Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assumptions: Discount Rate: 2% Interest Rate: 1% Which project provides the most return, based on Net Present Value? What assumptions did you have to make

Assumptions:

Discount Rate: 2%

Interest Rate: 1%

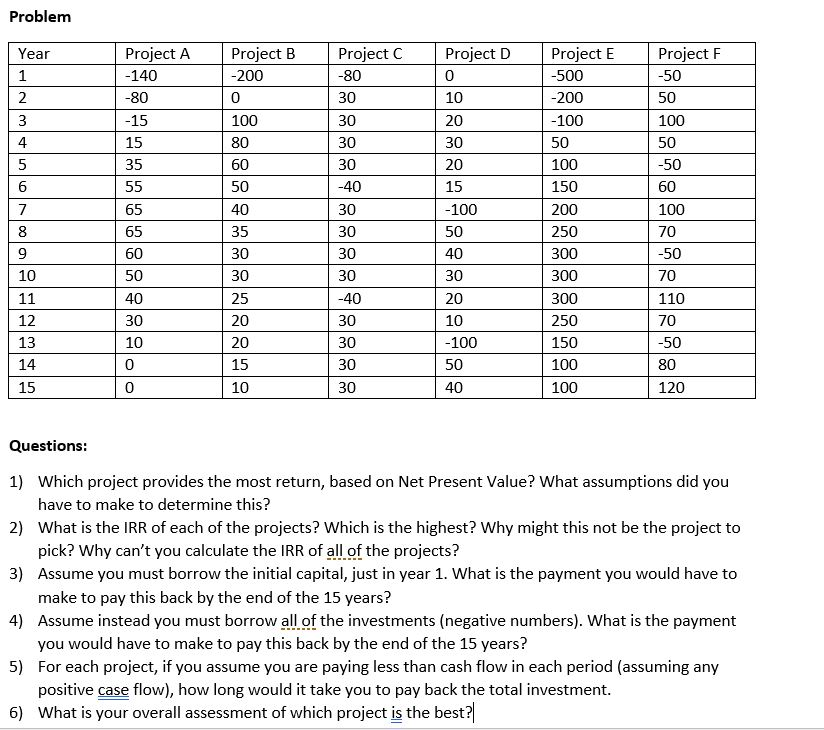

Which project provides the most return, based on Net Present Value? What assumptions did you have to make to determine this? What is the IRR of each of the projects? Which is the highest? Why might this not be the project to pick? Why can't you calculate the IRR of all of the projects? Assume you must borrow the initial capital, just in year 1. What is the payment you would have to make to pay this back by the end of the 15 years? Assume instead you must borrow all of the investments (negative numbers). What is the payment you would have to make to pay this back by the end of the 15 years? For each project, if you assume you are paying less than cash flow in each period (assuming any positive case flow), how long would it take you to pay back the total investment. What is your overall assessment of which project is the best?| Which project provides the most return, based on Net Present Value? What assumptions did you have to make to determine this? What is the IRR of each of the projects? Which is the highest? Why might this not be the project to pick? Why can't you calculate the IRR of all of the projects? Assume you must borrow the initial capital, just in year 1. What is the payment you would have to make to pay this back by the end of the 15 years? Assume instead you must borrow all of the investments (negative numbers). What is the payment you would have to make to pay this back by the end of the 15 years? For each project, if you assume you are paying less than cash flow in each period (assuming any positive case flow), how long would it take you to pay back the total investment. What is your overall assessment of which project is the best?|Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started