Question

Assuming the same SG&A predictions as in Part D the company's goal is to break-even over the four-year projected period 2021 through 2024, where breaking

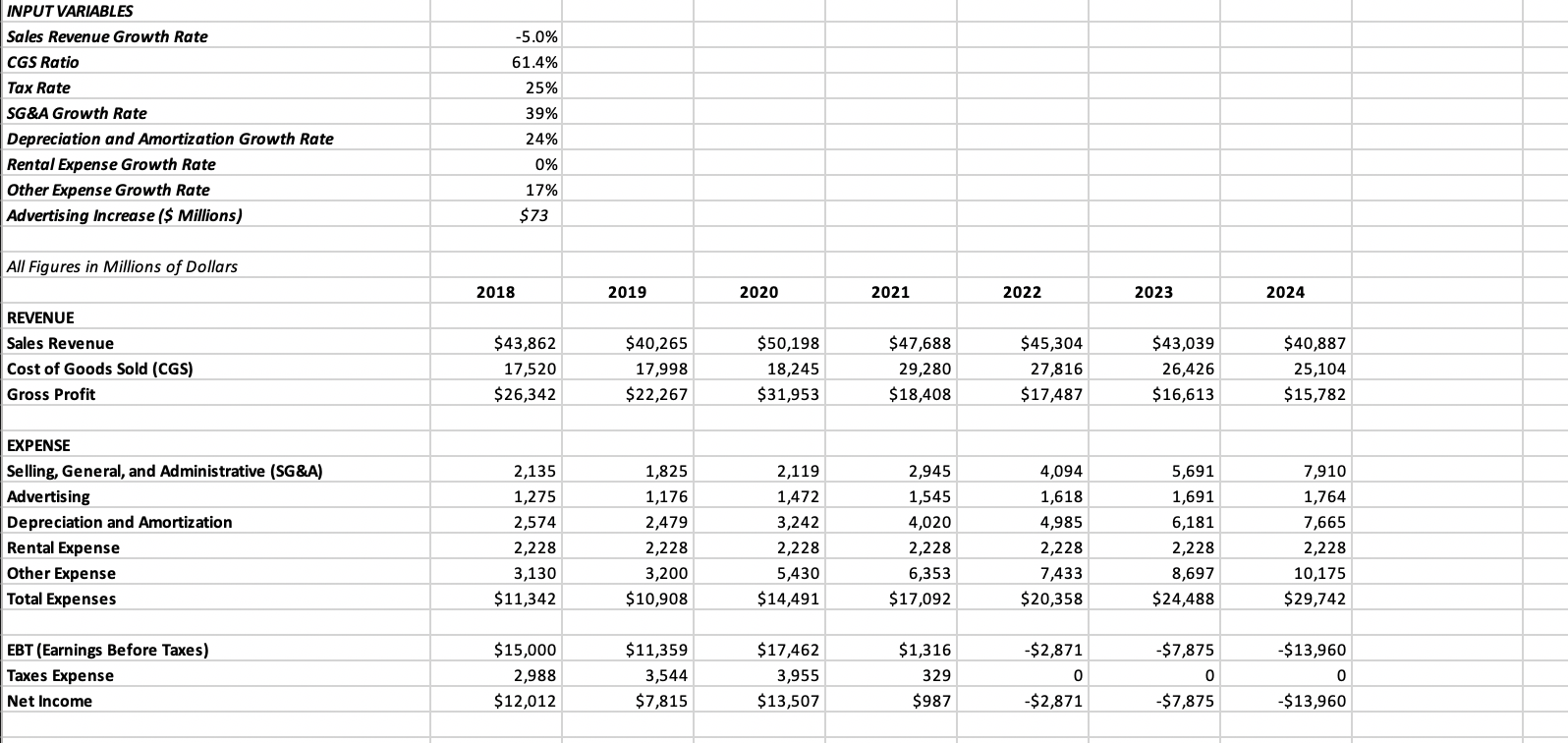

Assuming the same SG&A predictions as in Part D the company's goal is to break-even over the four-year projected period 2021 through 2024, where breaking even is defined as showing a non-negative sum of the Net Incomes for those four years. Assume also a worsening of the CGS Ratio to 61.4% and an aggressive Advertising campaign that will increase Advertising expenses by $73 million dollars each year over the previous year (instead of the $22 million dollars in Part A). What is the minimum Sales Revenue Growth Rate that would be necessary for the company to break-even (as defined above)? Show your answer to one decimal place (e.g., 5.3%). Indicate your answer on the sheet in a "Text Box" and also use an arrow to point from the textbox to the data that support your answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started