Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assuming you were employed as a risk analyst for a US investment bank, On 31st August 2022, You selected four listed companies (stock A, stock

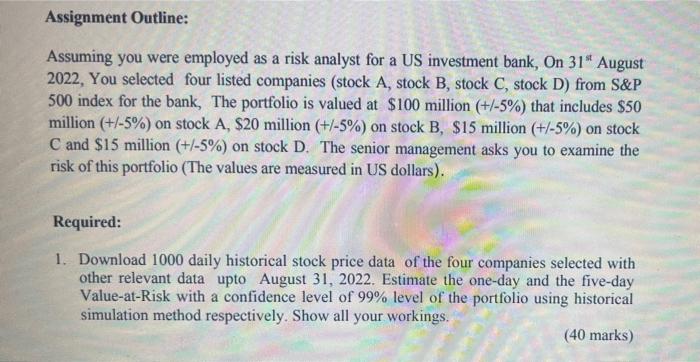

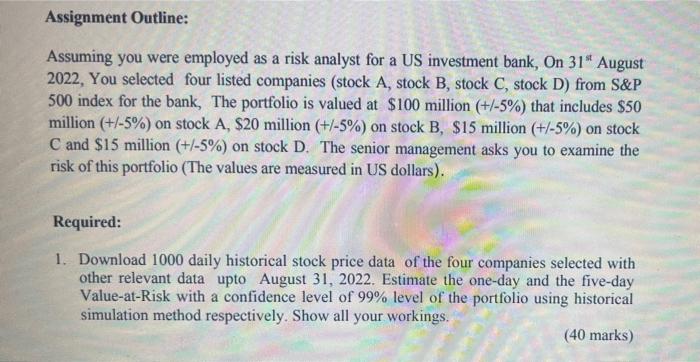

Assuming you were employed as a risk analyst for a US investment bank, On 31st August 2022, You selected four listed companies (stock A, stock B, stock C, stock D) from S\&P 500 index for the bank, The portfolio is valued at $100 million (+/5%) that includes $50 million (+/5%) on stock A, $20 million (+/5%) on stock B, $15 million (+/5%) on stock C and $15 million (+/5%) on stock D. The senior management asks you to examine the risk of this portfolio (The values are measured in US dollars). Required: 1. Download 1000 daily historical stock price data of the four companies selected with other relevant data upto August 31, 2022. Estimate the one-day and the five-day Value-at-Risk with a confidence level of 99% level of the portfolio using historical simulation method respectively. Show all your workings. (40 marks) Assuming you were employed as a risk analyst for a US investment bank, On 31st August 2022, You selected four listed companies (stock A, stock B, stock C, stock D) from S\&P 500 index for the bank, The portfolio is valued at $100 million (+/5%) that includes $50 million (+/5%) on stock A, $20 million (+/5%) on stock B, $15 million (+/5%) on stock C and $15 million (+/5%) on stock D. The senior management asks you to examine the risk of this portfolio (The values are measured in US dollars). Required: 1. Download 1000 daily historical stock price data of the four companies selected with other relevant data upto August 31, 2022. Estimate the one-day and the five-day Value-at-Risk with a confidence level of 99% level of the portfolio using historical simulation method respectively. Show all your workings. (40 marks)

Assuming you were employed as a risk analyst for a US investment bank, On 31st August 2022, You selected four listed companies (stock A, stock B, stock C, stock D) from S\&P 500 index for the bank, The portfolio is valued at $100 million (+/5%) that includes $50 million (+/5%) on stock A, $20 million (+/5%) on stock B, $15 million (+/5%) on stock C and $15 million (+/5%) on stock D. The senior management asks you to examine the risk of this portfolio (The values are measured in US dollars). Required: 1. Download 1000 daily historical stock price data of the four companies selected with other relevant data upto August 31, 2022. Estimate the one-day and the five-day Value-at-Risk with a confidence level of 99% level of the portfolio using historical simulation method respectively. Show all your workings. (40 marks) Assuming you were employed as a risk analyst for a US investment bank, On 31st August 2022, You selected four listed companies (stock A, stock B, stock C, stock D) from S\&P 500 index for the bank, The portfolio is valued at $100 million (+/5%) that includes $50 million (+/5%) on stock A, $20 million (+/5%) on stock B, $15 million (+/5%) on stock C and $15 million (+/5%) on stock D. The senior management asks you to examine the risk of this portfolio (The values are measured in US dollars). Required: 1. Download 1000 daily historical stock price data of the four companies selected with other relevant data upto August 31, 2022. Estimate the one-day and the five-day Value-at-Risk with a confidence level of 99% level of the portfolio using historical simulation method respectively. Show all your workings. (40 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started