Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming you are the accountants of Company A. Company A is the start-up service company that has the first period ended 30 September 20x2

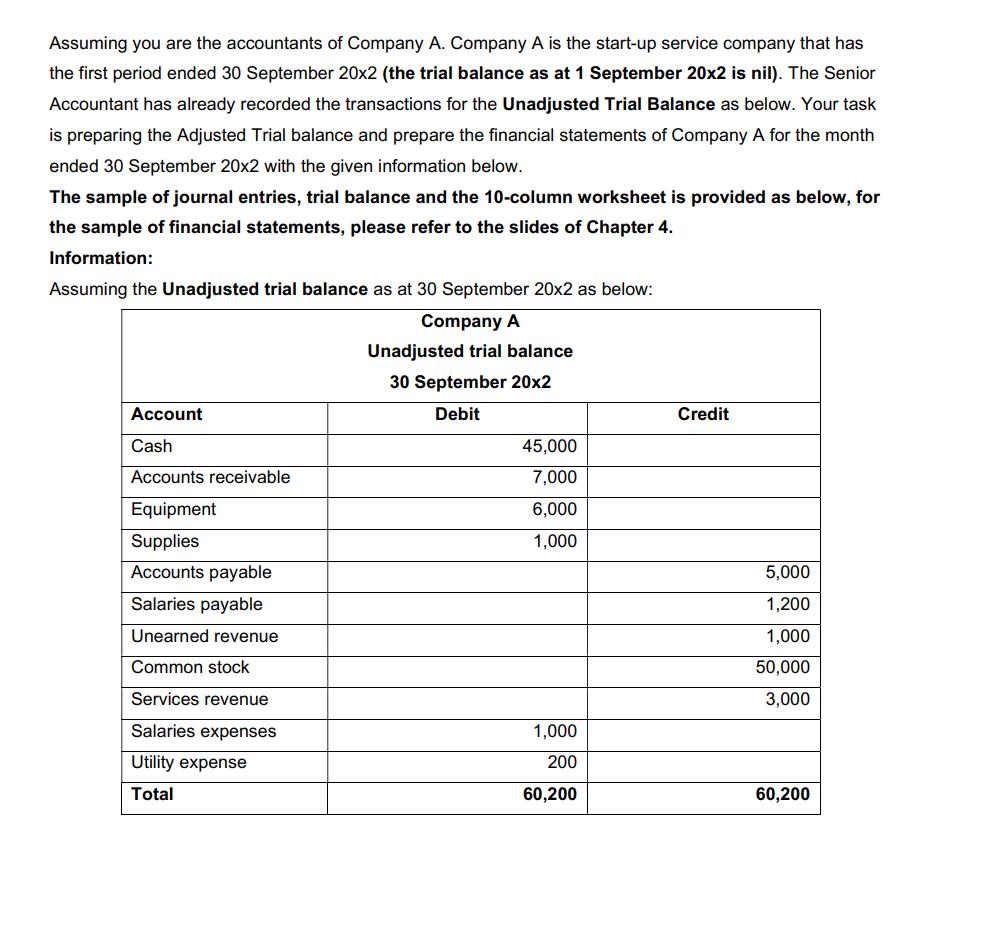

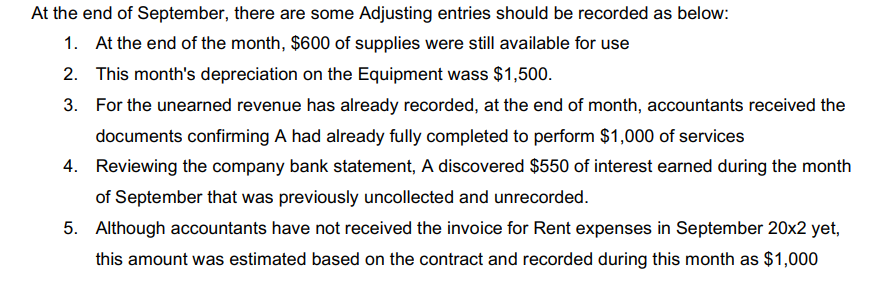

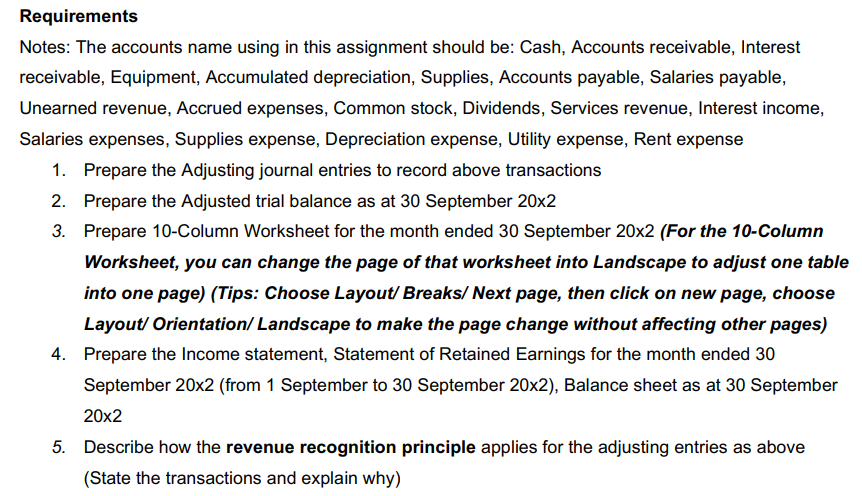

Assuming you are the accountants of Company A. Company A is the start-up service company that has the first period ended 30 September 20x2 (the trial balance as at 1 September 20x2 is nil). The Senior Accountant has already recorded the transactions for the Unadjusted Trial Balance as below. Your task is preparing the Adjusted Trial balance and prepare the financial statements of Company A for the month ended 30 September 20x2 with the given information below. The sample of journal entries, trial balance and the 10-column worksheet is provided as below, for the sample of financial statements, please refer to the slides of Chapter 4. Information: Assuming the Unadjusted trial balance as at 30 September 20x2 as below: Account Cash Accounts receivable Equipment Supplies Accounts payable Salaries payable Unearned revenue Common stock Services revenue Salaries expenses Utility expense Total Company A Unadjusted trial balance 30 September 20x2 Debit 45,000 7,000 6,000 1,000 1,000 200 60,200 Credit 5,000 1,200 1,000 50,000 3,000 60,200 At the end of September, there are some Adjusting entries should be recorded as below: 1. At the end of the month, $600 of supplies were still available for use 2. This month's depreciation on the Equipment wass $1,500. 3. For the unearned revenue has already recorded, at the end of month, accountants received the documents confirming A had already fully completed to perform $1,000 of services 4. Reviewing the company bank statement, A discovered $550 of interest earned during the month of September that was previously uncollected and unrecorded. 5. Although accountants have not received the invoice for Rent expenses in September 20x2 yet, this amount was estimated based on the contract and recorded during this month as $1,000 Requirements Notes: The accounts name using in this assignment should be: Cash, Accounts receivable, Interest receivable, Equipment, Accumulated depreciation, Supplies, Accounts payable, Salaries payable, Unearned revenue, Accrued expenses, Common stock, Dividends, Services revenue, Interest income, Salaries expenses, Supplies expense, Depreciation expense, Utility expense, Rent expense 1. Prepare the Adjusting journal entries to record above transactions 2. Prepare the Adjusted trial balance as at 30 September 20x2 3. Prepare 10-Column Worksheet for the month ended 30 September 20x2 (For the 10-Column Worksheet, you can change the page of that worksheet into Landscape to adjust one table into one page) (Tips: Choose Layout/ Breaks/ Next page, then click on new page, choose Layout/Orientation/ Landscape to make the page change without affecting other pages) 4. Prepare the Income statement, Statement of Retained Earnings for the month ended 30 September 20x2 (from 1 September to 30 September 20x2), Balance sheet as at 30 September 20x2 5. Describe how the revenue recognition principle applies for the adjusting entries as above (State the transactions and explain why)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

step 3of6 10 column worksheet Following is the 10 column worksheet of the company 10 Column workshee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started