Question

On April 15, Year 5, Bailey Inc. negotiated a large sale of their premium maple syrup to Sweet Co. for US$3,000,000. The contract required

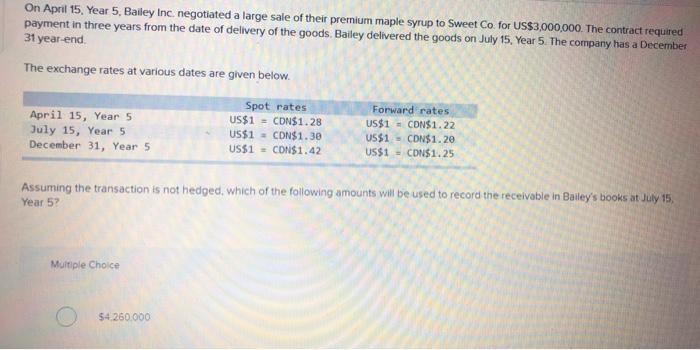

On April 15, Year 5, Bailey Inc. negotiated a large sale of their premium maple syrup to Sweet Co. for US$3,000,000. The contract required payment in three years from the date of delivery of the goods. Bailey delivered the goods on July 15, Year 5. The company has a December 31 year-end. The exchange rates at various dates are given below. Spot rates US$1 = CON$1.28 US$1- CDN$1.30 US$1 - CONS1.42 Forward rates US$1 = CDNS1.22 April 15, Year 5 July 15, Year 5 December 31, Year 5 US$1 CDN$1.20 US$1 = CON$1.25 Assuming the transaction is not hedged, which of the following amounts will be used to record the receivable in Bailey's books at July 15, Year 5? Multiple Choice $4.260.000

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

As the transaction is not hedged It will be recor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing and Assurance services an integrated approach

Authors: Alvin a. arens, Randal j. elder, Mark s. Beasley

14th Edition

133081605, 132575957, 9780133081602, 978-0132575959

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App