL, Capital 2,056,250 TOTAL P 3,084,375 P3,215,625 They agreed to the following adjustments: Equipment of GD is under-depreciated by P87,500 and that Cl is over-depreciated by P131,250. Allowance for doubtful accounts is to be set up amounting to P297,500 for GD and P196,875 for CL. Inventories of P21,875 and P15,312.50 are worthless in the books of GD and CL, respectively. The partnership agreement provides for a profit and loss ratio of 7:3 for GD and CL, respectively. How much will Timothy invest at the time of formation, if the capital of Paul is 30% more than the agreed capital of Timothy and any liability of Paul will not be assumed by the partnership? (2 Points) Paul admits Timothy as a partner in business. Accounts in the ledger for Paul on November 30, 2019, just before the admission of Timothy, shows the following balances: Cash Accounts receivable Allowance for Bad debts Merchandise inventory P52,000 140,000 10,000 360,000 Accounts payable Paul, capital P124,000 418,000 It is agreed that for the purposes of establishing Paul's interest the'following adjustments should be made: An allowance for doubtful accounts of 10% of accounts receivable is estimated to be uncollectible. The merchandise inventory is to be valued at P404,000 Prepaid expenses of P13,000 and accrued liabilities of P8,000 are to be established. a. b. C.

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Unadjusted Values GD 7 adjustment CL 3 Adjusted Values CL 3 GD 7 GD 7 CL 3 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started