Answered step by step

Verified Expert Solution

Question

1 Approved Answer

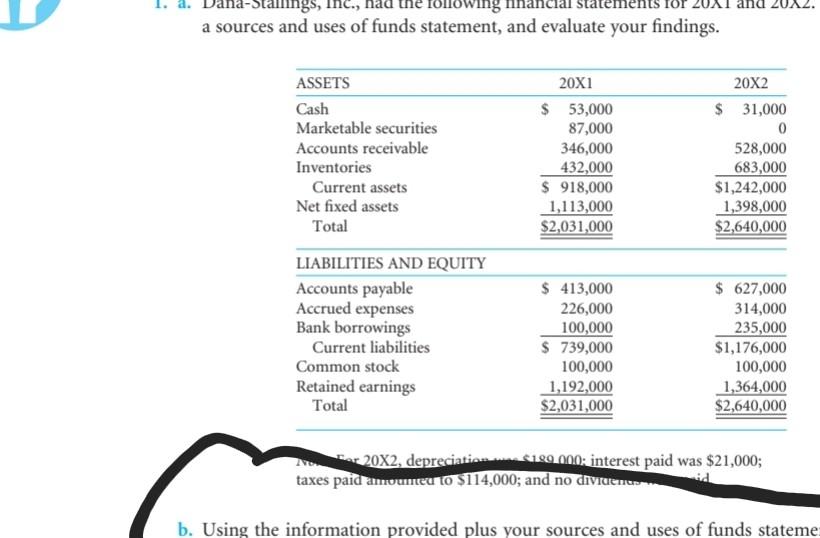

a-Stallings, Inc., following ncial statem a sources and uses of funds statement, and evaluate your findings. ASSETS Cash Marketable securities Accounts receivable Inventories Current assets

a-Stallings, Inc., following ncial statem a sources and uses of funds statement, and evaluate your findings. ASSETS Cash Marketable securities Accounts receivable Inventories Current assets Net fixed assets Total LIABILITIES AND EQUITY Accounts payable Accrued expenses Bank borrowings Current liabilities Common stock Retained earnings Total 20X1 $ 53,000 87,000 346,000 432,000 $ 918,000 1,113,000 $2,031,000 $ 413,000 226,000 100,000 $ 739,000 100,000 1,192,000 $2,031,000 Noor 20X2, depreciation taxes paid amounted to $114,000; and no dividend and 20X2 $ 31,000 0 528,000 683,000 $1,242,000 1,398,000 $2,640,000 $ 627,000 314,000 235,000 $1,176,000 100,000 1,364,000 $2,640,000 $199 000: interest paid was $21,000; id b. Using the information provided plus your sources and uses of funds stateme: a-Stallings, Inc., following ncial statem a sources and uses of funds statement, and evaluate your findings. ASSETS Cash Marketable securities Accounts receivable Inventories Current assets Net fixed assets Total LIABILITIES AND EQUITY Accounts payable Accrued expenses Bank borrowings Current liabilities Common stock Retained earnings Total 20X1 $ 53,000 87,000 346,000 432,000 $ 918,000 1,113,000 $2,031,000 $ 413,000 226,000 100,000 $ 739,000 100,000 1,192,000 $2,031,000 Noor 20X2, depreciation taxes paid amounted to $114,000; and no dividend and 20X2 $ 31,000 0 528,000 683,000 $1,242,000 1,398,000 $2,640,000 $ 627,000 314,000 235,000 $1,176,000 100,000 1,364,000 $2,640,000 $199 000: interest paid was $21,000; id b. Using the information provided plus your sources and uses of funds stateme

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started