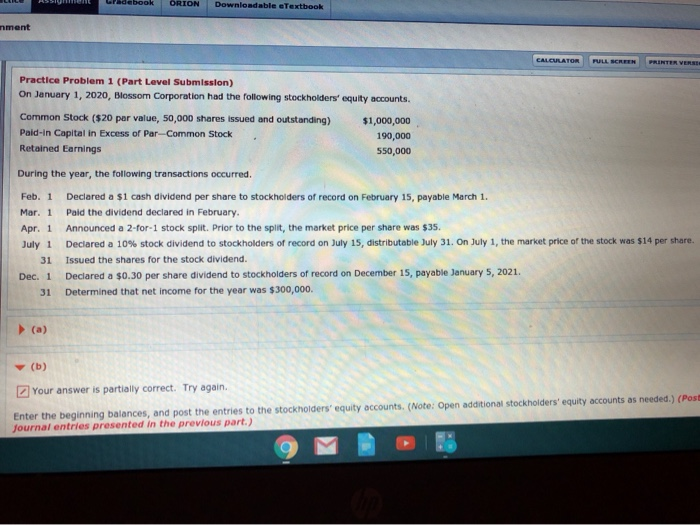

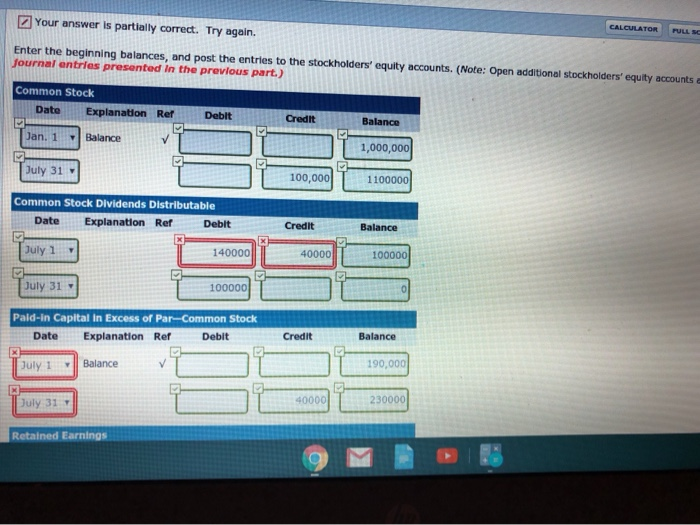

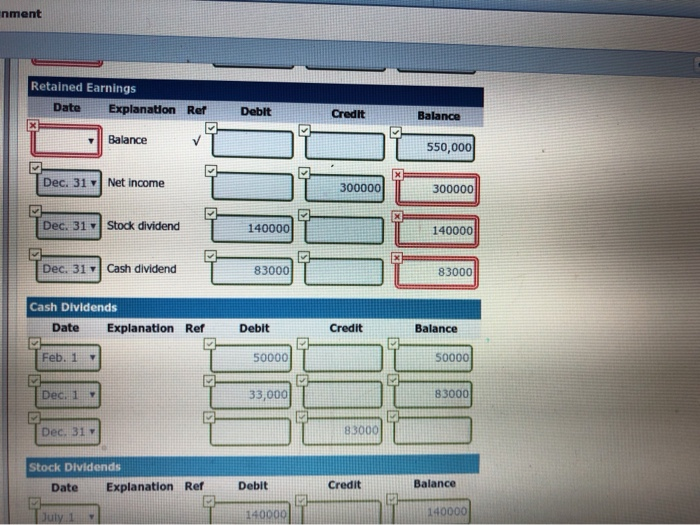

ASSUMON Ladebook ORION Downloadable eTextbook nment Practice Problem 1 (Part Level Submission) On January 1, 2020, Blossom Corporation had the following stockholders' equity accounts. Common Stock ($20 par value, 50,000 shares issued and outstanding) Pald-in Capital in Excess of Par-Common Stock Retained Earnings $1,000,000 190,000 550,000 During the year, the following transactions occurred. Feb. 1 Declared a $1 cash dividend per share to stockholders of record on February 15, payable March 1. Mar. 1 Paid the dividend declared in February Apr. 1 Announced a 2-for-1 stock split. Prior to the split, the market price per share was $35. July 1 Declared a 10% stock dividend to stockholders of record on July 15, distributable July 31. On July 1, the market price of the stock was $14 per share. 31 Issued the shares for the stock dividend. Dec. 1 Declared a $0.30 per share dividend to stockholders of record on December 15, payable January 5, 2021 31 Determined that net income for the year was $300,000. (a) (b) Your answer is partially correct. Try again Enter the beginning balances, and post the entries to the stockholders' equity accounts. (Note: Open additional stockholders' equity accounts as needed.) (Post Journal entries presented in the previous part.) 9 M Your answer is partially correct. Try again. CALCULATOR PULLS Enter the beginning balances, and post the entries to the stockholders' equity accounts. (Note: Open additional stockholders' equity accounts Journal entries presented in the previous part.) Common Stock Date Explanation Ref Debit Credit Balance Jan. 1 Balance 1,000,000 July 31 100,000 1100000 Common Stock Dividends Distributable Date Explanation Ref Debit Credit Balance July 1 140000 40000 100000 July 31 100000 Pald-in Capital in Excess of Par-Common Stock Date Explanation Ref Debit Credit Balance July 1 Balance 190,000 July 31 40000 230000 Retained Earnings nment Retained Earnings Date Explanation Ref Debit Credit Balance Balance 550,000 POP Dec 31 Net income 300000 300000 Dec. 31 - Stock dividend 140000 140000 TDec. 31 Cash dividend 83000 83000 Cash Dividends Date Explanation Ref Debit Credit Balance Feb. 1 50000 50000 Dec. 39 33,000 83000 Dec. 31 83000 Stock Dividends Date Explanation Ref Debit Credit Balance 140000 140000