Question

Assuming you are a new Finance manager in charge of optimizing the working capital of your firm Lopez Global Corporation. You have just received the

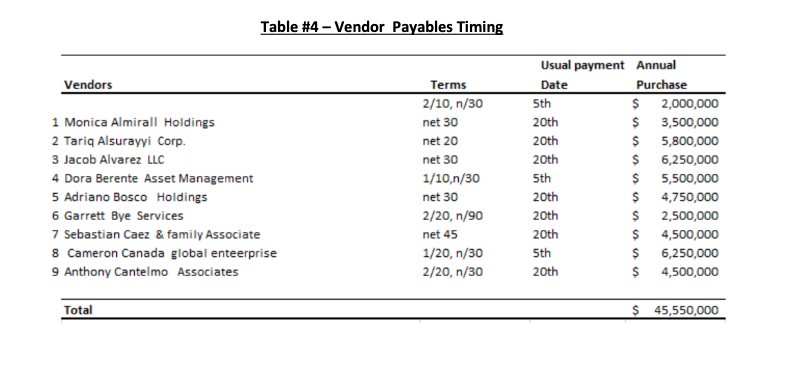

Assuming you are a new Finance manager in charge of optimizing the working capital of your firm Lopez Global Corporation. You have just received the payment timing of Joseph Centrone Corporation (Table 4) and asked to calculate the float savings generated by transitioning from making their vendor payments on 5th and 20th day to an actively managed (optimized) schedule.

Assume Joseph Centrone Corporation has a WACC of 12%.

Calculate the float savings for each of the vendors (in Table 4) and the total savings you will generate to Joseph Centrone Corporation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started